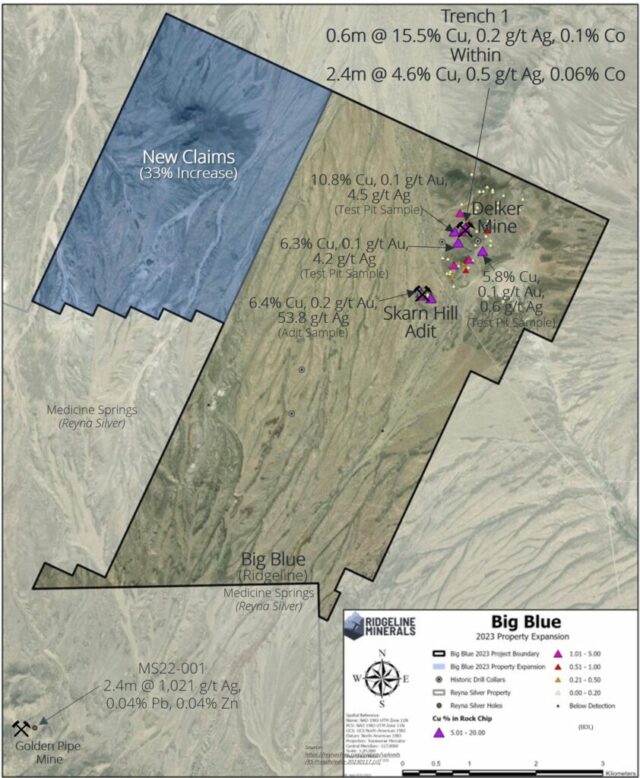

Ridgeline Minerals Corp. (TSX-V: RDG) (OTCQB: RDGMF) has added almost 3,000 acres to the land package at its copper-gold-silver project in Nevada, a property that now spans 41 square kilometres.

The Vancouver miner announced the expansion of its Big Blue project in Elko County on Wednesday, which involved staking 141 United States Bureau of Land Management claims. The company says it acquired an extensive historical geologic database on the property from an undisclosed party last month.

The database contains detailed maps, drill data, information on surface geochemistry and several generations of surface and airborne geophysics. The property also hosts the past-producing Delker Mine that generated over 94,000 pounds of copper between 1916 and 1917.

Ridgeline says the property has been significantly underexplored in recent decades. The company aims to have its maiden drill program at Big Blue next year.

The project is located approximately 75 kilometres southeast of Elko and situated to the north of the Medicine Spring project owned by Reyna Silver Corp. (TSX-V: RSLV) (OTCQX: RSNVF), which started a 3,000-metre drill program there early last month.

“Our team is very encouraged by the scale of the geophysical anomalies located on our new claim block, which suggest potential for a blind porphyry copper target at depth and distal carbonate replacement deposit (CRD) targets along strike,” said Ridgeline’s President and CEO Chad Peters.

“Until now, the Delker area has never been explored as a consolidated porphyry district and with this expansion we now control a target-rich land position with a robust geologic dataset to support our exploration model,” he added. Ridgeline shares rose by 2.7 per cent Wednesday to $0.19 on the TSX Venture Exchange.

Big Blue property expansion map. Image via Ridgeline Minerals

Read more: Calibre Mining reports record breaking sales and increased net income in Q2

Read more: Calibre Mining expands resources from open pit at Nevada’s Pan Gold Mine

Calibre Mining (TSX: CXB) (OTCQX: CXBMF) is another company making significant progress with mining operations in Nevada.

Calibre recently expanded its resources north and south from its Pan Mine’s open pit in central Nevada. High-grade drill results over significant lengths from the mine’s Palomino target reported by the company in July left analysts from Haywood Securities “gobsmacked” at the consistency of gold mineralization.

The company is on schedule for delivering on its 2023 production guidance of 250,000-270,000 ounces of gold and has budgeted $9 million for 40 kilometres of exploration in the state this year.

Calibre reported a 32 per cent sequential increase in its cash balance at the end of Q2 this year, bringing its position to US$77 million. The company had a 15 per cent year-over-year increase in gold production for the quarter, generating 68,776 ounces.

Calibre’s shares rose by 0.7 per cent Wednesday to $1.49 on the Toronto Stock Exchange and have been on a steady incline since January, rising by over 63 per cent.

Calibre Mining is a sponsor of Mugglehead news coverage

rowan@mugglehead.com