Toronto’s Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) nearly doubled its silver production year-over-year (YoY) in the second quarter of 2023.

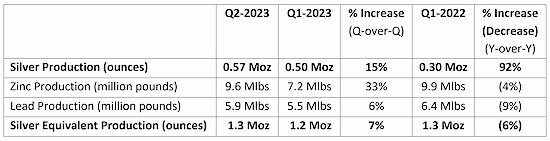

On Monday, the precious metals company reported a 92 per cent YoY increase and 15 per cent sequential increase in silver production to 570,000 ounces for the quarter ending June 30. Consolidated attributable silver equivalent production remained the same for Americas YoY in Q2 at 1.3 million ounces and increased sequentially by 100,000 ounces from Q1 this year.

The company also announced that it installed a new hoist at its 60 per cent owned Galena Complex in Idaho, a joint venture with the Canadian investor Eric Sprott who owns the other 40 per cent. For 2023, Americas expects to produce between 2.2 and 2.6 million ounces of silver and 5.5 to 6 million ounces of silver equivalent.

“Production in the second half of the year is expected to be higher than the first half of the year,” said Darren Blasutti, President and CEO of Americas.

“The Galena hoist is expected to positively impact the Galena Complex operations for many years to come,” he added.

Table via Americas Gold and Silver

Read more: Calibre Mining reports 32% sequential cash balance increase to US$77M

Read more: Gobsmacked by Calibre Mining’s high grades from Palomino, Nevada: Haywood Securities

During the quarter, the company produced 335,000 ounces of silver from its Cosalá operations in Sinaloa, Mexico, representing a 162 per cent increase YoY from the 128,000 ounces generated in Q2 last year. Americas says this significant increase can be attributed to higher production from Cosalá’s San Rafael mining operation.

Silver production from the Galena Complex increased by 39 per cent YoY during Q2 to 238,000 ounces.

For Q1 this year Americas reported a 72.75 per cent sequential increase in its cash balance and had US$3.4 million on hand at the end of the quarter.

However, the company also reported a 16.4 per cent drop in revenue YoY at the end of Q1 and a 3,455 per cent increase in net losses at approximately US$10.5 million.

Other Canadian silver producers with operations in Mexico include Vancouver’s Pan American Silver Corp. (TSX: PAAS) (NYSE: PAAS); owner of the La Colorada silver mine in Zacatecas which has produced 5.9 million ounces of the metal; First Majestic Silver Corp. (TSX: FR) (NYSE: AG), owner of the San Dimas silver/gold mine in Durango; and MAG Silver Corp. (TSX: MAG) (NYSE American: MAG), which is involved with the Juanicipio project in Zacatecas in a joint venture with Fresnillo plc (LON: FRES).

Americas Gold and Silver shares rose by 3 per cent Monday to $0.50 on the Toronto Stock Exchange.

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) is another Canadian precious metals producer with substantial operations in Latin America that recently reported a significant increase in its cash balance. Last week the company announced that it had 32 per cent more cash on hand at the end of Q2 than the previous quarter at US$77 million.

Calibre’s share price has risen by 81.3 per cent since the beginning of the year and rose by 0.6 per cent Monday to trade at $1.65 on the TSX.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com