Recharge Resources Ltd. (CSE: RR) (OTC: RECHF) (Frankfurt: SL5) closed an acquisition which significantly expanded the size of its Pocitos II lithium brine project.

The company said on Wednesday that this expansion includes 532 more hectares, increasing the total project to 1,332 hectares. The project is located close to Pocitos township in Salta Province of Argentina.

Acquisition terms include three separate payments. The first is a cash payment of USD$25,000 followed by another payment of USD$75,000 three months after. The terms conclude with a further cash payment of USD$700,000 six months after the purchase agreement. The company has also offered the option to receive payment in the form of 20 per cent in shares.

The Pocitos 1 and II project benefits from the presence of gas, electricity, and accommodation facilities. Pocitos 1 encompasses approximately 800 hectares, while Pocitos II covers 532 hectares, both of which are accessible by road.

The collective exploration efforts have exceeded USD$2 million in project development. These encompass activities such as surface sampling, trenching, TEM and MT geophysics surveys, as well as the drilling of three wells, which yielded outstanding brine flow results.

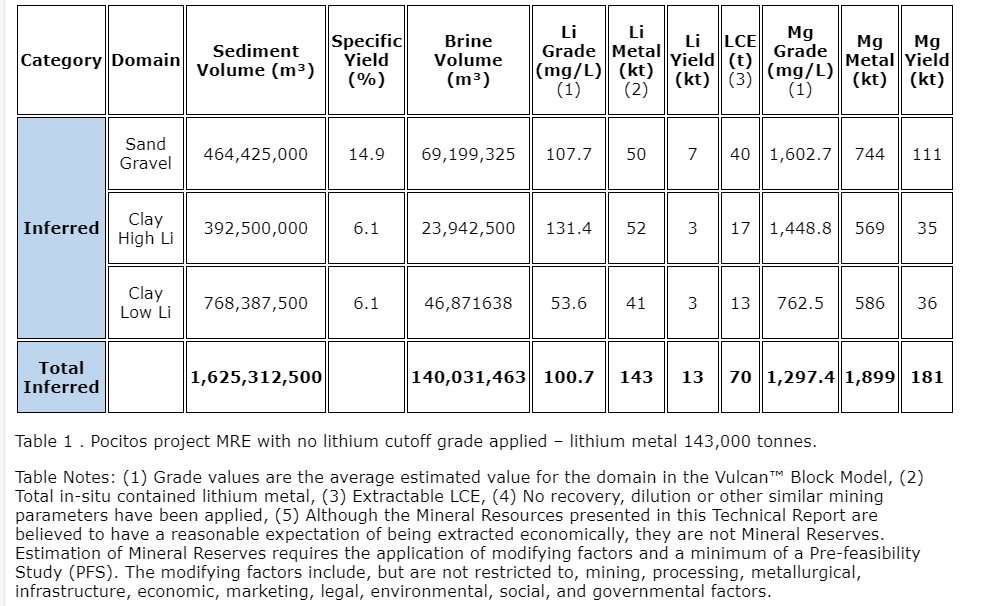

For upcoming exploration, locations for immediate follow-up drilling have already been designed and identified. During the December 2022 drill campaigns, the company recorded lithium values of 169 parts per million (ppm) from a packer test in drill hole 3.

“This strategic expansion not only signifies our growing footprint in the lithium sector,” David Greenway, CEO of Recharge Resources, said, “but also reinforces our commitment to developing sustainable and high-yield lithium resources.

“The integration of Pocitos II into our portfolio represents a significant milestone for Recharge Resources as we continue to solidify our position in the lithium market and work towards meeting the global demand for clean energy solutions.”

Image via Recharge Resources.

Read more: Lithium South Development updates leadership roster, appoints new director

Expansion decision informed by geophysics data

The decision to acquire the property stemmed from the outstanding geophysics data obtained in the recent MT survey and the necessity for a larger area to pump brine into the proposed Ekos Research Pty Ltd.’s Ekosolve Technology (Ekosolve) direct lithium extraction (DLE) production system.

This marks another milestone in the company’s efforts to construct a 20,000-tonne DLE plant at the Pocitos project. The goal is to supply up to 20,000 tonnes of lithium carbonate per year to clients of Richlink Capital.

The company’s COO and director, Phil Thomas, recently visited Shanghai, China, where he met with Richlink and its clients. During his visit, he inspected a lithium chloride and lithium n-butyl plant.

Thomas stated that the recent magnetotelluric survey recorded favourable resistivity, which secures the company’s excellent position within the heart of the salar.

“The company is pushing forward on all fronts with a pending drill program to continue to build on this soon to be release MRE report,” Thomas said. “These developments should make for an exciting next period for Recharge and its stakeholders at the Pocitos I and II Project.”

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Argentina has been fertile ground for mergers and acquisitions

Recharge Resources isn’t the only lithium company pushing forward in Argentina.

Argentina’s abundant lithium reserves and favorable investment climate have attracted lithium companies in recent years. These aren’t just the usual suspects of the lithium industry such as the United States-based Albemarle Corporation (NYSE: ALB) or Livent Corporation (NYSE: LTHM) either.

In previous years, Argentina has become a haven for juniors searching for a path to prominence after a healthy spate of acquisitions wherein larger companies have expanded their holdings by swallowing smaller companies.

A few of these prior mergers include Lithium Americas (TSX: LAC) acquisition of Millennial Lithium for USD$491 million. Additionally, Chinese-based Zijin Mining (SHA: 601899) acquired Neo Lithium Corp in February.

Among them is Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ), which filed its updated mineral resource estimate and technical report in early November for its Hombre Muerto North Project (HMN) in Argentina. It presently sits at a CAD$28 million market cap, which could make it a prime target for the companies mentioned earlier or others like them.

.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com