Hycroft Mining Holding Corporation (NASDAQ: HYMC) (FRA: R5A) shares were up by more than 21 per cent at market close on Feb. 18 after the mining company dropped a transformative new mineral resource estimate.

The rally persisted into the next trading session with stock rising another 3.6 per cent to US$42.15 amid heavy trading volume.

This momentum builds on a staggering 1,450 per cent gain over the past year and highlights growing confidence in the Nevada miner’s massive gold-silver project.

The updated MRE has delivered 55 per cent growth in measured and indicated resources to 16.4 million ounces of gold and 562.6 million ounces of silver. Meanwhile, inferred resources have increased by 50 per cent to 5 million ounces of gold and 38 per cent to 132.8 million ounces of silver.

Hycroft has also established an initial high-grade measured and indicated silver resource of 90.2 million ounces for the newly discovered Brimstone and Vortex systems, which remain open along strike and at depth. This highlights the site’s underground potential.

This latest estimate is based on data from 70 new drill holes, refined geological models and improved metallurgy that achieves 83 per cent gold and 78 per cent silver recoveries via pressure oxidation.

Hycroft is now forwarding milling plans and evaluating sulphuric acid production as a revenue-generating by-product as it prepares for full-scale production.

“Right now it’s going for well over US$100 per ton,” said chief executive Diane Garrett in an interview.

She added that Hycroft could become a very substantial producer and help fill a void for Nevada lithium and copper mining companies that need it but frequently have to get it shipped to their sites.

Hycroft Mining’s best news ever. This is a wild increase in reserves. 1,645,630,000 oz silver equivalents. Increased from 1,040,000,000 oz silver equivalent. Huge news for the mine. Also POX processing recovery higher than expected. Let’s go! $hymc @HycroftMining pic.twitter.com/46fkhuigTK

— Andrew Huotte (@AndrewHuotte) February 18, 2026

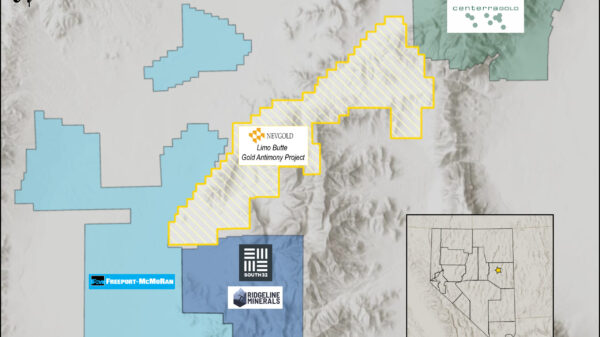

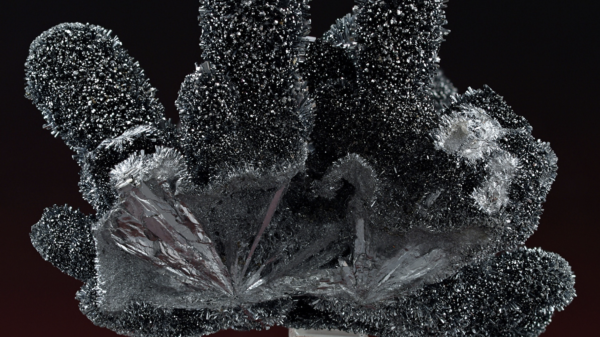

Read more: NevGold expands Bullet Zone discovery as drilling confirms oxide gold-antimony system

Silver prices propel Hycroft’s performance

Hycroft’s strong performance on the markets in recent months has been significantly linked to the historic silver rally the world has been observing.

The metal is currently trading above US$77 per ounce, supported by robust industrial demand from solar panels, electric vehicles, AI infrastructure and electronics. Its safe haven appeal alongside gold is also significant.

This pricing environment has been directly amplifying the value of Hycroft’s silver-heavy resource base, which exceeds 695 million ounces across all categories. Traders are now intrigued about the dual catalyst of higher metals prices and the company’s expanded scale.

Eric Sprott boosts his stake

The billionaire mining investor bought up an additional 200,000 shares for US$9.2 million at the end of January, building on an already dominant position in the company. He now indirectly owns a stake greater than 40 per cent through his private company Sprott Mining — a wholly-owned subsidiary of 2176423 Ontario Ltd.

Sprott has committed more than US$225 million to Hycroft since June of 2025. This sum includes purchasing 2.34 million shares valued at approximately US$24.1 million from AMC Entertainment Holdings Inc (NYSE: AMC) (FRA: AH91) in December after the company decided to take profits and continue focusing on the movie business.

Major institutions have also been supporting Hycroft by taking considerable positions, including BlackRock Inc (NYSE: BLK), Franklin Templeton, Schroders plc (OTCMKTS: SHNWF) (LON: SDR), Tribeca and Pala Investments.

Despite the expanded resource and favourable metals pricing, Hycroft still faces substantial risks including permitting hurdles, significant capital requirements for pressure oxidation infrastructure, execution challenges and potential commodity price volatility that could negatively impact project economics.

Read more: NevGold Corp. advances toward gold-antimony resource with expanded Nevada drilling

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com