Electric car startup Rivian Automotive Inc. (NASDAQ: RIVN) rolled the dice earlier this week by introducing new electric vehicle models in a downward moving market.

As companies like Tesla Inc. (NASDAQ: TSLA) cut prices to stimulate demand, Rivian has produced new R2 midsize SUVs with hope to drawing attention and changing the market’s course. The company introduced two new models for $70,000 electric pickups and $75,000 SUVs.

At the unveiling in Laguna Beach, California, Rivian aimed to recreate the buzz of five years ago when it launched the R1T pickup, generating excitement ahead of the Los Angeles Auto Show with singer Rihanna present and reviewers predicting the company could become the Tesla of trucks. This time, the stakes are much higher.

“R2 could be existential for them,” Elliot Johnson, chief investment officer at Evolve ETFs, which manages investments in Rivian and other EV makers, said. “They need to be able to produce at scale, on time and have the market accept it.”

The first R2 vehicles, expected to be priced between $45,000 and $50,000.

Rivian incurred losses of tens of thousands of dollars per vehicle last year as it grappled with scaling up production and expanding demand beyond its initial enthusiastic customer base. Rivian shares have plummeted 53 per cent year-to-date, impacted by disappointing deliveries and the company’s February projection of flat production growth in 2024.

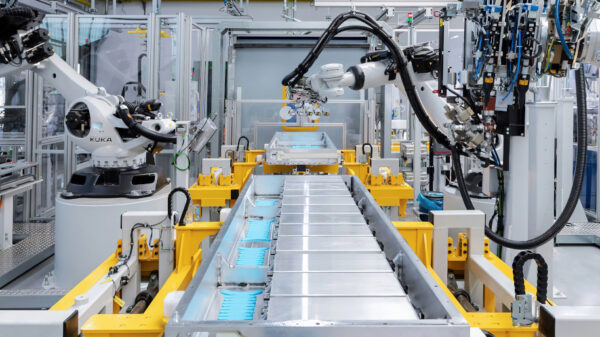

The EV maker’s struggles partly stem from unforgiving market conditions. Supply-chain constraints, resulting from the COVID-19 pandemic, made parts difficult to obtain, while demand for EVs has dwindled amidst increased competition from both new startups and established legacy automakers.

Read more: Lithium South preliminary economic assessment shows optimism for lithium’s future

Read more: Lithium South near completion of production well and economic assessment at flagship operation

Depressed EV market demand is unlikely to be short term

Circumstances surrounding the depressed EV market are likely not short-term either, according to investment bank Goldman Sachs.

Goldman Sachs warns that it is too early to declare an end to the plunge in battery raw materials prices, cautioning that substantial supply pipelines and challenges in Western electric vehicle markets could prolong lower prices.

In a research note published on Tuesday, the forecast follows a steep decline in prices for some of the most sought-after energy transition metals. These materials, including nickel, copper, lithium, and cobalt, find diverse applications in electric vehicles, wind turbines, and solar panels.

“Despite the significant downside in battery metals prices, with nickel, lithium, and cobalt prices down 60 per cent, 80 per cent, and 65 per cent from cycle peak, respectively, we believe it is too early to call a decisive end to these respective bear markets,” said Nicholas Snowdon in a note to clients.

The U.S. investment bank noted that margin pressures have led to significant supply rationing effects over the past quarter, citing incremental supply cuts in lithium and nickel.

Furthermore, alongside downgrades in Western EV-related demand, the bank highlighted that “significant” supply pipelines mean that the projected 2024 surpluses for lithium and nickel “remain sizeable.”

Some companies on the production side for EV’s, and more specifically, for lithium, aren’t particularly worried about the long term prospects.

Read more: Lithium South and POSCO Holdings ink mutual development agreement

Read more: Lithium South Development technical report shows 40% increase in lithium recovery

It’s still business as usual for lithium producers

Chilean giant Sociedad Química y Minera de Chile (SQM) (NYSE: SQM) is leaning into the supply glut by continuing to build stockpiles of the battery metal for when the market rebounds.

The company’s strategy of continuing to increase output while buyers deplete inventories reflects a bet on buyers returning as underlying electric vehicle demand continues to grow in the shift away from fossil fuels, potentially prolonging the glut in the long run.

While some suppliers rein in spending and output, low-cost SQM continues to operate at full capacity. An expansion in Chile has increased its lithium carbonate capacity to 210,000 metric tons, with annual company-wide production expected to reach 220,000 to 230,000 tons.

SQM anticipates stable prices in the short term and expresses optimism for the future. And SQM isn’t alone in this sentiment.

The PEA results highlight attractive project economics, including a short payback & exceptional Internal Rate of Return. We look forward to taking the HMN Lithium Project to the next stage of development.https://t.co/yoFRpPW71W$LIS $LISMF $OROCF $TSLA #Mining #ElectricVehicle pic.twitter.com/jqDUHccqmQ

— Lithium South Development Corporation (@LithiumSouth) March 4, 2024

For example, Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) is optimistic about the future. It released positive results from its Preliminary Economic Assessment (PEA) for its Hombre Muerto North Lithium Project (HMN Lithium Project) near Salta, Argentina.

The study based its assumption of a lithium price of USD$20,000/tonne (t) for a production start-up in 2029 on current published market analysis and benchmarking against price assumptions in multiple technical reports from similar brine lithium projects.

Additionally, United States treasury minister Janet Yellen toured Albemarle Corporation’s (NYSE: ALB) operations in Chile. She met with President Gabriel Boric, government officials, and business executives in Santiago to discuss expanding ties between the nations.

“I can’t tell you numbers, but I imagine that we will be expanding substantially our purchases from Chile,” she said.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com