Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX) started drilling in the Lithocap Zone of Precipitate’s Pueblo Grande Project in the Dominican Republic as part of an earn-in agreement with Precipitate Gold Corp. (TSXV:PRG) (OTC:PREIF).

Precipitate announced the beginning of Barrick’s program on Monday, and noted that Barrick has the right to earn a 70 per cent stake in Precipitate’s Pueblo Grande Project.

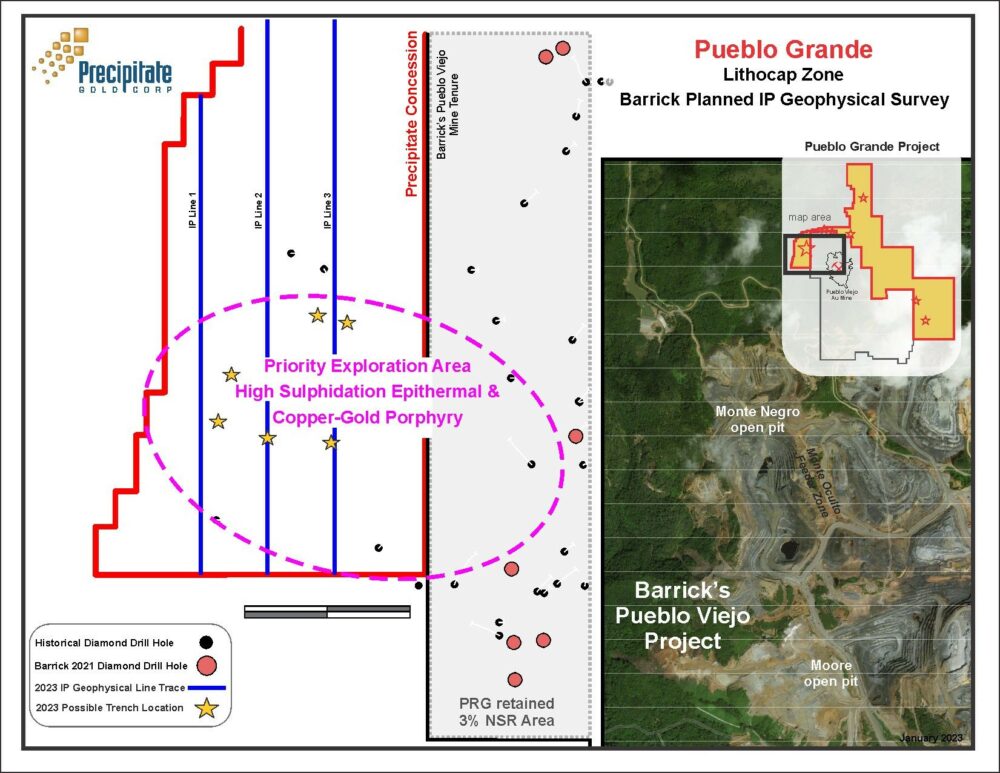

Barrick’s program will drill up to 3,000 meters deep and create 10 holes in Lithocap Zone to investigate several unexplored areas. The company chose these areas based on information from surface sampling, and geophysical techniques like induced polarization (IP) and magnetic surveys.

These surveys have shown that there are some anomalies in the ground that have a high charge, meaning they might contain valuable minerals like gold.

Barrick based its decision making on both new and existing data, and chose to expand its drilling efforts to include surface level gold similar to what it found previously in the Pueblo Viejo mining pits. The company also intends to explore the possibility of finding copper and gold deeper underground in a potential porphyry-style target.

“This drill phase will test multiple previously untested highly prospective targets immediately west of Barrick’s Pueblo Viejo mining operation, which is one of the largest operating gold mines in Latin America,” said Jeffrey Wilson, Precipitate’s president and CEO

“Barrick’s reinterpretation of new and historical data has identified a number of compelling, untested geochemical and geophysical anomalies situated near surface and at depth. We expect Barrick’s drilling to be systematic and comprehensive and we look forward to receiving data that is derived from this program.”

Lithocap zone map. Image via Precipitate Gold.

Read more: Calibre Mining reports record breaking sales and increased net income in Q2

Read more: Calibre Mining expands resources from open pit at Nevada’s Pan Gold Mine

Barrick to spend 10M over six years: earn-in conditions

The earn-in agreement’s conditions involve spending a minimum of USD$10 million on specific work-related expenses before the agreement’s sixth anniversary. This spending is divided into stages, with at least USD$2 million spent before the second anniversary, including a guaranteed minimum of USD$1 million. The spending progressively increases to USD$3.5 million by the third anniversary, USD$5 million by the fourth and USD$7 million by the fifth.

Additionally, Barrick needs to conduct a minimum of 7,500 meters of drilling and complete a pre-feasibility study before the sixth year. If Barrick successfully fulfills all these conditions, it will own 70 per cent of the project. When all the conditions are met and Barrick has received its 70 per cent ownership, the mine would effectively become a joint venture between Precipitate and Barrick, with the former taking on 30 per cent ownership of the project.

If the company’s ownership in the JV drops below 10 per cent, Precipitate’s share will change into a a Net Smelter Return royalty, the exact percentage of which depends on whether there were any pre-existing agreements about this before. If there weren’t, the NSR will be 1.5 per cent, and if there were, it will be 1 per cent of the profits.

Follow Joseph Morton on Twitter

joseph@mugglehead.com