A Nevada mine site being funded by the world’s largest gold mining company has become the latest in the U.S. to be accepted into the FAST-41 program.

Headwater Gold Inc (OTCMKTS: HWAUF) (CNSX: HWG) revealed Monday that its exploration permit at the company’s flagship Spring Peak property has been selected for the federal initiative. It focuses on improving the timeliness of environmental reviews for projects of national security value.

FAST-41 not only prioritizes mining projects, precious metals and critical minerals, but extends into transportation, pipelines, water resources, energy and other sectors.

The junior’s exploration project is standout because of funding being wholly-provided by Newmont Corporation (TSE: NGT) (NYSE: NEM) (FRA: NMM) through an earn-in agreement. Newmont holds an 8.3 per cent stake in the company.

The leading gold producer has the option to take a 75 per cent interest in Spring Peak specifically by spending a total of US$55 million. Newmont has already invested US$40 million and owns 51 per cent.

Spring Peak resides next to Hecla Mining Company‘s (NYSE: HL) (FRA: HCL) past-producing Aurora precious metals mine. It has yielded 1.9 million ounces of gold and more than 20 million ounces of silver since activities commenced in the 1860s.

“So far in my career, I don’t think I have ever seen this level of broad-based national momentum behind domestic exploration and mining,” said Headwater CEO Caleb Stroup. “Pair that with stong metal prices and the future looks bright.”

“With permitting clarity and a funding partnership in place, we’re well positioned to progress exploration at Spring Peak,” he also stated.

The level of government enthusiasm for valuable domestic mining projects has also become evident in the antimony sector. Companies actively mining the metalloid in the U.S. like Nova Minerals Ltd (OTCMKTS: NVAAF) (FRA: QM3) (ASX: NVA) and Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA) have received millions in government backing to advance their projects.

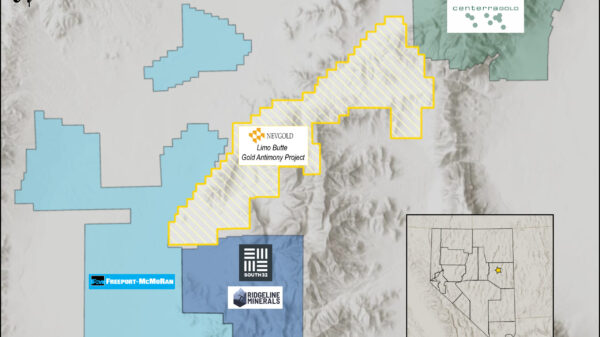

Others working in Nevada particularly, such as NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) and Xtra Energy Ord Shs (OTCMKTS: XTPT), could potentially attain entry into a fast-tracking program or receive federal backing as national supply concerns persist.

Read more: NevGold targets U.S. critical mineral supply chain with new antimony-gold find

FAST-41 projects achieve ROD 1.5 years faster

On average, they progress much quicker, generally getting a record of decision within 18 months. In order to become eligible for the program, a project must require a total investment exceeding US$200 million.

In August, the newly published 2025 Draft List of Critical Minerals expanded eligibly for FAST-41 by adding six commodities to a list of strategic materials. Namely silver, copper, rhenium, lead, silicon and potash.

Gold has also been recognized as a critical mineral by Trump, though not explicitly on that list, thereby enabling FAST-41-like expediting for projects deemed shovel-ready.

In relation to rhenium, rare metals have been of great concern for the Trump Administration in recent months. The American leader just signed a US$8.5-billion-dollar rare earths deal with the Australian government to help mitigate supply challenges.

The Trump Administration’s Executive Order 14156, enacted in January, has been indirectly supporting the program too by prioritizing metal and mineral projects.

Title 41 of the Fixing Americas Surface Transportation (FAST) Act was first enacted 10 years ago.

Read more: NevGold Expands Gold-Antimony Potential at Limousine Butte in Nevada

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com