What are the top three uranium companies in Canada’s Athabasca Basin you may ask?

The country’s economy has benefitted significantly from the mining jurisdiction since 1975 and it has produced over 900 million pounds of triuranium octoxide (U3O8) since that time. The vastly underexplored region spans approximately 100,000 square kilometres in northern Saskatchewan and Alberta.

Canada currently produces approximately 22 per cent of the world’s uranium and the vast majority of the country’s exports come from the Basin.

The trio of top companies are listed in order of size based on their current market capitalization as follows:

1. Cameco Corporation

The top uranium operator in the region is Cameco Corporation (TSX: CCO) (NYSE: CCJ), which currently has a $26.4 billion market capitalization.

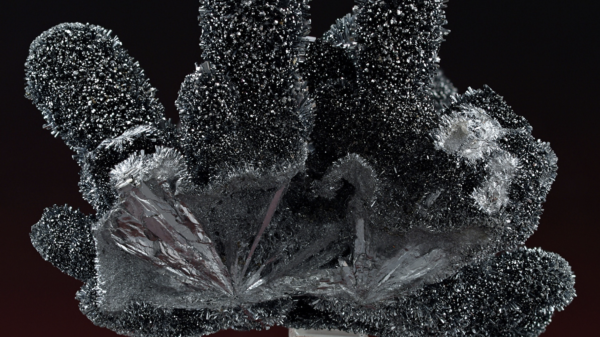

The company’s Cigar Lake operation in the jurisdiction is the world’s highest-grade uranium mine. It produces U3O8 with an average grade of 17.21 per cent, far higher than the global average of approximately 0.2 per cent.

It is also the world’s largest uranium mine, which accounted for 14 per cent of the world’s supply last year. Cameco holds a 54.5 per cent interest in the site.

The company also operates the McArthur River, Key Lake and Rabbit Lake uranium operations in the Basin.

McArthur River is another major mine that has been in service since 1999, producing U3O8 at an average grade of 6.7 per cent. Key Lake is the world’s largest high-grade uranium mill and Rabbit Lake was the longest-operating uranium mine in North America before production was suspended in 2016. It opened in 1975 and produced over 203 million pounds of uranium concentrate.

In addition to its major projects in the Athabasca Basin, the company also holds a 40 per cent stake in Kazakhstan’s Inkai in situ recovery (ISR) uranium mine through a joint venture with the country’s state-owned company Kazatomprom (FRA: 0ZQ).

Cameco and Brookfield Renewable Partners LP (TSX: BEP-R) (NYSE: BEP) recently obtained regulatory approval for their major US$7.9 billion joint acquisition of the renowned nuclear services provider Westinghouse Electric.

Cameco owns and operates the world’s largest commercial uranium refinery in Blind River, Ontario. The facility opened in 1983 and produces uranium trioxide (UO3) powder which is sent to its conversion facility in Port Hope to be refined into uranium dioxide (UO2) used for CANDU nuclear reactors and uranium hexafluoride (UF6).

The Port Hope facility is the only uranium conversion plant in the entire country.

The Key Lake mill. Photo via Cameco Corporation

Read more: ATHA Energy aerial surveys over Athabasca Basin reveal strong potential for uranium

Read more: ATHA Energy well-positioned to capitalize on world’s best uranium jurisdiction: TF Metals interview

2. NexGen Energy

The second-largest uranium miner in the jurisdiction is NexGen Energy Ltd. (TSX: NXE), a Vancouver-based company with a $4.45 billion market capitalization.

NexGen just became the first company to obtain full Provincial Environmental Assessment approval for a Saskatchewan uranium project in over two decades. The province’s Premier Scott Moe congratulated NexGen on the achievement for its flagship Rook I project.

Rook I, situated in the southwestern section of the Athabasca Basin, is estimated to contain 256 million pounds of measured and indicated U3O8 resources.

NexGen recently participated in the Government of Canada’s Trade Mission to Japan aimed at establishing long-term trade and investment opportunities between the two countries.

Our Japan trade mission has been truly remarkable, with engaging discussions on uranium's pivotal role in the green transition and energy security. This collaboration has been exceptionally productive. Exciting opportunities await! #IndoPacificStrategy @leighcuryer @travmcph pic.twitter.com/8g0C0nHm0T

— NexGen Energy Ltd. (@NexGenEnergy_) November 2, 2023

The company holds a 50.1 per cent stake in IsoEnergy Ltd. (TSX-V: ISO), a uranium explorer with a 248,000-hectare land package in the Canadian uranium mining jurisdiction.

NexGen and IsoEnergy have given ATHA Energy Corp. (CSE: SASK) (OTCQB: SASKF) rights to 10 per cent of resources discovered on certain portions of their land package. ATHA is an appealing investment prospect as it currently holds the largest land package in the entire Athabasca Basin, spanning 3.4 million acres.

ATHA has a cash balance of $25 million for its exploration and development work in the region and doesn’t need to contribute financially to any of the exploration efforts of NexGen or IsoEnergy.

During the past year, NexGen shares rose by over 40 per cent. They are currently trading for $8.48 on the Toronto Stock Exchange.

NexGen’s core shack. Photo via NexGen Energy

Read more: ATHA Energy performs largest multi-platform EM survey in the history of the Athabasca Basin

3. Uranium Energy Corporation

The third-largest uranium producer in the Athabasca Basin is Uranium Energy Corporation (NYSE American: UEC), a Texas-based mining company with a US$2.3 billion market capitalization.

The company has several uranium projects in the region, including the Roughrider, Hidden Bay, Shea Creek, Horseshoe-Raven and Christie Lake operations. Its 1.13-million-acre land package in the Basin contains 109.9 million pounds of measured and indicated U3O8 resources.

Last year, the company acquired a portfolio of uranium projects in the jurisdiction from Rio Tinto Group (ASX: RIO) (NYSE: RIO) (LON: RIO) for $1.5 million. The uranium operator is involved in a joint venture with Cameco at the Millenium project in the Basin.

In addition to its projects in Saskatchewan, Uranium Energy holds American projects in Texas and Wyoming with 76.1 million pounds of measured and indicated U3O8 resources.

Earlier this year, the company acquired Uranium One Americas for US$112 million in cash, thereby doubling production capacity in the United States.

Uranium Energy is actively involved with two ISR uranium projects in Paraguay as well.

Drilling underway at the Burke Hollow ISR project in Texas this year. Photo via Uranium Energy Corporation

Read more: Eagle Plains adds 2 Athabasca Basin uranium projects to its portfolio

Read more: Purepoint Uranium adds 8.8K hectares to its Athabasca Basin property through staking

Uranium and nuclear power have been attracting new or renewed interest from investors and hedge funds in recent days. This increased focus is attributable to decarbonization efforts worldwide, an increasing number of reactors under construction, the emerging small modular reactor market, climate concerns and other factors.

The commodity is currently worth about US$73.50 per pound, a high dollar figure that hasn’t been observed since 2008.

The majority of uranium produced in the Athabasca Basin is exported to foreign markets like China, the European Union and Japan. The remainder is used for nuclear power stations in Ontario and eastern Canada, generating approximately 15 per cent of the country’s electricity.

Canada is one of the top producers of the radioactive metal in the world, second only to Kazakhstan.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com