Authorities in the United States have started releasing thousands of Chinese-made cryptominers originally seized at ports nationwide by the U.S. Customs and Border Protection Agency.

Reuters originally reported on Wednesday that the enforcement actions came about regarding wider issues involving Chinese technology in sensitive sectors, and were ramped-up due to trade tensions due to the United States’ tariffs on China, and other countries.

The agencies’ actions align with the U.S. Department of Commerce’s Bureau of Industry and Security guidelines, which set rules for engaging with “advanced semiconductors” commonly used in AI and crypto to “prevent diversion” of these materials to further Chinese interests.

In November last year, Blockspace, an industry publication focused on Bitcoin mining and hardware, first reported that the seizures began by targeting models from Bitmain, a privately owned Chinese firm.

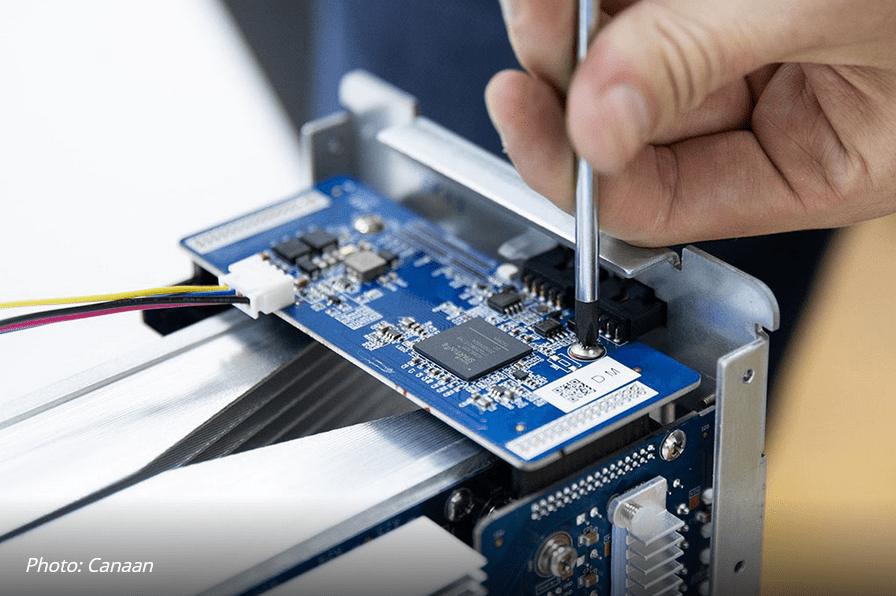

By February, U.S. federal agencies had expanded their seizures to include hardware from manufacturers MicroBT and Canaan Creative (NASDAQ: CAN).

Blockspace reported authorities may have detained mining machines due to AI chips from Sophgo, a Chinese company under trade restrictions. Before the releases began, agencies had stranded up to 10,000 mining machines at various U.S. entry points. Some affected retailers claimed their seized equipment was valued at over $5 million.

At the time, authorities tagged the equipment as “seized and subject to forfeiture” under U.S. legal codes. This tag granted them discretionary power over such products if they deem them subject to restriction or prohibition.

Read more: Trump names five cryptocurrencies to new U.S. strategic reserve

Read more: Tether attempt at Bitcoin mining ends in court battle

United States has made it tough on cryptominers in the past

These seizures have created significant operational challenges for U.S.-based miners who rely on regular equipment upgrades to stay competitive. According to data from Hashrate Index, the U.S. accounts for 43.8 per cent of the Bitcoin network hashrate, the second-largest share of mining pools by country, compared to China’s 45.8 per cent.

Over the past four years, the United States has introduced several measures that have created obstacles for cryptocurrency mining. The U.S. federal government implemented stricter regulations surrounding the importation of mining equipment, especially targeting hardware with advanced semiconductors.

These actions have disrupted operations for miners reliant on regular equipment upgrades. Additionally, certain states, such as New York, have imposed moratoriums on new cryptocurrency mining operations due to environmental concerns.

These states argue that mining’s energy consumption negatively impacts local ecosystems. At the same time, the federal government ramped up scrutiny on the environmental impact of Bitcoin mining. It called for greater transparency in energy usage and carbon emissions. These regulatory moves have led to operational challenges for U.S.-based miners, restricting growth potential.

President Trump has promised a new cryptocurrency friendly regime and so far has made good of this promise.

In January 2025, he signed an executive order titled “Strengthening American Leadership in Digital Financial Technology,” establishing the Presidential Working Group on Digital Asset Markets.

Trump tasked this group with exploring the idea of a national digital asset stockpile using seized cryptocurrencies. Subsequently, on Sunday, President Trump announced plans for a U.S. “Crypto Strategic Reserve” comprising Bitcoin, Ethereum, XRP, Solana, and Cardano.

This initiative aims to position the U.S. as the “Crypto Capital of the World” and bolster the digital asset industry.