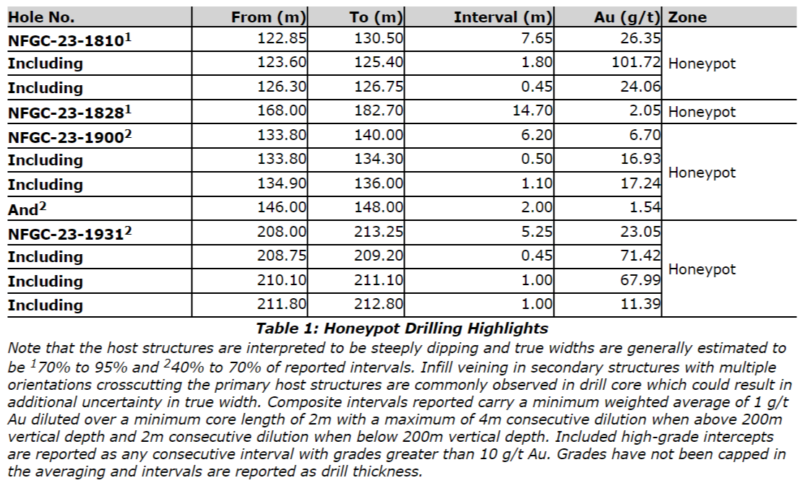

New Found Gold Corp. (TSXV: NFG) (NYSE-A: NFGC) assays from its recently discovered Honeypot Zone in Newfoundland and Labrador returned high gold grades including including 26.4 g/t Au over 7.65m.

The company said on Wednesday that the gold within Honeypot is hosted by a primary fault that has been revealed and sculpted through drilling, and extends along a strike length of 280 meters and to a depth of 190 meters. It also seems to gather in strength as the company digs deeper.

The company discovered Honeypot through a follow up drill program that tested a mineralized fault which had initially been identified through grid drilling. Honeypot is located 230 meters north of the company’s Jackpot zone, and 1.3 kilometers north of the company’s Lotto zone on the east side of the Appleton Fault Zone.

Honeypot shares a similar east-northeast striking and steeply dipping orientation with its neighboring Jackpot Zone. The company is aiming drilling efforts at expanding Honeypot both along its strike and to greater depths.

“Our first pass grid drilling reconnaissance program working north of Jackpot intersected a near-surface, brittle fault with characteristics similar to the other epizonal high-grade gold-bearing faults found along this segment of the AFZ,” Melissa Render, VP of exploration for New Found, said.

The company is also involved in a 650,000 meter drill program at Queensway in Newfoundland, and approximately 10,000 meters of core is currently pending assay results.

The rich history of Newfoundland and Labrador in the resources industry, along with the government’s strong support for its further growth, has led to the jurisdiction’s ranking as 8th out of 77 jurisdictions worldwide.

Chart from New Found Gold.

Read more: Calibre Mining sets gold production record in 2023, reports 52% cash balance increase

Read more: Calibre Mining’s merger with Marathon Gold deemed ‘tremendous opportunity’

Newfoundland and Labrador possess tier one potential

Newfoundland and Labrador has witnessed a surge in popularity among gold mining companies due to its rich and underexplored geological potential. The province offers a favourable regulatory environment, stable political climate, and robust infrastructure, making it an attractive destination for exploration and development.

The Valentine Gold Project is one of the big name top tier projects operating in the area, and it’s the subject of a recent merger between Marathon Gold (TSX: MOZ) and Calibre Mining (TSX: CXB) (OTCQX: CXBMF).

The all-stock transaction is set to value the company at CAD$345 million and is expected to generate a robust annual cash flow of CAD$508.4 million. Calibre will own a 66 per cent stake of the combined company with Marathon will retain the remaining portion.

In Q3 of last year, Calibre achieved its fourth consecutive quarterly record in gold sales by selling 73,241 ounces. The company’s share price has surged by over 52 percent in the past year, and several financial firms have made predictions that it will continue to rise.

Earlier this month, Calibre became a member of the Mining Association of Canada and is actively collaborating with the organization to improve and refine its mining and business practices.

Read more: Calibre Mining joins Mining Association of Canada

Matador Mining projects annual production of 88,000 ounces

Meanwhile, after a USD$3.6 million equity financing for exploration over the summer, Matador Mining Ltd. (ASX:MZZ) (OTCQX:MZZMF) made the strategic decision to step back and take stock of its resources.

The company holds a portfolio of projects located unquestionably within one of the world’s few Tier 1 regions. The Cape Ray Shear Zone, boasting a potential mineralization strike length of over 120km, accommodates several projects that, in their own right, could have served as flagship projects.

Additionally, the region has seen a lack of significant exploration efforts for decades, contributing to Matador’s excellent opportunity for making discoveries. The presence of substantial neighbouring resources, such as the Valentine deposit and Big Ridge, which has 0.9 to 1.4 million ounces of Au, serves as compelling evidence of mineralization.

.

Calibre Mining is a sponsor of Mugglehead news coverage

.