Vizsla Silver (TSE: VZLA) (NYSE AMERICAN: VZLA) announced on Thursday that it is acquiring the historic Santa Fe silver project for a mix of cash and shares.

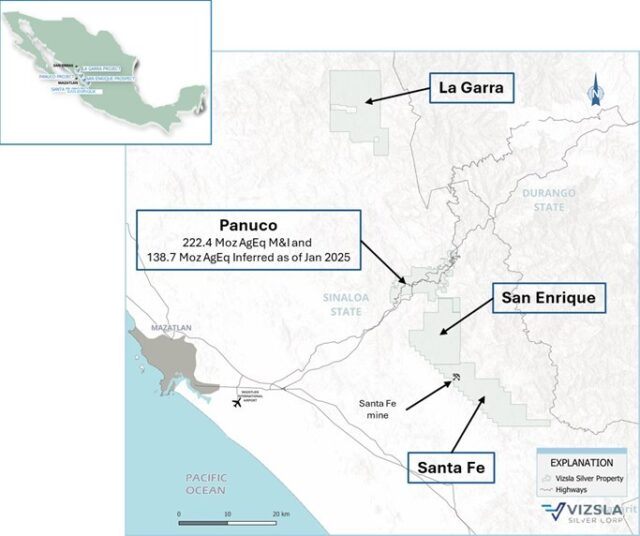

The company announced on Thursday that the acquisition also includes production and exploration concessions, and comprises 12,229 hectares located south of the Panuco project.

The purchase has two different components, including a one-time cash payment of USD$1.4 million and then 2.7 common shares within 15 days of the effective date.

The large property package covers 12,229 hectares, located 22 km southeast of Panuco and immediately south of the recently acquired San Enrique prospect (see press release dated April 16, 2024). It includes a fully permitted 350 tpd flotation plant that produces silver and gold from a northwest-trending epithermal vein. From 2020 through 2024, the Santa Fe mine processed 370,366 tonnes of ore, averaging 203 g/t silver and 2.17 g/t gold.

Furthermore, the project area has full coverage with LiDAR, high-resolution aero-magnetic, and radiometric surveys. It also features detailed mapping and IP geophysics around the mine area. Previous drilling campaigns by Aurico Gold in 2014 and Fortuna Mining (TSE: FVI) (NYSE: FSM) in 2020 outlined the high-grade shoot currently mined. Additionally, these campaigns reported anomalous silver intercepts in four other target areas.

“Vizsla Silver continues to expand its land position in western Mexico along the highly prospective Sinaloa Silver Belt with the acquisition of the producing Santa Fe mine,” said Michael Konnert, President, and CEO.

Read more: Vizsla Silver finds 897 G/T AG/EQ over 5.85 meters including 2,256 g/t over 1.13M

Read more: Callinex Mines finds new polymetallic drill targets in Manitoba

Santa Fe shows a deep history of drilling

The producing Santa Fe mine and known vein prospects account for about 12 per cent of the total property package.

Mining at Santa Fe began during the Spanish era.

The previous operator, Mr. Eduardo de la Peña, discovered a historic shaft and smelter-furnace when he began mining historic waste dumps in 2008. He trucked approximately 20,000 tonnes of dump material—grading around 2.0 g/t gold and 200 g/t silver—to the El Coco mill in Panuco for processing.

Between 2008 and 2014, Mr. de la Peña staked additional claims surrounding the original Santa Fe mine. In 2014, he drilled the property’s first 1,000 metres. That same year, Oro de Altar (ODA), a subsidiary of Aurico Gold, optioned the project. ODA completed a high-resolution airborne survey, detailed mapping, and drilled 11,957 metres across 45 diamond drill holes.

Location map of the Santa Fe property and Santa Fe mine with respect to the Panuco Project, San Enrique and La Garra. Image from Vizsla Silver Corp.

Aurico’s drilling outlined a high-grade shoot along the main “Mother” vein. Consequently, Mr. de la Peña built additional mine infrastructure. He also installed a 6 km-long power line in 2016. In addition, he constructed a processing plant and underground mine in 2018.

In 2020, Minera Cuzcatlan, a Fortuna Silver Mines subsidiary, optioned the property. It drilled 7,547 metres in 17 holes and completed a LiDAR survey. Also, from 2020 to 2024, the Santa Fe plant processed 370,366 tonnes of ore, averaging 203 g/t silver and 2.17 g/t gold.

Under the option agreement, Vizsla Silver holds the option to also acquire a 100 per cent interest in specific production concessions.

.