Larvotto Resources Ltd (ASX: LRV) (FRA: K6X) has released a definitive feasibility study for Australia’s most significant antimony resource as the commodity continues to capture the limelight. It was well-received, sending shares up by over 10 per cent on the Australian Securities Exchange.

The study, released Tuesday, shows that the Hillgrove gold-antimony mine has an after-tax net present value of C$620.79 million. Furthermore, it is expected to have yearly EBITDA of C$224.5 million and annual free cashflow of C$114.5 million for over eight years. This DFS builds on a pre-feasibility study released last August.

The anticipated all-in sustaining costs for the operation are projected to clock in at negative C$1,222.80 per ounce at the mid-range price scenario — one of the study’s most notable details. The mining company bought this project for a mere C$7.15 million in late 2023.

Production is set to commence next year with first ore being processed by the end of Q2. Larvotto is aiming to more than double the capacity of the processing plant as activities ramp up. Over C$132 million worth of processing infrastructure has already been installed.

Stibnite antimony-bearing ore taken from Hillgrove. Photo credit: Larvotto Resources

Read more: Promising antimony find in Nevada strongly positions NevGold Corp in minerals race

Expected to meet 7% of international antimony needs

The mine is projected to have a 102 per cent mid-range internal rate of return.

“Hillgrove is expected to produce seven per cent of global antimony requirements when global supply is tightening and Western Governments are prioritizing strategic supply chains,” said Ron Heeks, managing director at the company.

Larvotto anticipates significant extension potential after the initial 8-year mine life has passed by. It will churn out about 5,400 tonnes of antimony per annum with peak annual gold production expected to total 48,000 ounces (85,000 ounces gold equivalent, AuEq). The mid-range payback period is 11 months.

“The DFS confirms Hillgrove as a technically sound, high-margin critical minerals project with a rapid pathway to production,” Heeks added.

Larvotto and Warriedar Resources Ltd (ASX: WA8) (FRA: 2KI0) are Australia’s top two antimony stocks. In the United States where demand is soaring due to China cutting off its supply to the nation, companies like Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA), NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) and United States Antimony Corp (NYSEAMERICAN: UAMY) have been in the spotlight.

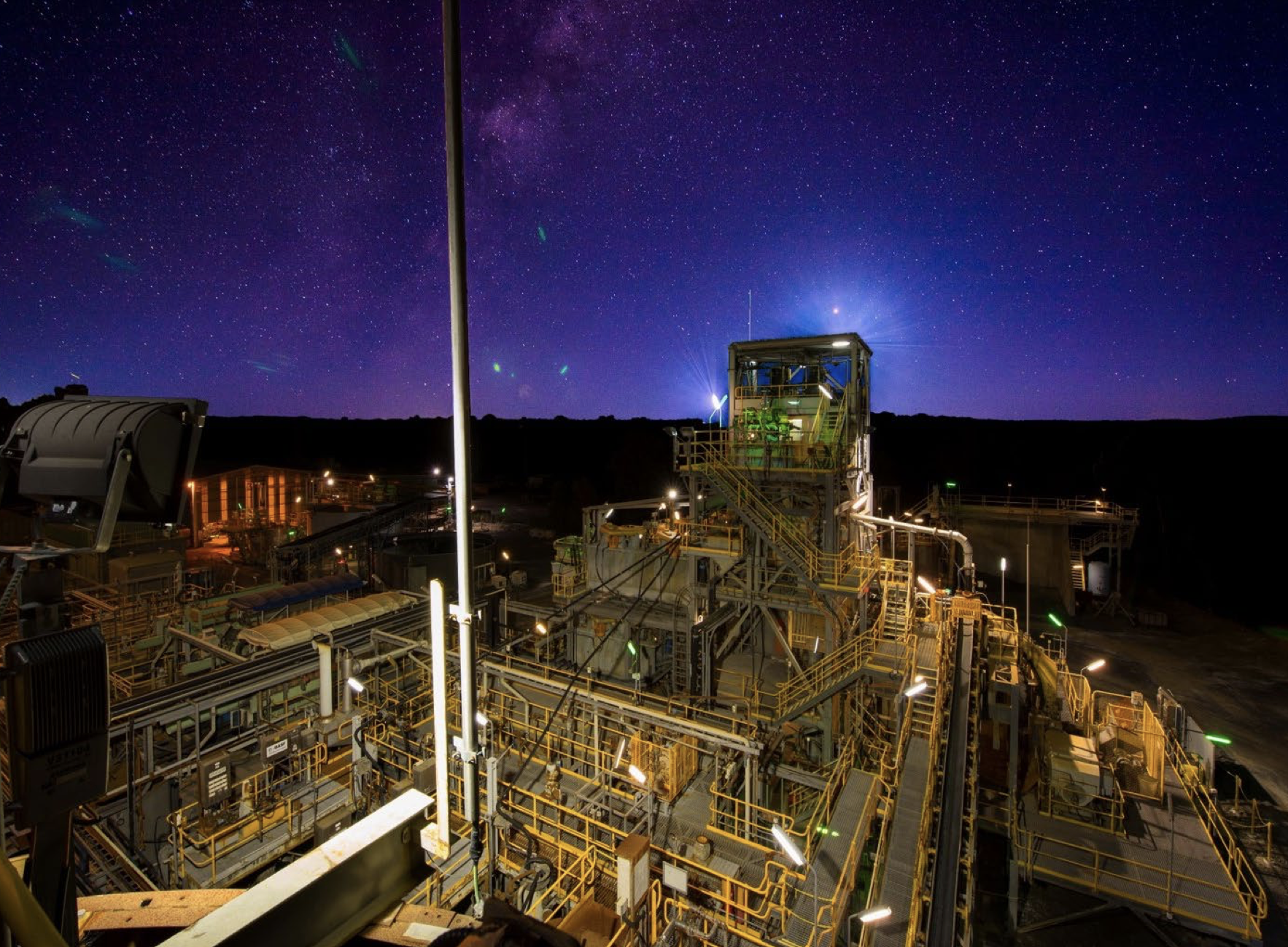

Layout of Hillgrove. Image credit: Larvotto Resources

Read more: NevGold’s long intervals of antimony & gold mineralization turn heads

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com