The global critical minerals market is accelerating rapidly, projected to grow from USD$328.19 billion in 2024 to USD$586.63 billion by 2032, according to new report from DataM Intelligence.

Released on Wednesday, this represents a compound annual growth rate of 7.53 per cent from 2025 to 2032, fuelled by booming demand from electric vehicles, batteries, and renewable energy projects.

Critical minerals—including lithium, nickel, cobalt, graphite, and rare earth elements—form the backbone of global decarbonization strategies. They are essential for batteries, wind turbines, solar cells, and electric drivetrains. Policy support, supply-chain diversification, and technological innovation have turned these materials into strategic economic assets.

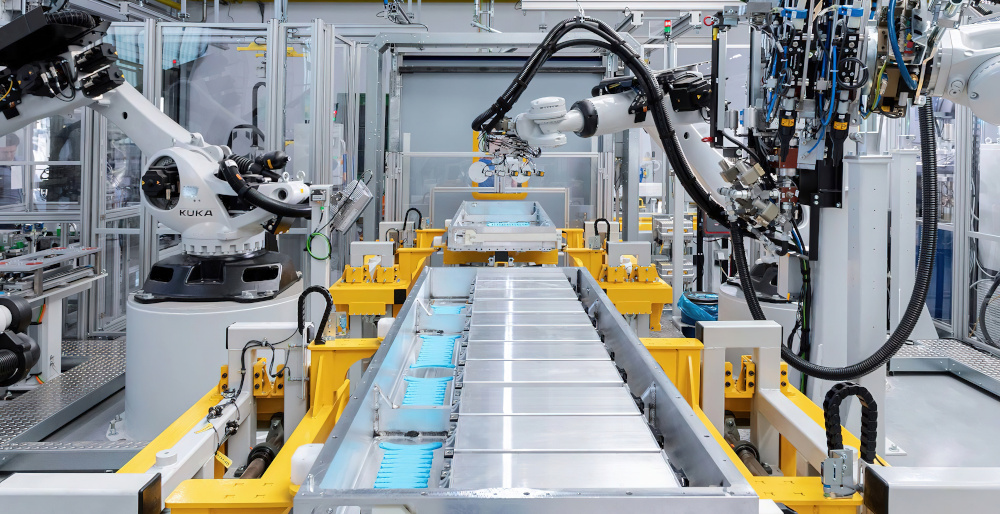

Global EV production exceeded 14 million units in 2024, requiring more than 1.1 million tons of lithium carbonate equivalent, a 30 per cent increase from the prior year. Meanwhile, renewable energy capacity additions surpassed 500 gigawatts, consuming roughly 20 per cent more rare earth materials than in 2023. Battery metals, including lithium, cobalt, nickel, and graphite, generated USD 115 billion in revenue in 2024 and are projected to more than double to USD 240 billion by 2032.

Governments in the United States, European Union, Japan, and Australia allocated over USD$60 billion in 2024 to support domestic exploration, processing, and recycling initiatives. Recycling and circular economy programs could supply up to 17 per cent of global demand by 2032. This initiative is set to reduce supply risks while supporting sustainability goals.

Energy storage represents the largest application segment, contributing 42 per cent of market revenue at USD$138 billion in 2024. The firm further projects it to surpass USD$270 billion by 2032 as gigafactory production ramps up.

Read more: NevGold edges closer to gold-antimony resource with latest Limousine Butte results

Read more: NevGold targets U.S. critical mineral supply chain with new antimony-gold find

US EV market reaches $70B in 2024

Furthermore, EVs contribute 30 per cent at $USD99 billion, growing at 8.4 per cent CAGR. Electronics and semiconductor manufacturing account for 15 per cent, USD$49 billion, while industrial alloys and magnets represent 10 per cent, USD$33 billion.

The United States market reached USD$70 billion in 2024 and the study says it will exceed USD$130 billion by 2032.

The Inflation Reduction Act and the U.S. Critical Minerals Strategy 2024 have allocated USD$6 billion for domestic refining and recycling. Albemarle Corporation (NYSE: ALB) has expanded capacity to over 400,000 tons LCE annually, leading U.S. lithium production, it leads the US market, in which 30 new projects in lithium and rare earth processing are underway across Nevada, Texas, and Wyoming.

Japan’s market reached USD$19 billion in 2024 and is expected to hit USD$36 billion by 2032, at 8.1 per cent CAGR. The country imports over 90 per cent of its critical minerals. However it is investing USD$2.5 billion in recycling and overseas partnerships, especially with Australia and Canada. Leading automakers, including Toyota and Honda, have secured long-term lithium and nickel contracts. Japan aims to recycle 20 per cent of battery metals domestically by 2030 under its Green Innovation Fund initiative.

Top players also control over 65 per cent of production, making the critical minerals sector moderately consolidated.

Albemarle, Lynas Rare Earths (ASX: LYC), MP Materials (NYSE: MP), Glencore (LON: GLEN), Rio Tinto (NYSE: RIO), and Pilbara Minerals (ASX: PLS) dominate the market.

Albemarle reported USD$9.6 billion revenue, with lithium accounting for 75 per cent while Lynas boosted rare earth separation by 30 per cent at its Malaysian facility.

Read more: NevGold targets U.S. critical mineral supply chain with new antimony-gold find

Read more: NevGold Expands Gold-Antimony Potential at Limousine Butte in Nevada

The critical minerals market will remain a cornerstone of the market

Other companies are pivoting or partially pivoting into critical minerals to attract U.S. government investment. This includes benefits from programs like FAST-41, which accelerates permitting for strategic energy projects.

NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) has been exploring opportunities in this space. Meanwhile, Lithium Americas (NYSE: LAC) and its Thacker Pass lithium deposit in Nevada have received federal backing.

These initiatives reflect strong U.S. interest in developing domestic supply chains for materials while promoting clean energy growth.

The critical minerals market will remain a cornerstone of the global energy transition.

Asia-Pacific will retain a 52 per cent market share, and North America will grow fastest at an 8.2 per cent CAGR. In addition, investors are projected to spend over USD 100 billion globally on lithium and rare earth projects by 2032.

.

NevGold Corp is a sponsor of Mugglehead news coverage

.