In 2025, the global metals market continues to navigate a complex intersection of economic uncertainty, shifting geopolitical dynamics, and evolving industrial demand. Gold, long regarded as a traditional safe haven, remains a cornerstone asset for investors wary of inflationary pressures and currency volatility. After trading in a USD$1,800 to USD$2,000 per ounce range over the past year, gold’s appeal has been buoyed by central bank purchases and renewed geopolitical tensions, including ongoing conflict zones and strained relations between major powers.

Beyond gold, less widely followed sleeper metals like silver are beginning to regain investor and industrial attention. Silver prices have hovered around USD$22 to USD$26 per ounce recently but are supported by growing demand in photovoltaic manufacturing, electronics, and emerging green technologies.

Meanwhile, critical minerals like antimony are gaining prominence amid supply chain security initiatives, particularly in North America. Antimony, essential for flame retardants, lead-acid batteries, and various alloys, is listed under the U.S. FAST-41 program designed to expedite permitting for strategic minerals and infrastructure projects. Its supply is heavily concentrated outside western-friendly jurisdictions, intensifying interest in domestic sources.

This Mugglehead roundup profiles some of the key jurisdictions and companies working to advance gold, silver, and antimony projects — metals whose market trajectories are influenced by more than just commodity cycles. Geopolitical realities, regulatory shifts, and industrial transitions collectively shape their outlook and show why a diverse view of metals remains essential for investors and industry watchers alike.

Lithium in James Bay

James Bay has moved beyond the discovery phase. It’s now a full-scale lithium district, backed by real capital, real drill campaigns, and increasingly, real tension. The geology isn’t in question anymore — the Corvette discovery by Patriot Battery Metals (TSE: PMET) (ASX: PMT) (OTCMKTS: PMETF) established that. What matters now is scale, ownership, and who’s positioned to survive the capital squeeze and supply glut.

The region offers what few others in Canada can: district-scale pegmatite potential, a provincial government that’s all-in on electrification, and road-accessible targets within shouting distance of the grid. Brunswick Exploration (CVE: BRW) has gone wide, casting a first-pass net across multiple prospects. Winsome (ASX: WR1), Loyal Lithium (ASX: LLI), and a tightening circle of juniors are chasing proximity, optionality, and off-ramps.

The off-ramp just got clearer. In early 2025, Rio Tinto Group (NYSE: RIO) acquired Arcadium Lithium, picking up the combined former portfolios of Allkem and Livent portfolio and signalling that James Bay is now firmly on the majors’ map. For juniors, that deal reframes the landscape as being a battleground for consolidation.

But fire season is coming. Exploration windows are tightening as wildfires disrupt logistics, and Indigenous leaders are increasingly direct about who gets to operate, and on what terms. The Cree aren’t opposing mining, but they are raising the cost of admission.

Read more: China reveals lithium battery tech that spots deadly failures before battery activation

Read more: Codelco and SQM get regulatory approval for lithium joint venture in Chile

Nevada where gold and antimony meet

Nevada doesn’t need hype. It has gold and that’s always going to be better.

The state consistently ranks as one of the top global mining jurisdictions. Frontier regions need to trade on blue-sky potential, but Nevada’s appeal is simple: endowment, infrastructure, and a functional permitting process. That matters for juniors, especially given that speculative capital is tightening and times are under pressure.

Still, Nevada offers something few jurisdictions can and that’s a path to production that isn’t fantasy. That’s why companies like NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) and Military Metals Corp (CNSX: MILI) (OTCMKTS: MILIF) (FRA: QN90) are doubling down here, pivoting back and forth from gold to antimony while the metal remains hot.

That’s also how NevGold’s flagship Limousine Butte project in eastern Nevada checks multiple strategic boxes. The company’s carving out a position in low-cost, oxide-hosted gold with near-surface intercepts and heap-leach potential.

But antimony is what sets them apart. It’s a metal that rarely makes headlines, but sits squarely on the U.S. critical minerals list. The company’s exploring potential dual-metal zones that could reshape the economic profile of its claims. If proven out, it positions NevGold not just as a junior gold story, but as a domestic supplier of a metal that currently comes almost entirely from China, Russia, and Tajikistan.

There’s also a quiet consolidation dynamic taking shape. Mid-tiers are watching closely. The majors, led by Barrick Mining Corp (TSE: ABX) (NYSE: B) and Newmont Corporation (TSE: NGT) (NYSE: NEM) (FRA: NMM), focus on squeezing value from their legacy JV assets, and juniors are maneuvering in the gaps, picking up land, data, and expired option plays.

