Many investors have been paying more attention to antimony in recent months, and so has GoldMining Inc (TSE: GOLD) (NYSEAMERICAN: GLDG) (FRA: BSR).

On Wednesday, the Canadian company revealed that it had identified significant antimony (Sb) mineralization in old core samples at its Crucero gold project in Peru. An intercept found to contain 44.37 grams per tonne gold equivalent (42.15 g/t gold & 0.63 per cent Sb) over 7 metres was worthy of note. GoldMining also says that there are historic grab samples containing up to 39.6 per cent Sb.

“With past antimony prices, its economic importance was not recognized,” CEO Alastair Still said in a release from GoldMining, “and with the growing strategic importance of antimony exemplified by an increase in the antimony price to approximately US$50,000 per tonne, we believe that we can enhance the economic value for the Crucero Project thorough re-evaluation of our database to quantify antimony as it occurs with the gold mineralization.”

At the beginning of last year, antimony was only worth a mere US$11,600 per tonne. The skyrocketing price, limited supply and reliance on foreign suppliers like China, Russia and Tajikistan have made North American companies like GoldMining pay much more attention to what was once considered a byproduct with minimal value at their gold operations.

Turkey, Myanmar, Bolivia and Australia also produce significant quantities of the metalloid element. It is essential for military technologies, electronics and weapons.

Read more: NevGold’s long intervals of antimony & gold mineralization turn heads

Read more: NevGold pulls critical mineral antimony from Limo Butte property in Nevada

GoldMining has stake in Nevada antimony property

Thankfully for GoldMining, the Crucero operation in South America is not the only military metal asset that the company may be able to cash in on in the near future.

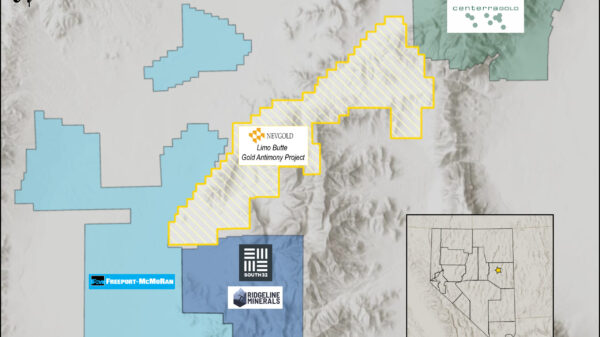

GoldMining currently has a 28 per cent stake in NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50). NevGold is currently exploring and developing a promising gold-antimony property in the mining-friendly state of Nevada.

Recent drill results from the junior’s Limousine Butte project have shown consistent antimony mineralization over considerable lengths. A 24.3 metre intercept assayed earlier this month containing 2.23 g/t AuEq (1.32 g/t Au and 0.20 per cent Sb) was worthy of note. Moreover, one sample taken from this mine site yielded 9.6 per cent antimony.

“The oxide gold-antimony grades, near-surface mineralization, and hole thickness highlight the significant gold-antimony potential that we have at the project,” NevGold chief executive, Brandon Bonifacio, said recently.

Perpetua Resources Corp. (TSE: PPTA) (NASDAQ: PPTA) and United States Antimony Corp (NYSEAMERICAN: UAMY) are two other stocks that have been pulling alot of attention recently for their ROI potential.

$UAMY is an overlooked gem. As the only US producer of antimony, it's positioned to benefit from rising demand in defense, EV batteries, and flame retardants. Domestic supply chain = national security priority. Undervalued, under-the-radar, and full of potential. pic.twitter.com/HU4bj126yl

— Mr. (@prestonveal08) April 14, 2025

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com