Equinox Gold Corp (TSE: EQX) (NYSEAMERICAN: EQX) (FRA: 1LRC) is updating its 2025 production and cost guidance to account for the additions in place with the combination with Calibre Mining Corp (TSE: CXB) (OTCMKTS: CXBMF) (FRA: WCLA), which will close by the end of June.

Additionally, Equinox announced on Wednesday that its updated guidance will also incorporate the lagging ramp-up from the company’s Greenstone Gold Mine in Ontario, Canada.

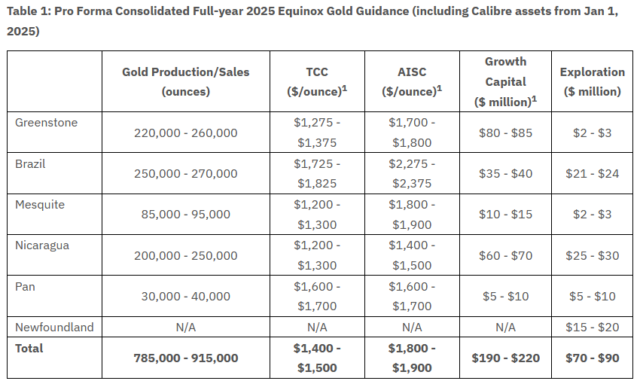

The company projects pro forma full-year 2025 gold production between 785,000 and 915,000 ounces. It expects total cash costs (TCC) of USD$1,400 to USD$1,500 per ounce. Additionally, all-in sustaining costs (AISC) should range from USD$1,800 to USD$1,900 per ounce. These figures include Calibre’s full-year guidance.

The guidance excludes production and costs from Calibre’s Valentine Gold Mine and Equinox Gold’s Los Filos Complex. Also, Equinox Gold will host a conference call and webcast to review the pro forma guidance. The event will begin Thursday, June 12, 2025, at 7:00 am PST (10:00 am EST).

“Since achieving commercial production at Greenstone in Q4 2024, the ramp-up has been slower than planned,” said Greg Smith, president and CEO of Equinox.

“Mine productivity and equipment availability, particularly with the primary loading fleet, have fallen short of plan, impacting mining rates and delaying access to higher-grade ore zones.”

Year-to-date mined grades have come in below expectations, partly due to higher-than-anticipated dilution. On the processing side, throughput and recovery have improved. However, overall performance remains below plan.

Read more: Calibre Mining supports future mining industry workers at Newfoundland science fair

Read more: Calibre Mining understands the balance between economic performance and sustainability

Equinox expects to produce between 135-145 gold ounces in Q2

The company is addressing these issues and has revised Greenstone’s full-year production guidance to 220,000 to 260,000 ounces of gold. Further, refinements to other assets and the anticipated completion of the Calibre merger have prompted updated pro forma guidance.

Consolidated 2025 pro forma production is now expected to total 785,000 to 915,000 ounces of gold. The company also projects an AISC of USD$1,800 to USD$1,900 per ounce. This excludes output from the Valentine and Los Filos mines.

In addition, Equinox Gold expects to produce 135,000 to 145,000 ounces of gold in Q2 2025, including 45,000 to 50,000 ounces from Greenstone. Calibre is forecast to contribute 70,000 to 72,500 ounces during the same period.

Full-year guidance for Calibre and the consolidated company appears below, offering added visibility into the scale of the combined operation.

Image via Equinox Gold.

The merger with Calibre Mining is expected to bring several strategic changes beyond asset additions.

Notably, Calibre’s former CEO Darren Hall will join Equinox Gold’s board of directors as incoming president and chief operating officer, adding operational depth and regional expertise, particularly in the Americas.

This integration should strengthen governance and broaden the company’s strategic vision.

In addition, Calibre’s strong track record of disciplined growth and low-cost production may influence future capital allocation decisions.

The combined company is also expected to benefit from enhanced investor visibility and market relevance. With increased production scale and diversified geographic exposure, the new entity could position itself among the top three gold producers based in Canada by output.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.