A top performing Australian hedge fund thinks it is a safe bet to have a major interest in uranium. Melbourne’s L1 Capital has seen a 20 per cent return on its investments annually for the past decade.

The investment manager, founded in 2007, is the number one shareholder of Canada’s budding uranium producer NexGen Energy Ltd. (TSX: NXE). NexGen still needs to clear certain regulatory hurdles at its Rook I project in Saskatchewan’s Athabasca Basin before the site becomes one of the world’s top uranium producing assets.

It will be capable of churning out almost 30 million pounds of the radioactive element per annum. Production is anticipated to begin in 2027.

10.7-year initial mine life

Once production begins, L1 Capital believes the miner will become a takeover target for the world’s top uranium companies. The Australian firm is not deterred by the mediocre performance of NexGen’s stock in recent days. It has risen by 0.7 per cent since Jan. 1.

“It’s such a strategic asset that once they get their final approvals, it’s a very high likelihood that it would be a good takeover candidate for one of the majors,” L1’s top researcher Amar Naik said recently.

NexGen has a series of strategic partnerships with other influential uranium companies and groups in northern Canada. ATHA Energy Corp. (TSX-V: SASK) (OTCQB: SASKF) (FRA: X5U), for instance, holds a 10 per cent carried interest on certain portion’s of NexGen’s land package. In April last year, NexGen partnered with the local Clearwater River Dene First Nation to establish a gravel supply company needed to provide essential material for Rook I.

The company’s chief executive Leigh Curyer discussed the operation and the company’s financial strategy in an interview earlier this month.

@NexGenEnergy_ has some of the highest G&A within the mineral exploration & development realm.

Part of it is the way they've decided to spent marketing dollars, which includes the sponsorship of a hockey, a football, and an F1 team.

But why?

I asked $NXE's CEO Leigh Curyer. pic.twitter.com/1H9tKzngd6

— Antonio (@antonioresource) June 5, 2024

Read more: ATHA Energy’s geodata director scoops prize for AI deposit targeting method

Read more: ATHA gives Riverboat Energy option to take majority interest in Vista uranium project

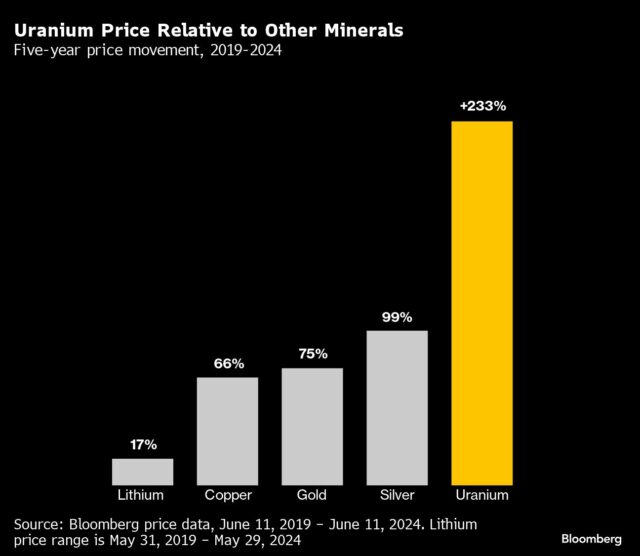

Uranium price ascends much quicker than other commodities

The radioactive metal’s value is a clear indicator of the modern-day nuclear renaissance. Its price has risen by about 233 per cent in the past five years.

Post-Fukushima woes appear to be a thing of the distant past now.

Furthermore, uranium has been gaining steam at a much faster speed than other popular metals and minerals like gold, silver, copper and lithium. More than triple the rate of those commodities, actually.

“We are entering a new era for the market in nuclear fuel, which I believe is unprecedented,” Curyer said at the end of May.

Graph: Bloomberg

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com