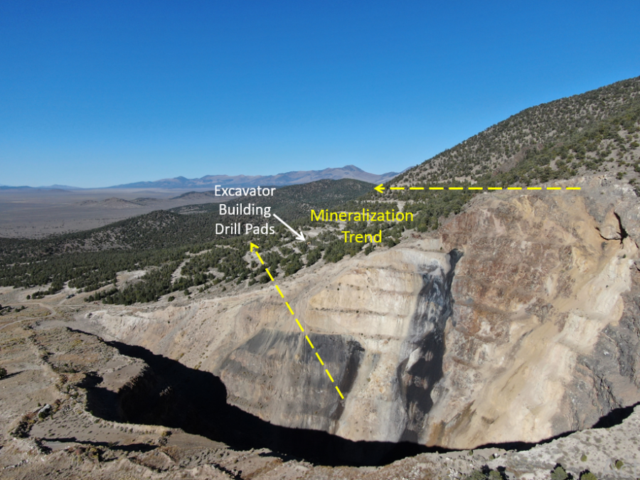

Mineralization trend at Limousine Butte in Nevada. Image via NevGold.

The Thelon Basin for uranium

The Thelon Basin is where uranium speculators go when the Athabasca feels too crowded. It’s not a new frontier. The geology is well-mapped, the historical drillholes are there, and the proximity to legacy discoveries like Kiggavik adds undeniable appeal. But the Thelon is also a jurisdictional minefield, and everyone in the basin knows it.

The big asset is still previously mentioned Kiggavik. It’s a multi-deposit uranium system that Orano mothballed after shelving permitting efforts back in 2016. Since then, the basin has seen a slow but deliberate return of explorers, many betting that nuclear’s geopolitical resurgence will finally shift the needle on northern development.

Forum Energy Metals (CVE: FMC) is staking hard on that idea. Their Tatiggaq project lies just west of Kiggavik and is one of the few Thelon plays backed by both drill data and a defined target model. In 2023, Forum brought in Orano as a partner, giving the project some credibility.

ATHA Energy (CVE: SASK) (OTCMKTS: SASKF), meanwhile, has built a land position of scale, betting that access to untouched targets and capital can overcome the permitting drag.

That’s the choke point.

Nunavut’s permitting regime is long, uncertain, and deeply tied to Inuit consultation and land-use planning. Companies that treat it like Saskatchewan will get eaten alive. The ones that treat it like Greenland, where patient engagement and social license define the pacing, might last long enough to see a real return.

Read more: NevGold’s latest Nevada drill results show exceptional gold mineralization

Read more: NevGold’s latest drill results extend priority target at Limo Butte by over 200 metres

Zacatecas, Mexico for silver

The cliché that if you dig anywhere in Mexico you’ll hit silver is true.

But there’s nowhere more spiritually tied to the metal than Zacatecas — a high-altitude, high-grade district that’s fed Spanish empires and TSX juniors for generations.

The province’s namesake city was born of a silver vein. In 2025, it’s still very much alive, even as cartels and geopolitics give Canadian companies pause. Defiance Silver Corp. (CVE: DEF) for one, isn’t pausing. Its San Acacio project sits within spitting distance of the historic Veta Grande vein, and recent intercepts, including 2,110 grams per tonne silver over 0.65 metres, suggest a long life ahead.

Then there’s Excellon Resources (CVE: EXN) (OTCMKTS: EXNRF), eyeing a return to relevance with a restructured approach and attention to its Evolución project. And Capitan Silver (CVE: CAPT) (OTCMKTS: CAPTF) is doubling down on its Cruz de Plata project. Now Capitan obeys a hybrid gold-silver model that keeps margins flexible as spot prices swing.

The Zacatecas territory. Image from Excellon

Add Endeavour Silver Corp. (NYSE: EXK) (TSE: EDR) to the Zacatecas mix. The company’s acquisition of the Pitic and Lourdes projects signals renewed confidence in the district.

Still, Zacatecas isn’t all sunshine. Locals remain wary of Canadian operators, with rising scrutiny over water use and land access. Security, too, is always on the docket, especially after high-profile incidents in neighbouring states. But for juniors with the right community approach and patience to build trust, Zacatecas offers what few places can, namely infrastructure, legacy, and bonafide district-scale silver potential.

.

NevGold Corp is a sponsor of Mugglehead news coverage

.