Lithium prices have crashed in price amid a slowdown in the demand for electric vehicles, according to a report from data marketing firm Fastmarkets.

Released late last month, the report indicated that lithium prices are down more than 80 per cent from their all-time high in 2022, displaying that prices plummeted from an all-time high beyond $80,000 per metric ton in 2022 to below $14,000.

While electric vehicle (EV) sales remained robust, they could not match the exceptional year-on-year (YoY) growth rates observed in recent years. Excess EV production capacity, a buildup of inventory, and destocking by cathode producers resulted in thin demand for battery materials.

According to the report, it was this, coupled with upstream expansions and market oversupply, which led to a notable softening of battery raw material prices in 2023.

The Fastmarkets report forecasts that EV sales will continue to steadily rise in 2024, although with a lower year over year growth rate projected compared to 2023, due to the uncertain economic climate, particularly relatively high interest rates, which continue to influence buyers’ decisions.

Despite these facts, it hasn’t stopped the flow of investments going into the space spurred on by the United States government’s goal for 50 per cent of all new vehicle sales to be electric by 2030. This goal, along with incentives for EVs and domestic critical metals production, has prompted an influx of investments across the industry.

Read more: Lithium South Development first production well installed at Hombre Muerto lithium project

Read more: Lithium South Development expands production goals, updates PEA on Hombre Muerto lithium project

Economic headwinds impacted consumer sentiment on lithium in 2023

In recent years, global macroeconomic fluctuations have largely left the fundamental drivers of battery demand and battery raw material supply unaffected. However, this changed in 2023, as growing economic headwinds began to impact consumer sentiment.

This effect will be particularly evident in markets such as the US, where vehicle financing plays a determining role in consumer purchases. Some major western automakers scaled back their EV production forecasts at the end of 2023. As EV sales continue to fall short of expectations in Europe and the US, the report anticipates further delays or slowing of EV factory ramp-up in 2024.

However, the report also offers that the bottom is in sight for the market, as the industry moves fairly deep into the cost curve.

This bodes especially well for foreign markets and prospective investors, who could benefit from a rebounding lithium price.

Among the lithium producers expected to benefit the most include Lithium South Development Corporation (TSXV:LIS) (OTCQB:LISMF), POSCO Holdings Inc. (NYSE:PKX), Lithium Americas Corp. (NYSE:LAAC) (TSX:LAAC), Arcadium Lithium plc (NYSE:LTHM), and Rio Tinto Group (NYSE:RIO).

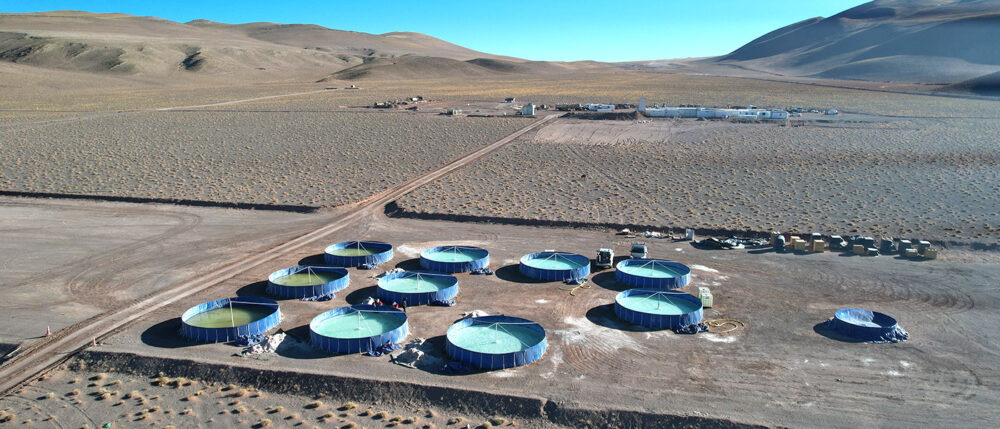

One of the projects progressing Argentina towards a Top 3 Lithium Producer status is the Hombre Muerto North Lithium (HMN Li) project, owned 100 per cent by Lithium South in Salta Province, Argentina. It spans across 9 claim blocks, 5 of which are situated directly on the salar.

In the spirit of compromise, POSCO, holding title on the Catamarca side, and Lithium South, holding title on the Salta side, have agreed to develop the area and share the brine produced on a 50/50 basis.

.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com