Quantum Computing Inc. (NASDAQ: QUBT) will acquire Luminar Semiconductor, a wholly owned subsidiary of Luminar Technologies Inc. (NASDAQ: LAZR), in an all-cash deal valued at USD$110 million.

Announced on Monday, the agreement positions QCi to accelerate its quantum hardware roadmap by absorbing LSI’s photonics portfolio, patents, and engineering team. The companies expect the transaction to close by the end of January 2026, pending approval from a U.S. bankruptcy court.

QCi signed a stock purchase agreement to bring LSI fully into its operations. The move gives QCi direct control of key photonic components that support its plan to build compact, integrated quantum systems for commercial markets.

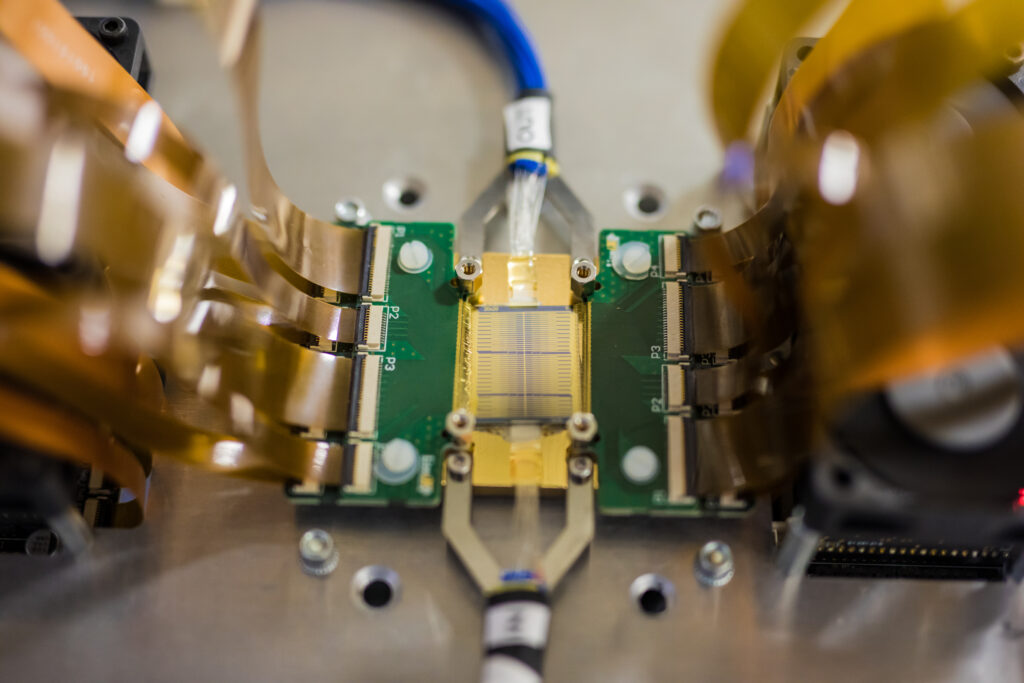

LSI manufactures and sells specialized optical parts used across advanced sensing and photonic applications.

QCi executives say these parts will become foundational in future quantum appliances. The acquisition also delivers a deeper engineering bench and strengthens the company’s supply chain. Additionally, QCi plans to maintain and expand LSI’s existing non-quantum customer base.

“This acquisition represents a meaningful step forward in our strategy to develop and scale practical, integrated quantum solutions,” said Yuping Huang, CEO and chairman of the Board of QCi.

“The post-closing revenue opportunity will be two-fold: to serve and expand LSI’s current non-quantum customer base; and to utilize LSI’s technology and products to drive the commercialization of quantum appliances in our targeted markets.“

Huang also indicated that LSI’s current customers will likely benefit from the change of ownership. He stated that increased investment should accelerate product development and expand available resources for ongoing projects.

Read more: Can Quantinuum program Helios transform enterprise quantum computing?

Read more: Core Scientific votes down merger with AI cloud firm CoreWeave

Deal arrives as Luminar initiates chapter 11

Furthermore, QCi expects tighter alignment across engineering teams to speed new technology introductions.

Luminar CEO Paul Ricci said LSI carries strong long-term potential and will gain the strategic direction needed to reach it. He explained that merging QCi’s and LSI’s technical strengths should allow teams to deliver new photonics and sensing innovations faster. In addition, he noted that the agreement gives LSI the support structure required to grow beyond its current portfolio.

The deal arrives as Luminar initiates voluntary chapter 11 proceedings in the Southern District of Texas. LSI remains outside the bankruptcy filing and continues normal operations.

However, because LSI is a subsidiary, the sale must proceed through a Section 363 process and receive court approval. QCi agreed to serve as the stalking horse bidder, which grants it customary bid protections during the sale process.

A stalking horse bid is a first, court-approved offer to buy a company or its assets during a bankruptcy sale.

The bankrupt company selects a preferred buyer to set the minimum acceptable price for the asset. That bidder—called the stalking horse—gets certain protections (like break-up fees or expense reimbursements) because it risks being outbid in the final auction.

The goal is to establish a baseline price, encourage competitive bidding, and prevent the assets from selling for less than they’re worth.

The companies anticipate a smooth path toward closing once the court reviews the agreement. Additionally, the parties expect no disruption to LSI’s ongoing business.

Read more: IonQ sparks Italy’s quantum renaissance through Q-Alliance partnership

Read more: D-Wave expands European presence, supports Italy’s quantum infrastructure initiative

Shares dip on acquisition news

Industry analysts say the acquisition gives QCi stronger control of its hardware pipeline at a moment when integrated photonics play a growing role in quantum commercialization. The deal also expands QCi’s ability to secure critical components internally rather than relying on external suppliers. Consequently, the company positions itself to reduce production risks and shorten development timelines.

Quantum Computing shares dropped after the acquisition announcement, with traders reacting quickly to the company’s decision to spend USD$110 million in cash during a volatile period for small-cap tech. The stock moved sharply lower in early trading, and market watchers said investors likely questioned the near-term financial strain. However, several commentators argued that the decline created a possible entry point. They pointed to QCi’s expanded photonics portfolio and deeper engineering capacity as reasons the company could gain strength over time.

Some analysts noted that small-cap quantum and photonics names often swing hard on major deals. Additionally, they said investors frequently reassess these moves once integration plans become clearer. Many Buy-the-Dip arguments focused on QCi’s attempt to secure critical components in-house, which could reduce supply risk.

In addition, observers said the combination may help QCi accelerate commercial timelines. Market voices also suggested that volatility does not always reflect long-term potential. Consequently, they encouraged investors to monitor updates from the bankruptcy court because any progress could shift sentiment quickly.

QCi and LSI now move toward a formal court review, while engineering teams prepare for a transition. Both companies state that customers should see continued support throughout the process and eventually gain access to a broader suite of photonic and quantum technologies.