Lithium South Development Corp. (CVE: LIS) (OTCMKTS: LISMF) has received a USD$62 million non-binding cash offer from South Korea’s POSCO Holdings.

Announced on Wednesday, the proposed deal targets the company’s portfolio of lithium exploration assets in Argentina’s Hombre Muerto salar.

The offer includes a 60-day due diligence period, followed by a 60-day negotiation window to finalize a definitive agreement. Lithium South disclosed the proposal in a news release issued Wednesday.

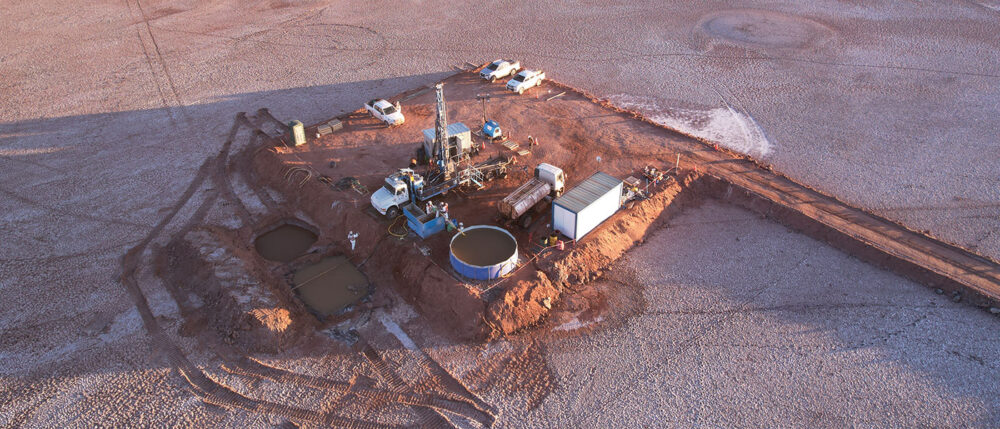

The company’s flagship asset is the 100-per-cent-owned Hombre Muerto North (HMN) project in Salta province. The project spans nine mining concessions covering 56.9 square kilometres. In addition, Lithium South holds purchase rights to two nearby claim blocks totalling 55.5 square kilometres.

Vancouver-based Lithium South and POSCO already share ownership of lithium brines on two HMN claim blocks — Viamonte and Norma Edith. These blocks overlap into Argentina’s Catamarca province, with POSCO assigned rights on the Catamarca side.

POSCO is also advancing its neighbouring Sal de Oro lithium project in Hombre Muerto. The South Korean giant plans to invest $4 billion in a production plant to anchor its long-term operations in the region.

Furthermore, Rio Tinto Group (NYSE: RIO), which recently acquired Arcadium Lithium, itself formed by the recent merger of Allkem and Livent, is developing the salar’s eastern and western flanks. Together, these players reflect a significant global push to secure future lithium supply from Argentina’s Lithium Triangle.

Read more: China reveals lithium battery tech that spots deadly failures before battery activation

Read more: Codelco and SQM get regulatory approval for lithium joint venture in Chile

The study projected a 25 year mine life

Last year, Lithium South released a new preliminary economic assessment (PEA) for HMN. It estimated an after-tax net present value of USD$934 million at an 8 per cent discount rate, with an internal rate of return of 31.6 per cent.

The study projected a 25-year mine life and a 2.5-year payback period. Production was estimated at 15,600 tonnes of lithium carbonate per year using proven solar evaporation.

Since then, the company has continued exploration to expand its resource base. Just last week, Lithium South announced it is drafting a comprehensive schedule for delivering a feasibility study by Q1 2026.

Investors responded positively to the POSCO news. Shares surged 28 per cent, pushing Lithium South’s market cap to CAD$35.3 million.

However, the broader lithium market is in flux. A global supply glut has pushed lithium prices down more than 80 per cent from their 2022 highs.

As a result, several major producers have delayed or downsized projects. Albemarle Corporation (NYSE: ALB) and others have warned of softer demand from Chinese EV manufacturers.

Additionally, newer lithium juniors are struggling to secure financing amid weaker pricing. Therefore, deals like POSCO’s proposal may reflect opportunistic positioning as market leaders seek long-term supply at lower valuations.

Still, demand forecasts remain strong for the late 2020s. Automakers continue to invest in battery supply chains. In the meantime, consolidation and capital discipline appear to be the prevailing trends.

.