Red Mountain Mining Ltd (FRA: RM0) (ASX: RMX) has unearthed antimony (Sb) grab samples with exceptional mineralization.

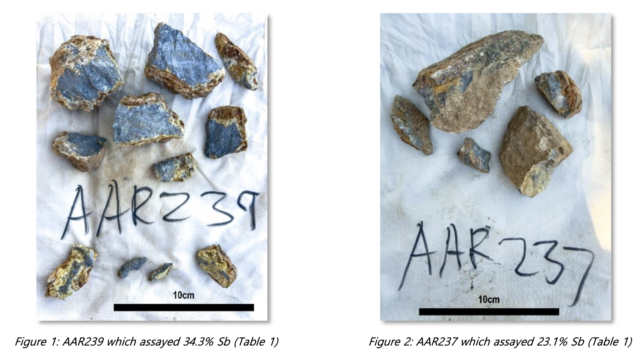

On Jan. 15, the Aussie junior revealed that assays on its latest rock chips returned grades as high as 34.3 per cent Sb, according to an ASX announcement. The results represent abnormally high-grade surface mineralization, often associated with massive stibnite — the primary ore mineral for antimony.

These samples were discovered at the Oaky Creek prospect area within the company’s Armidale Project in New South Wales, Australia.

These latest results build on a series of high-grade discoveries at Armidale. Prior rock chip sampling in 2025 yielded peaks of 39.3 per cent Sb and 36.3 per cent Sb.

The new assays, with 11 of 13 samples exceeding 1.9 per cent Sb across a 1.6-kilometre strike length, confirm consistent mineralization and extend the known corridor from the previous 1.2-km anomaly.

This progress underscores the project’s scale and bolsters confidence in a substantial Sb-Au deposit. For future development, Red Mountain plans infill auger sampling on a 50-metre x 20 metre grid, high-resolution magnetic surveys and a maiden drill program in the first half of 2026 to define targets and potentially outline resources.

The latest rock chip samples. Image credit: Red Mountain Mining

Read more: NevGold’s latest discovery represents near-term antimony production potential

Findings may attract government attention

With antimony’s critical status in Australia’s new AUD$1.2-billion-dollar strategic reserve, these steps could accelerate Armidale toward production amid global supply constraints. In Australia’s antimony sector, key players like Larvotto Resources Ltd (OTCMKTS: LRVTF) (FRA: K6X) (ASX: LRV) at Hillgrove boast the nation’s largest resource, with peak assays of 31.5 per cent Sb and a 7.4 g/t Au (equivalent grade including 90,000 tonnes of Sb).

Meanwhile, Trigg Minerals Ltd‘s (ASX: TMG) (OTCMKTS: TMGLF) (FRA: ATA) Taylors Arm mining area features historical grades up to 63 per cent Sb, with recent sampling at 31.4 per cent Sb. Furthermore, Southern Cross Gold‘s (ASX: SX2) (TSE: SXGC) (OTCMKTS: SXGCF) Sunday Creek operation near Melbourne has yielded over 10 per cent Sb in certain spots.

Red Mountain’s grab samples, routinely above 20 to 30 per cent Sb, rival or exceed these highs, positioning Armidale as a highly encouraging prospect with surface expressions suggesting easier initial access than deeper resources elsewhere.

ASX-listed miners pursue U.S. antimony

Australian antimony explorers are increasingly eyeing the United States to diversify amid geopolitical tensions, with companies like Locksley Resources Ltd (OTCMKTS: LKYRF) (ASX: LKY) (FRA: X5L) advancing the high-grade Mojave asset (up to 46 per cent Sb) in California.

Additionally, Felix Gold Ltd (ASX: FXG) (OTCMKTS: FXGDF) is targeting Alaska’s Treasure Creek for rapid restarts and Nova Minerals Ltd (ASX: NVA) (OTCMKTS: NVAAF) (FRA: QM3) is exploring near Anchorage.

As this trans-Pacific push gains momentum amid U.S. funding initiatives, peers such as NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) are making strides by unearthing oxide antimony-gold zones in Nevada. NevGold recently identified 2.4 to 3.0 million tonnes of previously mined material in historical leach pads at the Limousine Butte project containing notable antimony grades.

As demand surges for this critical mineral in defence and renewables, such cross-border efforts could help reshape supply chains.

Read more: NevGold expands Limo Butte footprint by staking 90 promising antimony-gold claims

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com