The leading South African gold miner AngloGold Ashanti plc (NYSE: AU) (JSE: ANG) will invest C$22.05 million in G2 Goldfields Inc. (CVE: GTWO) to expand exploration initiatives in Guyana.

The company announced on Tuesday it subscribed to 24.5 million common shares at C$0.90 per share. The move will grant AngloGold approximately 11.7 per cent ownership of G2’s total shares.

After the announcement, G2 Goldfields stock went up by 13.4 per cent to $0.76.

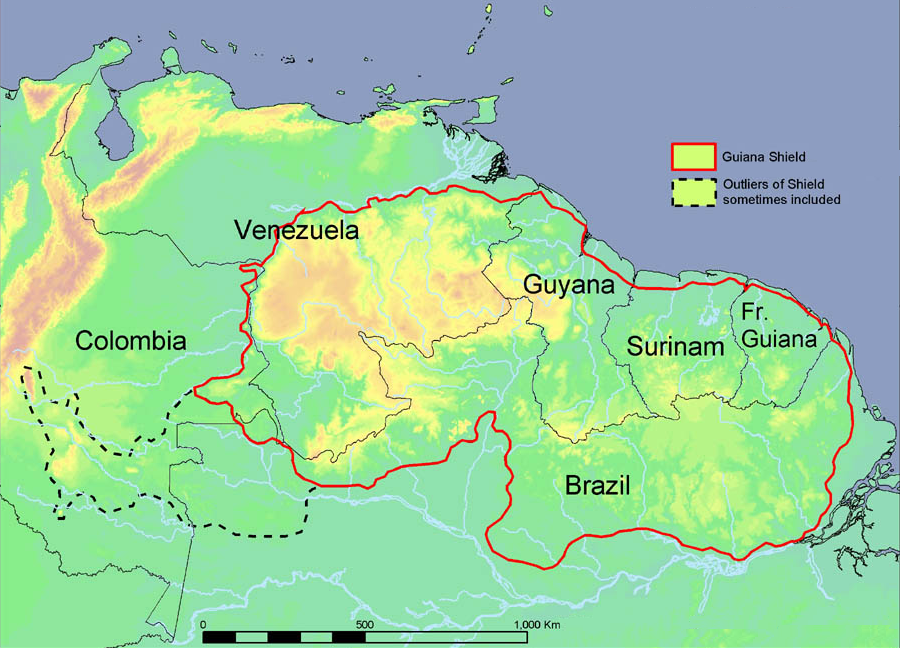

Guyana is renowned for the gold-rich Guiana Shield, with deposits that include the Aurora (6 million ounces) and Omai (5 million ounces) mines. In addition, Guiana Shield boasts Toraparu (7.0 million ounces) deposits.

G2’s principal OKO project includes the OKO Main Zone and Ghanie deposits. In April 2022, G2 announced an Indicated Mineral Resource estimate for the OKO Main Zone. The estimate projected the zone to contain about 220,000 ounces of gold (793,000 tonnes grading 8.63 g/t Au) and an Inferred Mineral Resource estimate of 974,000 ounces of gold (3,274,000 tonnes, grading 9.25 g/t Au). A Mineral Resource update is anticipated in the first half of 2024.

G2’s leadership, including Patrick Sheridan and Dan Noone, has a successful history of gold discoveries in Guyana. This has contributed to the development of Aurora, the country’s largest gold mine.

Journeying North #OKONW pic.twitter.com/QHxWd88BoD

— G2 GOLDFIELDS (@G2Goldfields) December 15, 2023

Read more: Calibre Mining’s merger with Marathon Gold deemed ‘tremendous opportunity’

Read more: Calibre Mining joins Mining Association of Canada

Within a 20 kilometre radius of OKO Main and Ghanie, G2 has identified other exploration targets, adjacent to Reunion Gold Corporation’s OKO West discovery. Reunion Gold Corporation also published an Indicated and Inferred Mineral Resource of 4.24Moz, grading 1.91 g/t, in June 2023.

AngloGold expressed confidence in the significant growth potential of G2’s exploration properties. As part of the subscription, AGA will be granted pre-emptive and top-up rights for future security issuances by G2 Goldfields.

“This strategic investment in G2 will provide us with a strong position in one of the world’s key gold provinces,” AngloGold CEO Alberto Calderon said. He added that the region comes with significant potential for new discoveries.

“We look forward to G2’s continued exploration success as the Guiana Shield continues to develop,” Calderon said.

The deal should conclude in January 2024, subject to the execution of definitive documentation and satisfaction of customary conditions. This move signifies AngloGold’s commitment to expanding its presence in promising gold exploration ventures.