Virgin Galactic Holdings Inc (NYSE: SPCE) (FRA: 0QL0) shares rose immensely at their peak during intraday trading on Friday following the release of Q1 results that beat analyst expectations.

Highlights serving as catalysts for the spike included a significantly slimmer net loss and improved EBITDA compared to the first quarter of 2024. Sir Richard Branson’s space tourism company narrowed that loss by US$18 million to US$84 million and boosted the pre-tax earnings metric by US$15 million to negative US$72 million.

Losses per share for the quarter decreased from US$5.10 in Q1 of 2024 to US$2.38 last quarter.

Meanwhile, sales for the three-month period beat Wall Street expectations by over 53 per cent at US$461,000.

Virgin revealed that it will start offering more commercial spaceflights in 2026 after a phase of stagnation for research and development purposes. Revenue has decreased significantly over the past few quarters as a result. The aeronautics company paused space tourism operations in 2024 for the most part to upgrade its Delta spacecraft in preparation for launch next summer. Two of these are currently being worked on.

Passengers looking to board the six-person space shuttle and ascend above the atmosphere will need to pay more than the previous US$600,000 offered. The exact price tag increase has not been specified, but analysts have a bullish outlook for the more expensive tickets.

“The assets being built as we march through our pre-revenue phase are tremendous, and we expect them to open up a powerful and profitable business model,” CEO Michael Colglazier boasted in a release about the financial results.

Virgin’s aim is to build a multinational spaceline business, thereby making space travel more affordable to the masses. The California-based company currently competes with Jeff Bezos and Blue Origin for supremacy above the clouds.

Read more: Sidus Space heads for the stars with 220% spike, but why?

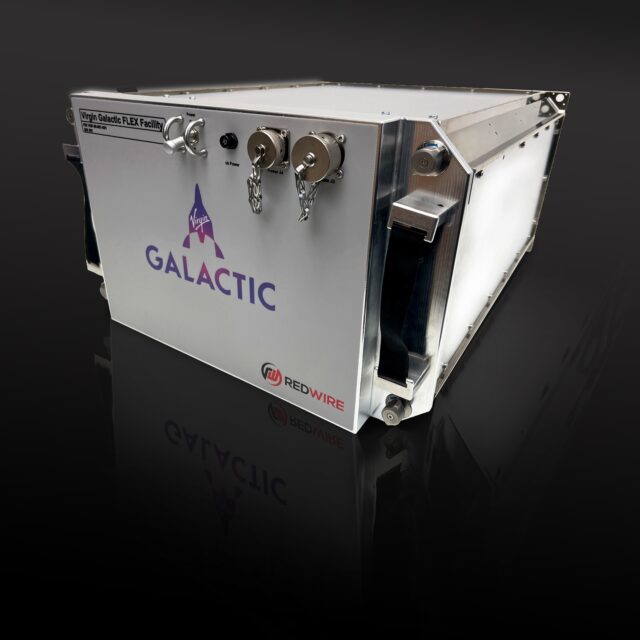

Virgin Galactic partners with Redwire

The company and Redwire Corp (NYSE: RDW) initiated a collaboration agreement in January.

Together, they are making “research payload lockers” that are capable of providing controlled environments for sensitive experiments and materials in space.

“Our new state-of-the-art research platform, designed for compatibility with longer duration space mission locker standards, means we can offer a suborbital space lab suited for testing technologies and research in preparation for orbital, lunar, or Martian missions,” said Virgin Galactic researcher Sirisha Bandla.

Credit: Virgin Galactic

Branson aims to be a philanthropist

As of May, Virgin Galactic only completes one or two commercial flights per month for private astronauts and research purposes. Its ships can fit four people at the moment, but the number of flights and astronauts who can squeeze inside the spaceships will soon be increasing.

Branson was knighted at Buckingham Palace in 2000 for his prominent business endeavours and philanthropic activities. To date, he is estimated to have donated US$1-2 billion to charitable causes.

In an interview on Thursday, the British billionaire business magnate said that he would give his fortune to charitable causes when he passed away rather than leaving his kids a large inheritance.

“My family definitely don’t expect large sums of money when I move on. Money is there to be used to tackle problems in the world.”

Virgin Galactic went public in 2019. The company was founded by Branson in 2004 and it completed its first test flight in 2013.

Read more: AstroForge gets first-ever U.S. gov license for deep space asteroid mining

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com