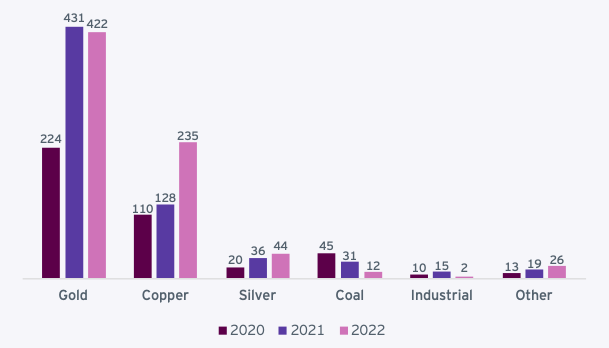

British Columbia broke records in 2022 by allocating a staggering $740 million to its exploration sector, surpassing its previous high of $681 million in 2012. The surge in spending was driven by an 84 per cent increase in copper expenditure, which rose from $128 million in 2021 to $235 million in 2022, reflecting the province’s commitment to expanding its mining industry.

That data comes from a new survey released at Toronto’s 2023 Prospectors and Developers Association of Canada (PDAC) Convention running between March 5-8 by B.C.’s Ministry of Energy, Mines and Low Carbon Innovation (EMLI) in partnership with Earnst & Young Global Limited (EY).

The two parties based their data on survey responses, information obtained from financial reports and a series of press releases gathered from 170 companies operating in the province with a total of 230 projects.

The companies surveyed ranged from grassroots outfits and junior explorers to major publicly traded global corporations with operations in B.C.

Approximately 46 per cent of survey respondents indicated that gold is the province’s primary commodity and early-stage/grassroots projects acquired 78 per cent more funding than last year, increasing from $161 million in 2021 to $285 million in 2022. These projects accounted for 39 per cent of the year’s total expenditure or $288.6 million of the $740 million total.

Copper was the primary contributor to the sector’s record expenses in 2022 with provincial costs attributed to the commodity rising by over $100 million from 2021, which EY says was due to favourable market conditions and demand. The commodity accounted for 32 per cent of the total exploration expenses last year in a province producing more than half of Canada’s copper.

Yearly exploration expenses by commodity, 2020-2022. Numbers represent millions in Canadian dollars. Photo via B.C.’s Ministry of EMLI and EY

Read more: Toronto welcomes the return of PDAC, the world’s largest mining convention

Read more: Minister of Natural Resources announces over $344M investment in critical minerals development

The province’s $740 million expenditure on exploration last year exceeded the previous 10-year high of $681 million reported in 2012 by about 10 per cent and a total of $441 million was invested in precious metals projects.

Exploration for critical minerals in B.C. increased by 77 per cent year-over-year and precious metals spending rose by 91 per cent from 2020 as well.

Of the $740 million spent last year, $42 million went toward exploration agreements and community consultation with First Nations groups.

“It’s exciting to see exploration spending strengthening in B.C., particularly as the need for minerals and metals increases as we undergo a global transition towards electrification and a low carbon future,” said Kendra Johnston, President and CEO of British Columbia’s Association for Mineral Exploration.

“We’re also encouraged to see survey respondents increase their commitment to working with First Nations throughout the exploration and development lifecycle to ensure benefits extend to the local and surrounding communities.”

B.C. saw a 32 per cent increase in employment within the sector and a 97 per cent increase in permanent First Nations workers during 2022 from the previous year.

Read more: NevGold submits exploration and expansion plans for gold project in Nevada

Read more: NevGold Corp. gets exploration notice approval from Bureau of Land Management

What did decrease in 2022 was the total number of projects and metres drilled, which dropped by 20 and 24 per cent respectively due to exploration in the province shifting focus to earlier stage activities.

Noteworthy critical minerals projects in the province include the Galore Creek copper operation run by Galore Creek Mining Corporation, a 50/50 joint venture between Newmont Corporation (NYSE: NEM) (TSX: NGT) and Teck Resources Limited (TSX: TECK.A and TECK.B) (NYSE: TECK); the Thorn gold-copper-silver project run by Brixton Metals Corporation (TSX-V: BBB) (OTCQB: BBBXF); and the Wicheeda rare earth elements deposit owned by Defense Metals Corp. (TSX-V: DEFN) (OTCQB: DFMTF) (FSE: 35D).

Photo via Defense Metals Corp.

Expenditure for gold exploration went up by 89 per cent in 2022 from 2020 but was still not quite as high as last year, dropping 2 per cent from 2021. The report also showed a 91 per cent increase in precious metals spending from 2020 last year.

Notable precious metals operations in B.C. include the Eskay Creek gold project owned by Skeena Resources Limited (TSX: SKE) NYSE: SKE) and the Silvana silver project run by Klondike Silver Corp. (TSX-V: KS).

Coal exploration in the province dropped immensely by about 60 per cent. The province spent $36 million on coal in 2021 and only spent $12 million on the commodity in 2022. There has been a steady downward trend in coal expenditure since 2014.

Yearly coal expenses in B.C., 2014-2022. Numbers represent millions in Canadian dollars. Photo via B.C.’s Ministry of EMLI and EY

In mid-December last year, the Canadian federal government unveiled a $3.8 billion critical minerals strategy, and on Tuesday, additional details about how the funding would be distributed were released by Natural Resources Canada.

Among the funding initiatives, $144.4 million is going toward a Critical Minerals Technology and Innovation Program and $70 million is being put toward a Global Partnerships Program aimed at fostering international collaborations related to critical minerals supply chains.

rowan@mugglehead.com