Western Australia’s Deep Yellow Limited (ASX: DYL) achieved a key milestone Monday by obtaining a mining license for its flagship uranium project in Namibia.

The license given by the African nation’s Ministry of Mines and Energy for the Tumas operation is valid for two decades. It will become the fourth major uranium mine in the country.

“This represents another key accomplishment in the progress to develop this significant uranium asset,” John Borshoff, Managing Director and CEO of the company, said.

Deep Yellow says it plans to make a final investment decision for the project in Q3 next year.

The expectation for the mine is a lifespan exceeding 30 years and production around 3.6 million pounds (Mlb) of yellowcake uranium (U3O8) annually. The company updated its mineral resource estimate for the project at the end of November.

Resource drilling at Tumas delivered an 11% uplift to the MRE and places $DYL in a strong position to advance Tumas towards 30+ yr LoM target

Additional resource drilling is planned to the west of Tumas 3 in FY25 to identify a further 30Mlb#uraniumhttps://t.co/CSAR5xEhC6

— Deep Yellow (@DeepYellowLtd) November 30, 2023

Read more: ATHA Energy to acquire Latitude Uranium and 92 Energy, creating industry’s largest uranium portfolio

Read more: ATHA Energy increases private placement offering up to $22.84M

Namibian mines supply 10 per cent of the the world’s uranium

Namibia currently has three major uranium mines: Rössing, Langer Heinrich and Husab.

The lifespan of the Rössing operation was extended until 2036 at the beginning of this year. The mine, primarily owned by China National Uranium Corporation, generated a net profit of C$60.3 million in 2022. It produced 2,444 tonnes of uranium the previous year.

Langer Heinrich, primarily owned and operated by Paladin Energy Ltd (ASX: PDN) (OTCQX: PALAF), was shut down in 2018 but production is expected to restart early next year. The project’s deposit was discovered in the early 1970s and Paladin acquired it in 2002. It has produced over 43 Mlb of U3O8 and is expected to generate an additional 77 Mlb or more going forward.

Swakop Uranium’s Husab operation on the country’s west coast produced 3,960 tonnes of U3O8 last year. It is located about 5 kilometres from the Rössing mine. The operation primarily supplies China.

Namibia sits in spot number three on the lists of the world’s top uranium producers. Kazakhstan is top dog and Canada is number two.

The majority of Canada’s uranium comes from the Athabasca Basin, a vast area in northern Saskatchewan and Alberta. The top companies in the region are Cameco Corporation (TSX: CCO) (NYSE: CCJ), NexGen Energy Ltd. (TSX: NXE) (NYSE: NXE) and Uranium Energy Corporation (NYSE American: UEC).

ATHA Energy Corp. (CSE: SASK) (OTCQB: SASKF) holds the largest land package in the jurisdiction, spanning 3.4 million acres.

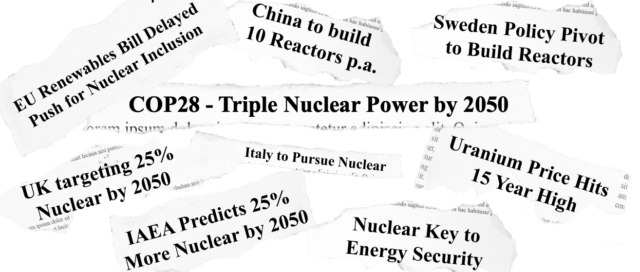

In recent days, an assortment of factors have prompted a new or renewed interest in the nuclear industry from investors, hedge funds, explorers and others.

Image via Deep Yellow Limited

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com