Mako Mining Corp (CVE: MKO) (OTCMKTS: MAKOF) (FRA: GQR0) has now entered a definitive agreement to acquire a shovel ready gold and silver operation in Nevada. Construction and development of the open pit, heap leach precious metals mine has been fully authorized by state authorities.

The Vancouver-based mining company is obtaining the Mt. Hamilton operation through a structured deal with Sailfish Royalty Corp (CVE: FISH) (OTCMKTS: SROYF). Through their agreement, Sailfish will provide US$40 million to fund the purchase of the site from its owner, Mt. Hamilton LLC, in exchange for a 5-year gold stream and a 2 per cent net smelter return royalty.

Sailfish will be entitled to purchase 341.7 ounces of gold per month at 20 per cent of the spot price set out by the London Bullion Market Association during the 60-month period. Approval from shareholders and the TSX Venture Exchange is still pending.

Mt. Hamilton resides in White Pine County along the east side of the Battle Mountain trend. This Nevada jurisdiction has been rich source of gold, silver, copper and critical minerals since the late 1800s. It hosts considerable quantities of tungsten, zinc, manganese, molybdenum and antimony.

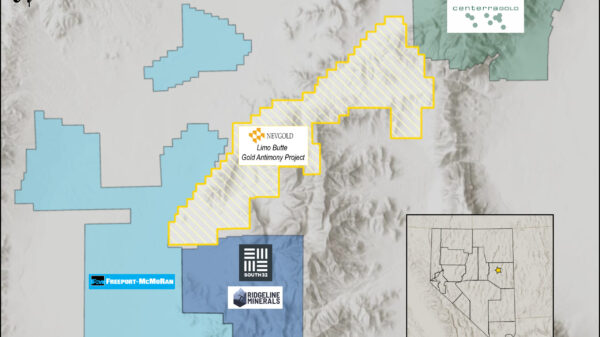

In the county, Mako will be working alongside NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50), developer of the Limousine Butte gold-antimony project; Griffon Gold Mine operator Nevada Sunrise Metals Corp (CVE: NEV) (OTC Pink: NVSGF)(FRA: K4L); and KGHM Polska Miedz SA (OTCMKTS: KGHPF) (FRA: KGHA), owner of the Robinson operation.

Though promising considering the current precious metal pricing environment, Mako Chief Executive Officer Akiba Leisman says one of the primary issues with Mt. Hamilton is that its resource is sitting at the top of a mountain and that there isn’t enough room up there to set up processing infrastructure. He and his associates have been contemplating how to strategically approach this issue.

“We considered developing an ore shoot that would enable us to use gravity to take the ore material and waste down through the mountain,” Leisman explained in an interview last month.

In addition to a 600,000-ounce gold and silver deposit, Mt. Hamilton hosts multiple tungsten targets.

Read more: NevGold surges after closing C$10M financing deal

Mako is debt free; reports more than 2-fold EBITDA increase

In Q3 results, released on Nov. 20, Mako reported having no debt and adjusted earnings before interest, taxes, depreciation and amortization totalling US$9.3 million. This amount marked an immense year-over-year increase from US$4.25 million in the third quarter of 2024.

The high price of gold also made the company’s revenue rise by more than US$10 million year-over-year during the three month period at US$27.6 million.

Like many precious metals mining companies, Mako’s stock price has been rising significantly. Shares are up by over 130 per cent year-to-date and trading for C$7.34.

“With US$66 million in cash, no debt, and cash flow coming from two operating assets, we expect to have enough cash resources to fully construct Mt. Hamilton in 2026,” Leisman stated.

Mt. Hamilton’s first gold pour is being targeted for H2 next year.

Read more: NevGold edges closer to gold-antimony resource with latest Limousine Butte results

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com