Shares of American cloud communications company Twilio Inc (NYSE: TWLO) bumped 22 per cent over the past two days on strong fourth-quarter results and an optimistic look for the foreseeable future.

On Friday, Twilio also announced a new USD$2 billion share repurchase program, effective through December 31, 2027. This buyback plan, representing approximately 11.5 per cent of the company’s current market cap, demonstrates leadership’s belief that the stock is undervalued.

By returning capital to shareholders and reducing the number of outstanding shares, the plan aims to increase earnings per share. Through previous programs, Twilio has already reduced shares outstanding by about 15 per cent.

The reaction to Twilio’s announcements was further amplified by positive analyst sentiments. Scotiabank, for instance, raised its price target for Twilio from $90 to $160, maintaining a Sector Outperform rating. This upgrade was based on the company’s preliminary results, the share repurchase announcement, and Twilio’s compelling story around AI growth. Such endorsements from analysts often lead to increased investor confidence and buying pressure on the stock.

Twilio’s focus on artificial intelligence (AI) and its potential to leverage this technology for growth has been highlighted as a key driver. The company’s strategic roadmap, which includes integrating AI tools into its platforms, has been viewed positively by the market. This is seen as a move to bolster growth rates and enhance service offerings, potentially leading to stronger long-term performance.

The immediate market reaction was evident in after-hours trading, where Twilio shares soared by 14.81 per cent following the announcements.

Read more: French gem Mistral AI reveals plans to go public in Davos

Read more: Top AI bots can’t be trusted to provide accurate historical info, study reveals

Twilio scraps Video API originally introduced during pandemic

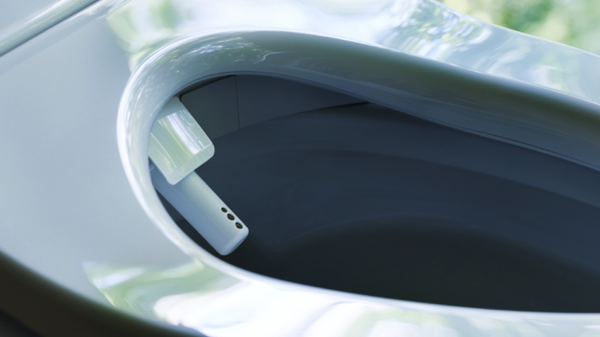

Twilio recently made headlines with several significant developments that highlight its evolving business strategy. The company announced the discontinuation of its Video API product to streamline operations and focus on core offerings.

Twilio introduced the Video API in 2020 during the COVID-19 pandemic. The functional intent beyond the launch included meeting the surging demand for remote communication tools. However, the company has since pivoted to prioritize other products within its customer engagement platform.

The shutdown will take effect later this year, with Twilio offering support to help customers transition to alternative solutions.

In addition to this strategic move, Twilio achieved a major milestone by reporting positive operating income on a GAAP basis for the fourth quarter, marking the first time in the company’s history.

This financial achievement reflects the success of Twilio’s cost-cutting measures, including a nearly 40 per cent reduction in headcount since the third quarter of 2022. Twilio has also placed greater emphasis on self-service within its sales process, enhancing efficiency and aligning with its shift toward profitability.