Aussie-American MTM Critical Metals Ltd (ASX: MTM) (OTCMKTS: MTMCF) (FRA: 8JC) has been using its patented technology to extract antimony (Sb) from old circuit boards and telecom equipment. The recycling company has historically been focused on pulling metals like gold, copper, gallium and germanium from e-junk, and it has now added a new element to the list.

MTM claims to have achieved a 98 per cent recovery rate, yielding a substance with 3.13 per cent Sb. This grade is much higher than the average percentage found in ore throughout the world’s top deposits (averaging around 0.6 per cent), the metal recycler pointed out.

“Achieving 98 per cent recovery of antimony at over 3 per cent grade, from domestic urban feedstock, is particularly significant given the United States currently has no meaningful domestic Sb production,” chief executive, Michael Walshe, said.

The only sizeable deposit in the U.S., being developed by Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA), is still in the permitting phase and won’t enter production for another two or three years. Antimony recycling from e-waste at scale could help mend the current domestic supply shortage.

“MTM has cracked the code on high-grade recovery from electronic scrap [with its ‘flash joule heating technology’],” commented David Tasker, managing director at the Australian investor relations firm Chapter One Advisors. “Their FJH tech beats some of the world’s richest mines.”

MTM Achieves 98% Recovery of High-Grade (3.1%) #Antimony from U.S. E-Waste

Demonstrates Onshore Urban Mining Potential Aligned with U.S. Critical Metals Strategy pic.twitter.com/JyCrnSYOty

— Maurice Salvador (@SalvadorMaurice) June 2, 2025

Read more: NevGold raises $5M for promising gold-antimony prospects in Nevada

News sends MTM shares up by over 14% on the ASX

The innovative accomplishment had the company looking spiffy on the Australian Securities Exchange Tuesday.

But, MTM is not the only one to have developed a method of extracting the metalloid from e-waste. Others reside in Asia and Europe.

China’s Hunan Chenzhou Mining Group, Japan’s DOWA Holdings Co Ltd (TYO: 5714) (OTCMKTS: DWMNF) (FRA: DMI) and Belgium’s Umicore SA (OTCMKTS: UMICF) (FRA: NVJP) are a few others that have found ways to get Sb out of discarded electronics.

MTM has been having discussions with the U.S. Department of Defense and Department of Energy in recent weeks about how its recycling tech could be utilized to lessen national security fears. These two agencies have become increasingly concerned with the nation’s Sb shortage, particularly after China cut off exports at the end of 2024. They may decide to provide MTM with funding.

Fast-tracking Perpetua’s Stibnite Au-Sb project, taking advantage of antimony recycling methods like MTM’s and developing promising antimony-bearing properties held by American juniors like NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) appears to be the best way forward for the U.S.

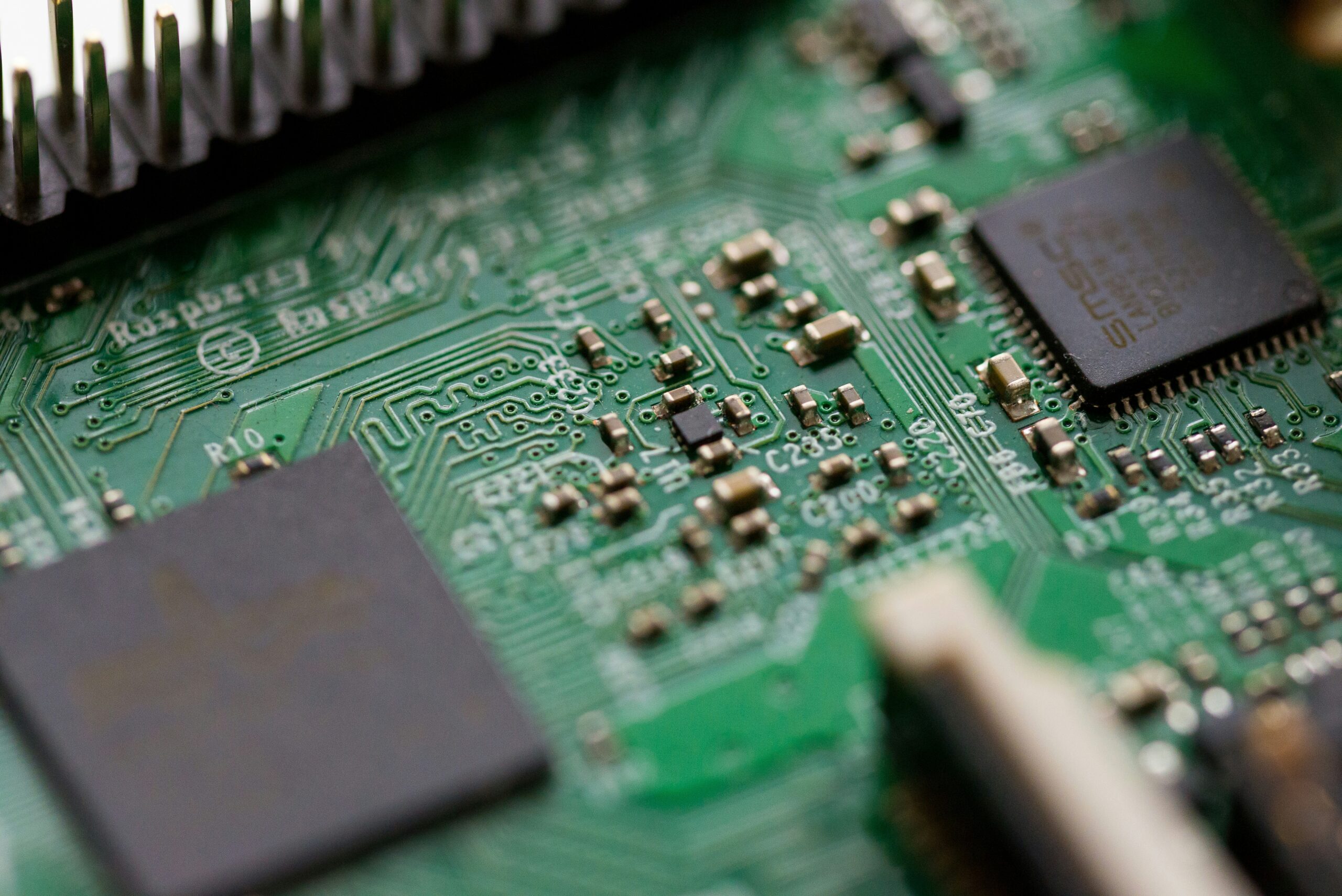

E-scrap and extracted antimony. Photo credit: MTM Critical Metals

Read more: NevGold’s Nevada property may just be the next American antimony resource of scale

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com