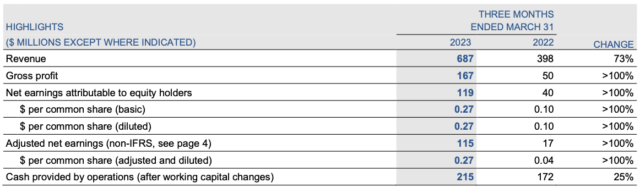

Saskatchewan’s uranium miner Cameco Corporation (TSX: CCO) (NYSE: CCJ) observed a 73 per cent year-over-year increase in revenue last quarter, jumping to $687 million from $398 million in 2022.

The Saskatoon-based company announced its financial results for Q1 on Friday and generated net earnings of $119 million.

As of March 31, the company had $2.5 billion in cash and cash equivalents and $1 billion in long-term debt.

Table via Cameco Corporation

Read more: Fission Uranium applies to build mine in Athabasca Basin

Read more: Poland selects American manufacturer for country’s first nuclear reactors

Cameco also announced last week that it had signed a 10-year supply agreement with Westinghouse Electric Company, a subsidiary of Brookfield Business Partners (NYSE: BBUC, BBU) (TSX: BBUC, BBU.UN), to provide about 5.7 million pounds of uranium concentrate to the Kozloduy nuclear power station in Bulgaria — one of only two in the country.

Nuclear power generates about 33 per cent of the country’s electricity.

“Our recent contracting success to supply new markets in Eastern Europe clearly demonstrates the desire of our customers to diversify,” said Gitzel on Friday.

What do you mean the uranium miners are done for?#uranium #cameco #spx pic.twitter.com/6hcjgF5qq4

— Patrick Karim (@badcharts1) April 28, 2023

The company produced 4.5 million pounds of uranium concentrate last quarter and aims to generate 20.3 million pounds this year.

“Our results demonstrate the strength and purpose of the strategic decisions we have made over the last several years, and the continued support we see developing for nuclear power around the world,” said Tim Gitzel, President and CEO of the company.

“In fact, I am not sure there’s ever been a better time to be a pure-play investment in the growing demand for nuclear energy,” he added.

At the end of last month Cameco announced that the Canada Revenue Agency had reassessed the company’s taxes for the years between 2007-2013 and would be refunding Cameco $300 million.

Last fall, Cameco signed a uranium supply agreement with China’s Nuclear International Corporation in a deal with confidential details that aren’t being publicly disclosed.

Cameco’s shares rose by 2.87 per cent Friday to $37.25 on the Toronto Stock Exchange.

rowan@mugglehead.com