McEwen Mining (NYSE: MUX) (TSX: MUX) subsidiary McEwen Copper announced it updated its Preliminary Economic Assessment (PEA) for the Los Azules project in San Juan, Argentina, revealing promising prospects.

The company announced Tuesday, that its mineral resource estimate has been revised upwards to 10.9 billion pounds of copper (indicated) and 26.7 billion pounds (inferred).

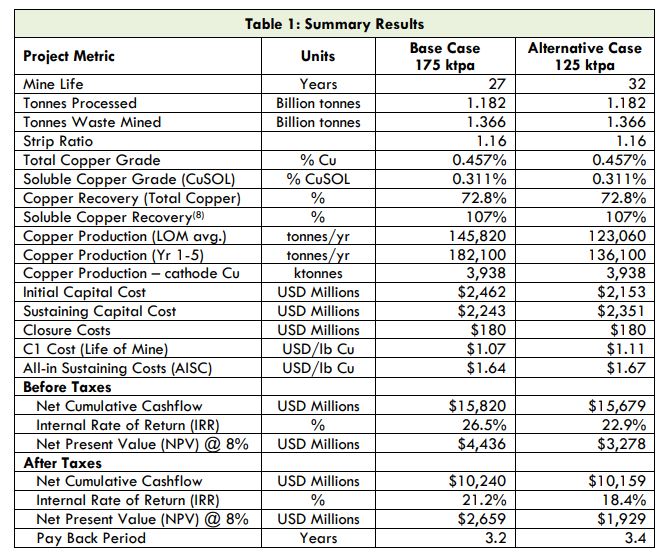

The project is set to produce an average of 401 million pounds of copper cathode annually for the first five years and 322 million pounds annually over the 27-year mine life.

The total recoverable copper is estimated to be 8.7 billion pounds, derived from 11.90 billion pounds of total copper, with an average recovery rate of 72.8 per cent.

The project’s after-tax net present value is projected at $2.7 billion, with an internal rate of return of 21.2 per cent and a payback period of 3.2 years based on a copper price of $3.8 per pound.

Photo via McEwen Copper.

Read more: McEwen Mining reports high grade gold assays in Stock Mine Extension Trend

Read more: McEwen Copper reports ‘significant’ assay results at Los Azules

The Los Azules project, as outlined in the updated PEA, is set to kick off with an initial capital expenditure of approximately $2.5 billion. This investment translates to a project capital intensity of $7.7 per pound of copper.

In terms of operational costs, the average cash costs are projected to be $1.07 per pound of copper, with all-in-sustaining costs rounding off at $1.6 per pound.

Moving on to the project’s financial performance, it is expected to generate a robust average EBITDA of $1.101 billion per year during the initial five years. This figure is estimated to moderate to $692 million per year from the sixth year onwards, extending up to the 27th year.

In addition to its financial prospects, the project also showcases a strong commitment to environmental sustainability. The carbon intensity of the project is estimated at 670 kg CO2 equivalent per tonne of copper, a figure that stands significantly lower than the industry average.

Moreover, McEwen Copper has set an ambitious goal to achieve carbon neutrality for the project by 2038.

The project’s water management plan has also been carefully assessed. The estimated water consumption is projected to be 137 liters per second for the first decade of operation, gradually increasing to 163 liters per second from the 11th year through to the 27th year.

Lastly, the project aims to place approximately 1.2 billion tonnes of mineralized material on the heap leach pad. This material is expected to have an in-situ total copper grade of 0.5 per cent and an in-situ soluble copper grade of 0.3 per cent, further underlining the project’s promising potential.

Read more: McEwen Copper reports new assay results from Los Azules

Read more: McEwen Mining reports 22% gold production increase in Q4 2022 at Fox operation

Los Azules project shifts strategy from traditional milling to heap leaching

The 2023 Preliminary Economic Assessment (PEA) for McEwen Copper’s Los Azules project marks a significant change in approach compared to the 2017 PEA. Previously, the plan was to build a mine with a traditional mill and flotation concentrator to create a concentrate for export.

However, the 2023 PEA suggests a different method, using a process called heap leaching to produce copper cathodes, which can be sold in Argentina or internationally.

This change is due to three main reasons:

- Better for the environment: The new method is much kinder to the environment. It uses about 75 per cent less water, dropping from 600 litres per second to 150 litres per second. It also uses about 75 per cent less electricity, going from 230 MW to 57 MW. Plus, it’s expected to cut greenhouse gas emissions by around 57 per cent. The aim is to have zero carbon emissions by 2038. This makes the copper cathodes produced at Los Azules more attractive to customers who want to reduce their environmental impact.

- Easier to get permission: The new approach also makes it easier to get the necessary permissions to operate. The heap leach technology is already being used in San Juan, and by getting rid of tailings and tailings dams, saving water, and simplifying the mining process, it’s easier to get the project approved.

- Producing cathodes: The production of copper cathodes, which can be used directly in industry, including within Argentina, reduces export taxes and eliminates reliance on third-party foreign smelters. This also reduces greenhouse gas emissions associated with transportation and pollution from smelting, and mitigates counterparty and pricing risks.

While the new strategy involves certain trade-offs, such as lower overall copper recovery, slightly higher unit costs, and less immediate cash flow due to extended leach cycles, McEwen believes that the environmental benefits justify these economic compromises.

Furthermore, the company believes that some of these drawbacks can be mitigated by implementing developing technologies, making the leach project robust and setting it apart from other potential mine developments.

Read more: Calibre Mining’s Q1/23 financials show promising growth in gold mining sector: BMO

Read more: Calibre Mining 2022 sustainability report shows strong support for ESG initiatives

McEwen Copper has reached several milestones in 2022, including building a seasoned Argentine management team, improving critical access to Los Azules, advancing technical studies and welcoming investors Rio Tinto Ltd. (ASX: RIO) (LON: RIO)’s latest venture Nuton LLC and Stellantis (NYSE: STLA) (Euronext Milan: STLAM) (Euronext Paris: STLAP).

Following the year-end, a subsidiary of Stellantis invested ARS$30 billion and Nuton LLC increased its investment by $30 million in McEwen Copper.

Stellantis and Nuton now own 14.2 per cent each of McEwen Copper, while McEwen Mining owns 52 per cent. These transactions value McEwen Copper at approximately $550 million on a 100 per cent basis.

Natalia@mugglehead.com