Numinus Wellness Inc. (TSX: NUMI) (OTCQX: NUMIF) lost money this quarter because it cancelled its analytical testing services for third parties.

On Thursday, the psychedelics company released its third quarter financial reports ended May 31 and saw a sequential revenue drop of 5.7 per cent to $741,000 from $786,000 in the last quarter.

The drop was due to a shift in Numinus Bioscience operations where analytical testing services for third-party corporate clients were stopped.

Despite of the sequential dip, revenues grew year-over-year by 31.8 per cent to $741,064 due to the acquisition of Mindspace and the Neurology Centre of Toronto. Gross profit in the third quarter was $180,845 which is a decrease of 21 per cent from $228,759 in the last quarter. Loss and comprehensive loss totalled $7 million which is a decrease of 10.2 per cent from $7.8 million in the last quarter.

Cash balance by the end of the quarter dipped by 13.5 per cent to $41.8 million from $48.3 million in the last quarter.

Numinus also said it cancelled the opening of its second facility in Vancouver, British Columbia because the Novamind acquisition has provided other growth opportunities that may provide a higher return-on-investment.

Numinus also launched the pilot mental health program Corporate Ketamine-Assisted Psychotherapy which is based in Utah and is aimed to help businesses improve employee mental health by offering them ketamine therapy as a health benefit.

Read more: Numinus to offer ketamine-assisted psychotherapy

Read more: Numinus completes Novamind acquisition, upgrades leadership team

This June, Numinus announced the acquisition of Novamind positioning it as one of the largest psychedelics companies in North America. The psychedelics company now owns 13 wellness clinics across North America, four clinical research sites and a psychedelics research facility.

“We look forward to sharing our combined performance with you when we announce our fiscal fourth quarter results – which will be the first quarter demonstrating the power of our larger, cross-border platform,” Numinus CEO Payton Nyquvest said.

“Today, including the contributions of Novamind, Numinus is one of the highest revenue-producing mental health care companies providing psychedelic and ketamine-assisted therapies, with more than $12 million of combined proforma annual revenues (based on trailing four quarters),” he added.

The company says it wants to expand higher-margin services, increase business development activities, and proactively manage operating costs. Numinus’ goal is to find operational profitability within two years and corporate positive cash flow within three.

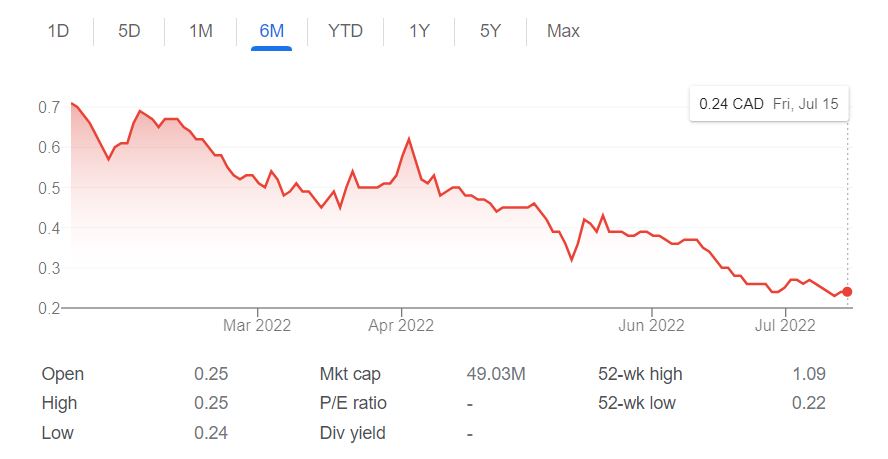

Company stock went down Friday by 2.13 per cent to $0.24 on the Toronto Securities Exchange.

Graph via Google Market Summary