Argentina has officially endorsed the use of Bitcoin in legally-binding contracts, opening the door to wider adoption.

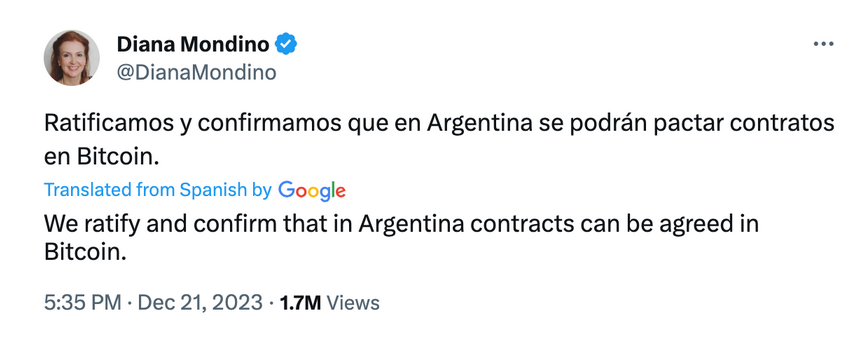

Diana Modino, Argentina’s Minister of Foreign Relations and International Commerce, posted this news to X on Thursday.

The tweet also highlights the broader acceptance of cryptocurrencies and other commodities like kilograms of beef or litres of milk as mediums for exchange.

While the tweet did not reveal specific government measures related to crypto, this aligns with President Milei’s perspective on combating financial inefficiencies and corruption through Bitcoin.

Observers view the move as a potential first step toward broader crypto adoption. Some believe that if South America’s second-largest economy embraces Bitcoin, it could exert influence on the global use of cryptocurrencies.

The formal approval of Bitcoin in contracts indicates that Argentina may be progressing towards adopting crypto on a larger scale.

According to Mauricio Di Bartolomeo, co-founder of crypto lending and trading platform Ledn, Argentinians can anticipate the legal ability to transact in Bitcoin and stablecoins soon, following Milei’s election.

In 2022, four Latin American countries—Brazil, Argentina, Colombia, and Ecuador—achieved rankings among the top 20 in global adoption of crypto assets. They pursued the benefits that digital assets claim to provide.

These include seeking protection against uncertain domestic macroeconomic conditions, circumventing capital controls, enhancing financial inclusion for unbanked populations, facilitating cheaper and faster payments, and fostering stronger competition.

Screenshot of tweet including translation.

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Cryptocurrency provides residents an escape from devaluation of peso

For decades, Argentina has grappled with economic troubles. This includes recurring cycles of extreme currency devaluation that have periodically made residents’ day-to-day financial activities challenging.

The country finds itself in the midst of another such cycle, with the Argentinian peso having lost approximately 51.6 per cent of its value in the year leading up to July 2023. However, during that same time period, Argentina led Latin America in raw transaction volume, receiving an estimated $85.4 billion in value. It ranks second in the region for grassroots adoption.

According to Alfonso Martel Seward, the head of compliance and anti money laundering (AML) at Argentina-based cryptocurrency exchange Lemon Cash, cryptocurrency can provide residents an escape from the devaluation of the Argentinian peso.

“We have really high inflation, and there are lots of restrictions against buying foreign currencies,” Seward said. “That makes crypto a valuable option for saving.”

Stablecoins in particular are also popular for this reason, providing a new for ordinary citizens to collect U.S. dollars.

Bitcoin could help foreign direct investment

One of the primary drivers for cryptocurrency adoption in most developing nations has been the lack of traditional financial services. Often people in emerging nations are locked out of the global economy for lack of bank accounts or credit cards. Conversely, cryptocurrencies offer a convenient alternative to these services since access is contingent on a smartphone and an internet connection.

High inflation also has a range of negative impacts on foreign direct investment (FDI).

It diminishes the real returns on investments, making them less attractive to foreign investors as the value of the country’s currency declines over time.

Additionally, inflation introduces uncertainty and risk into the investment environment. This makes it challenging for investors to predict future costs and potential profitability. Furthermore, it can lead to exchange rate instability, increasing the risk of unfavourable currency conversion for foreign investors.

Central banks also typically respond to high inflation with heightened interest rates, which raises the cost of borrowing for businesses and the expenses associated with financing investments. All these factors combined can deter foreign investors from engaging in FDI in countries with high inflation.

Argentina adopting Bitcoin could have positive effects on FDI.

Companies of all sizes stand to benefit from the adoption of Bitcoin. For example, the Coca-Cola Company (NYSE: KO) has maintained a presence in Argentina for 75 years. It operates 10 production plants and four bottling companies. It could benefit from simplified international transactions.

Another example includes the lithium extraction sector, where a company like Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) presently operates. It could benefit from Bitcoin’s transparency and provenance, knowing the origin of the life cycle of the funds used to buy its services.

Overall, Bitcoin’s positive impact on FDI stems from its ability to simplify international transactions, provide a reliable store of value, and enhance the transparency and security of cross-border investments.

.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com