Allegiant Gold Ltd (CVE: AUAU) (OTCMKTS: AUXXF) soared to a 52-week high on Friday after upsizing its stock offering by an additional C$2 million. Funding from the C$10.5-million-dollar private placement will be used to expedite development of the company’s flagship gold-silver project in Nevada.

The junior miner is issuing 20 million shares at C$0.50 apiece. They each come with half of a share purchase warrant. Two will be redeemable at a price of C$0.70 for up to 1.5 years after the financing closes.

“This financing will allow us to accelerate the development of Eastside through expanded geophysics, detailed mapping, and up to 18,000 metres of additional reverse circulation and diamond core drilling,” said CEO Peter Gianulis on Jul. 29.

Eastside holds a 1.4-million ounce inferred gold resource alongside 8.8 million ounces of silver.

The site has enabled Allegiant to attract interest from more established companies in the precious metals sector. Mining major Kinross Gold Corp (TSE: K) (NYSE: KGC) (FRA: KIN2) currently holds a 10 per cent stake in the company. Kinross invested C$4 million into Allegiant in 2022 in a deal facilitated by Gianulis.

Additionally, the mid-tier producer Iamgold Corp (TSE: IMG) (NYSE: IAG) (FRA: IAL) holds a 4 per cent interest.

Despite having no definitive timeline for production, Eastside is a considerable long-term investment prospect due to the current bull market for precious metals and Nevada’s favourable environment.

The Fraser Institute recently ranked the state second on the list of the world’s top mining jurisdictions for investment attractiveness. Finland is currently in first place while Alaska is sitting in third, according to the think tank’s most recent reputable report.

Read more: Antimony recovery results from NevGold’s Limo Butte project exceed expectations

Allegiant receives BLM assent for more exploration

The Unites States Bureau of Land Management has given the company permission to continue exploration at its Castle Gold project within the broader Eastside property. It is a critical portion of the company’s flagship operation.

“Projects like this support President Trump’s Executive Order 14241, ‘Immediate Measures to Increase American Mineral Production,'” the agency said on Thursday, “to boost domestic mineral production and reduce U.S. reliance on foreign minerals, enhance national security, and create jobs.”

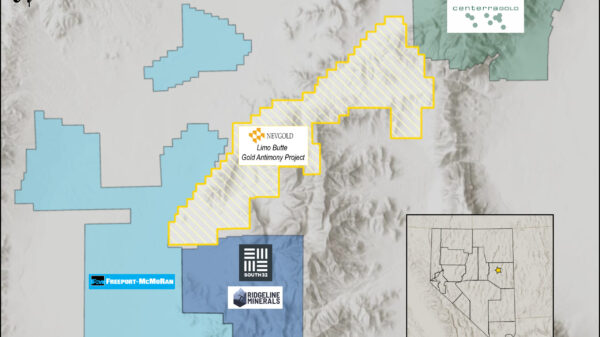

Nevada is home to a select group of other mining assets that could also help the nation reduce its reliance on international suppliers. A shortage of antimony (Sb) in the U.S., in particular, has made NevGold Corp‘s (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) Limo Butte project in White Pine County a standout.

Recent metallurgical test work on samples taken from the project property area significantly exceeded expectations with regard to antimony recovery. NevGold will be producing a gold-antimony mineral resource estimate at the project by the end of this year.

Also worthy of note for domestic critical minerals are the group of Nevada tungsten mines held by Guardian Metal Resources PLC (OTCMKTS: GMTLF) (LON: GMET) (FRA: 8TM) and the Last Chance Sb project being advanced by Military Metals Corp (CNSX: MILI) (OTCMKTS: MILIF) (FRA: QN90) in Nye County.

Read more: NevGold’s latest Nevada drill results show exceptional gold mineralization

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com