Ora Banda Mining Limited (ASX: OBM) officially announced a binding joint venture and farm-in agreement with Brenahan Exploration Pty Ltd (BEPL), a wholly-owned subsidiary of Wesfarmers Chemicals, Energy & Fertilisers (WesCEF).

Announced on Monday, the “BEPL Transaction” entails Ora Banda selling 65 per cent of its mineral rights (excluding gold and by-products) on the Davyhurst tenement package for $26 million in cash and a 2 per cent royalty.

This deal establishes a 65 per cent / 35 per cent joint venture between BEPL and Ora Banda, aimed at advancing exploration in the unexplored Davyhurst tenement package.

While gold remains the primary focus, an exploration program in April yielded promising results at the Federal Flag prospect. Three drill holes revealed more than 11 meters of spodumene containing 1.28 per cent lithium oxide, located just 10 kilometres to the south of the Davyhurst processing plant.

Five more areas, namely Barney, Waihi, Young Australian, Gila and Siberia, have been pinpointed as potential locations housing lithium-bearing LCT pegmatite swarms. Of these, the Barney and Waihi prospects take precedence as the top priorities for immediate follow-up, a decision rooted in the most up-to-date data available.

LCT pegmatite swarms refer to geological formations that contain lithium (L), cesium (Cs) and tantalum (T) minerals within pegmatite rocks. Pegmatites are coarse-grained, igneous rocks known for their exceptional mineral richness and can host a variety of valuable minerals, including lithium, cesium, and tantalum.

Read more: Lithium South Development updates leadership roster, appoints new director

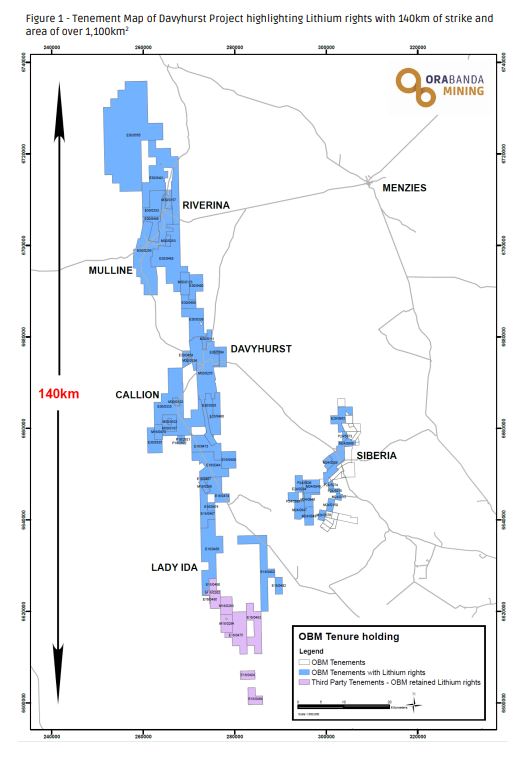

Tenement map of Davyhurst Project highlighting lithium rights with 140km of strike. Photo via Ora Banda Mining.

BEPL also gains the unique option to increase its stake to 80 per cent through exclusive funding of an additional $15 million for the exploration of the tenements over the next three years.

Ora Banda benefits from this partnership by being carried free of all exploration costs, starting from the initial discovery phase and extending through the completion of a Definitive Feasibility Study (DFS) for the relevant area. The company retains exclusive rights to gold minerals throughout its entire tenement package, preserving its full control over gold mining activities.

BEPL will provide an upfront cash payment of $22.1 million to Ora Banda, with the remaining $3.9 million cash consideration payable upon the earlier execution of formal mineral sharing, joint venture and royalty agreements or by April 30, 2024.

Additionally, Ora Banda has agreed to effectively sell 1.5 per cent of the 2 per cent royalty it receives from BEPL for non-gold minerals produced under the agreement to Hawke’s Point Holdings L.P. for $4 million, pending shareholder approval. This move will increase the total consideration of the deal to $30 million.

“The Davyhurst tenement package is very large and has never had any sustained or modern

exploration programs given its disjointed and under-capitalized historical ownership,” Ora Banda’s managing director Luke Creagh said in a statement.

“Although we have had encouraging early-stage lithium results, Ora Banda is a gold-focused company and given the underexplored nature and size of this belt, we expect it would take many years to do it justice for other minerals.”

In the impending carbon-free world, lithium stands as a vital component. As companies and governments embrace renewable energy and electric vehicles, lithium-ion batteries become pivotal. Lithium’s lightweight and high energy density makes it indispensable in reducing emissions and securing a sustainable, cleaner energy future.

natalia@mugglehead.com