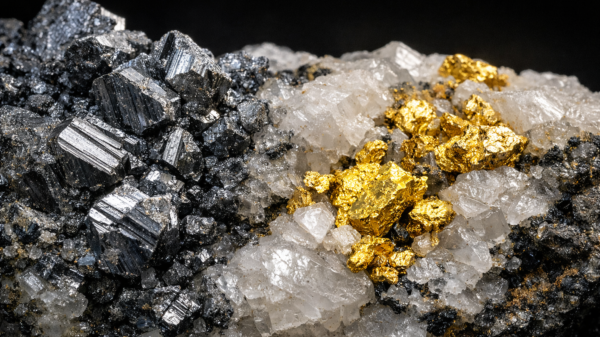

Newmont Corporation (TSE: NGT) (NYSE: NEM) has agreed to sell off its interest in the Akyem gold mine in Ghana to China’s Zijin Mining Group Co. for USD$1 billion in cash.

Originally announced on Monday, this deal represents another part of Newmont’s overall strategic divestment strategy as part of the company’s ongoing attempts to streamline its portfolio, with a focus on core assets.

Zijin Mining’s acquisition of the Akyem mine in Ghana’s Eastern Region strengthens its global presence and secures additional gold resources. As China’s largest listed metals producer, Zijin sees Akyem as a key opportunity to tap into one of the world’s major gold belts. The company plans to begin underground operations by 2028, demonstrating its commitment to long-term investment in the region and advancing its aggressive output targets.

Newmont, which began commercial production at Akyem in 2013, has decided to sell the mine as part of its broader strategy to divest non-core assets. This move allows Newmont to focus on higher-value, longer-life operations.

Zijin reported that the Akyem mine, one of the largest gold mines in Ghana, produced 11.9 tonnes of gold in 2021, 13.1 tonnes in 2022, and 9.2 tonnes in 2023. The processing plant is designed to handle a capacity of 8.5 million tonnes per year.

Newmont is seizing the opportunity to sell as gold prices reach record highs, maximizing the value of its assets. For Ghana, this transaction presents both opportunities and concerns. While it attracts foreign investment, there may be apprehension over control of the country’s resources. However, Zijin’s plan to further develop the mine could boost employment and drive infrastructure development in the region.

Read more: Calibre Mining shuffles strength into its board for future growth

Read more: Calibre Mining seeks new employees for the Valentine gold project

Newmont is transitioning to focus on copper mining

The Akyem project has sparked controversy, particularly over environmental impact and land compensation issues. Newmont previously faced criticism for its approach to local community relations and environmental practices at the site. How Zijin will address these ongoing concerns remains to be seen, especially with international scrutiny on the ethical practices of mining operations.

Newmont is transitioning strategically to focus on copper mining as part of global decarbonization efforts. Upon closing the Akyem mine deal, Newmont will receive USD$900 million upfront and an additional USD$100 million upon meeting certain conditions. The company plans to use the proceeds to strengthen its balance sheet and boost shareholder returns.

Earlier this year, Newmont sold its ownership in the Telfer and Havieron Australian assets for approximately USD$475 million, continuing its strategy of offloading non-core assets to focus on Tier 1 operations.

Copper plays a crucial role in electric vehicle (EV) manufacturing, as well as solar and wind energy projects. Newmont’s executives have reportedly been evaluating various mining sites in Canada, the U.S., Australia, and Ghana. Despite these moves, the company has affirmed its commitment to Ghana, investing between USD$950 million and USD$1.05 billion in development capital for the Ahafo North gold mining project in the Ahafo region.

.