GoldMining Inc (TSE: GOLD) (NYSEAMERICAN: GLDG) (FRA: BSR) has released an updated mineral resource estimate for its Crucero gold project in southeastern Peru that significantly enhances the site’s potential.

On Feb. 17, the company announced that the updated assessment shows 75 per cent more gold equivalent (AuEq) ounces than the previous MRE from 2017. It is now estimated that there is 1.74 million AuEq ounces.

This figure is representative of 1.31 million gold ounces and 51,000 tonnes of antimony. On the other hand, inferred resources now show 1.04 million gold equivalent ounces comprised of 0.73 million ounces of gold and 37,000 tonnes of antimony (Sb).

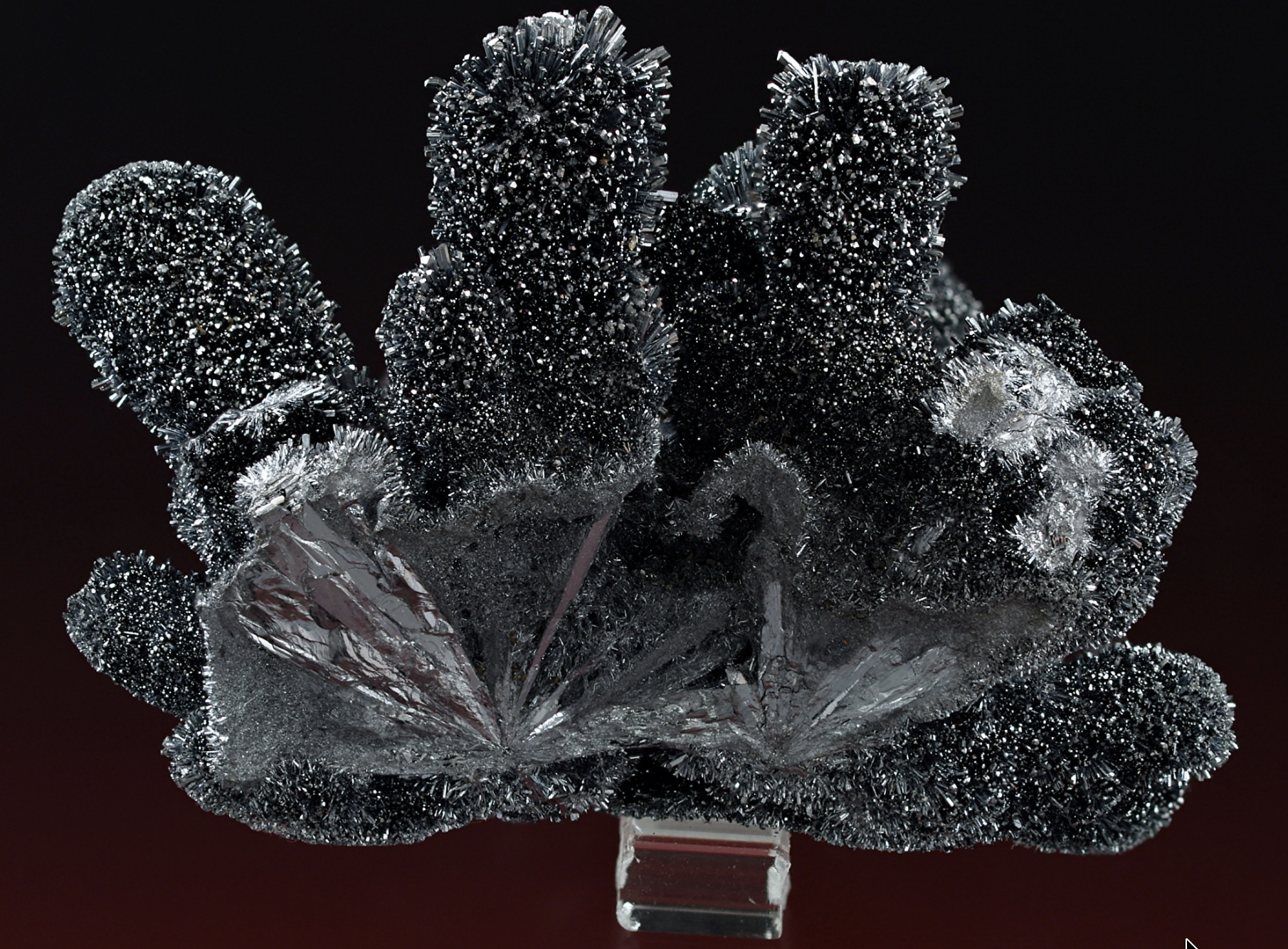

The latest update has incorporated antimony into the calculation for the first time. The metalloid accounts for roughly 25 per cent of the AuEq ounces and 29 per cent of the inferred ounces.

GoldMining has based its AuEq valuation on conservative long-term prices of US$3,110 per ounce for gold and US$28,700 per tonne for antimony while assuming 90 per cent recovery for both commodities.

“While we have always been encouraged by the exploration potential at Crucero, we have now demonstrated the emerging opportunity to unlock further value at the project through the identification and quantification of antimony mineralization that is co-occurring with gold,” stated chief executive Alastair Still in a news release.

Read more: NevGold expands Bullet Zone discovery as drilling confirms oxide gold-antimony system

Antimony discoveries add value to project

GoldMining has identified substantial antimony mineralization by re-assaying historical core samples from drilling that dates back to the 1990s. Previous explorers took note of the site’s antimony content but largely ignored it due to low prices at the time. With antimony’s recent price upswing and heightened demands in consideration, GoldMining decided to re-evaluate its database.

Historic intercepts at Crucero stood out, including a 93 metre core grading at 1.08 grams per tonne gold and 0.69 per cent antimony. Additionally, a 7 metre interval containing 42.15 g/t Au and 0.63 per cent Sb was also worthy of note. Historic grab samples held grades as high as 39.6 per cent antimony.

Crucero’s A1 Zone, which spans about 750 meters of strike, hosts the operation’s dual gold-antimony system. Having both the precious metal and critical mineral diversifies revenue potential and could strengthen Crucero’s appeal to investors. GoldMining also holds a key position as the largest shareholder of NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50), owning approximately 19 million shares or a 16.7 per cent stake. This holding in NevGold extends the company’s influence into other promising gold and antimony opportunities in North America.

Peru consistently ranks in world’s top 10 for gold

The nation is a leading producer of the precious metal and has a supportive mining environment. Crucero fits into a landscape of established and developing projects.

Peru is home to the massive open pit Yanacocha gold mine run by Newmont Corporation (TSE: NGT) (NYSE: NEM) (FRA: NMM) in the Cajamarca region. It also hosts the San Gabriel underground gold and silver mine operated by Compania de Minas Buenaventura SAA (NYSE: BVN) (FRA: MBU) and Hochschild Mining Plc‘s (LON: HOC) (OTCMKTS: HCHDF) (FRA: H3M) high-grade silver-gold operations like Immaculada and Pallancata in the south.

Recent data from Peru’s Ministry of Energy and Mines shows that the country holds about 3.9 per cent of the world’s gold reserves. The nation is also the world’s third largest silver producer behind Mexico and China, boasting the largest silver reserves in the world.

Currently, Crucero leads as one of Peru’s most advanced and publicized antimony projects. Nonetheless, risks it may face going forward include uncertainty around metallurgical recoveries and economic viability at scale, permitting and social licensing challenges in Peru and the need for substantial future capital to advance the project toward production.

Read more: NevGold Corp. advances toward gold-antimony resource with expanded Nevada drilling

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com