SQM Australia Pty Ltd, a subsidiary of Chilean lithium-giant Sociedad Química y Minera de Chile (SQM) (NYSE: SQM) has agreed to purchase 30 per cent of Pirra Lithium Limited from Haoma Mining NL and then bump its ownership to 40 per cent with a A$3 million (CAD$2.6 million) cash infusion for exploration.

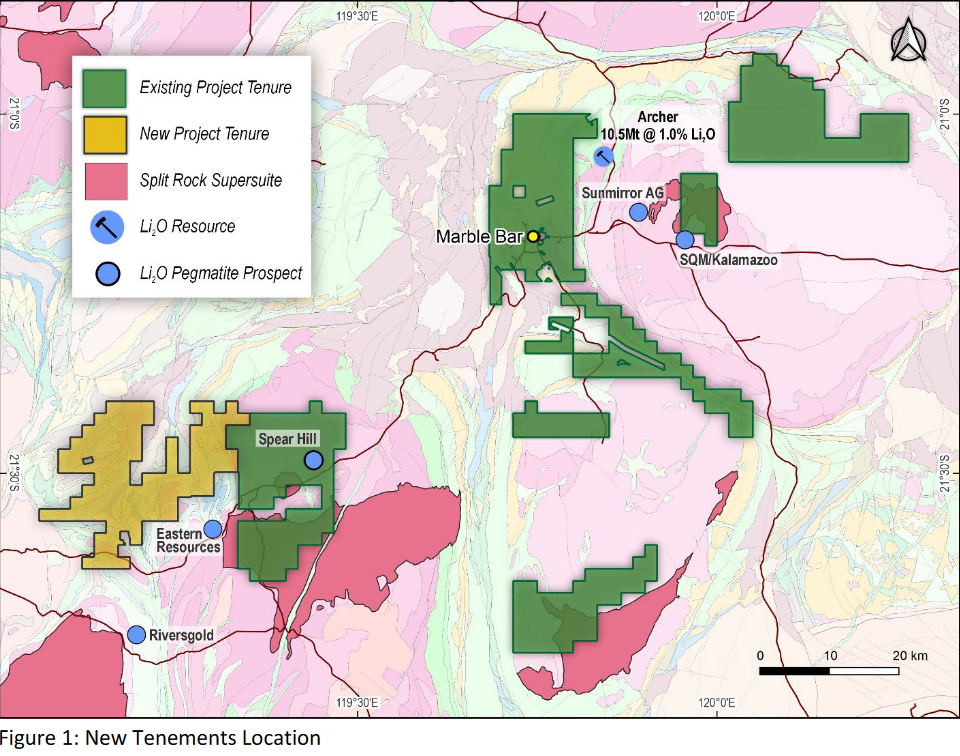

Calidus Resources Limited (ASX: CAI) made the announcement on Monday. Calidus owns 40 per cent of Pirra. Additionally, Pirra will buy 348 square kilometers of lithium rights from Haoma in the East Pilbara region of Australia which will be added to the existing rights sharing agreement between Pirra and Haoma.

Pirra has recently started mapping and sampling activities in the Tabba Tabba South tenement in the West Pilbara region, along strike from Wildcat Resources’ (ASX: WC8) major new discovery.

“With an increased landholding of over 1,411 square kilometers in the Pilbara, Pirra is now funded to rapidly progress exploration across these tenements,” said Dave Reeves, Calidus managing director.

“An initial focus will be the Tabba Tabba South tenements which lie immediately along strike from known lithium occurrences and on a belt that hosts significant lithium resources.”

The Tabba Tabba Shear has significant lithium deposits, including a known lithium deposit near the Pirra tenement boundary, and a reported lithium Mineral Resource on Fortescue Metals Group Ltd (ASX: FMG) land.

https://twitter.com/CalidusLtd/status/1716244181536985321?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1716244181536985321%7Ctwgr%5E3f718413ba192e0795d6d5f60014ab79dba0b257%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fpublish.twitter.com%2F%3Fquery%3Dhttps3A2F2Ftwitter.com2FCalidusLtd2Fstatus2F1716244181536985321widget%3DTweet

These deposits indicate the potential of Pirra’s Tabba Tabba South tenement, which covers about 8 kilometers along the Tabba Tabba Shear. However, due to thick alluvial cover, Pirra plans to start a mapping program to identify areas suitable for soil sampling and areas with thicker cover that will require augering and drilling.

The additional tenements southwest of Marble Bar have challenging terrain and limited access. While these areas have been explored for iron ore, gold and base metals, they haven’t been explored for lithium. Existing soil and stream sediment data are incomplete and do not include information about lithium. Initially, Pirra will focus on using remote sensing data to identify pegmatites or alteration linked to geological structures that could have facilitated the formation of lithium-rich rocks.

Map of the new tenements. Image via Calidus Resources.

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

SQM interested in greenstone belt

SQM showed interest in the greenstone belt, which is 65 kilometers southwest of Marble Bar and in close proximity to granites. Haoma currently owns this land, and Pirra and Haoma have formally entered into a binding terms sheet in order to proceed with this arrangement.

Haoma has agreed to transfer the rights for lithium exploration and extraction in these additional land areas to Pirra as part of the agreement. Pirra will also allocate $500,000 towards conducting exploration activities on these additional land areas. This investment will be disbursed over a period of 18 months, commencing after the completion of the terms sheet. Additionally, Pirra will use this allocated sum to cover any associated rent and fees during this 18-month timeframe.

Furthermore, as part of this agreement pertaining to the additional land areas, Pirra has agreed to compensate Haoma based on specific exploration milestones. Pirra will issue 7.5 million performance rights to Haoma. These performance rights have the potential for conversion into Pirra shares at a one-to-one ratio, contingent upon meeting certain conditions.

The conversion mechanism will be activated if, within a three-year window following the finalization of the terms sheet, a substantial lithium resource is identified on these additional land areas. To meet this threshold, the resource must exceed 20 million tonnes and contain more than 1.0 per cent lithium oxide (Li2O), as assessed using the Joint Ore Reserve Committee (JORC) Mineral Resource standard.

Completion of SQM’s agreement is anticipated to be 27 October 2023.

SQM shares dipped 0.8 per cent to $51.28 on Monday on the New York Stock Exchange.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com