In a significant move that could reshape the mining industry, Glencore plc (LON: GLEN) has made a non-binding proposal to acquire all outstanding shares of St. Paul, Minnesota-based PolyMet Mining Corp. (TSX: POM) (NYSE American: PLM) that it doesn’t already own.

Glencore’s proposed cash deal, which offers a substantial premium of over one and a half times PolyMet’s closing share price has been presented to PolyMet’s independent Special Committee for review.

The proposal, announced on Monday, offers a cash consideration of US$2.11 per share, marking a significant 167 per cent premium over the closing price.

However, the proposal is not without its conditions. It’s contingent on entering into a definitive agreement, a process that is currently under scrutiny by the Special Committee in consultation with its independent financial and legal advisors.

In a statement, PolyMet cautioned, “There can be no assurance that any definitive offer will be made, that any definitive agreement will be executed or that this or any other transaction will be approved or consummated.”

In the wake of this news, the stock market reacted. Glencore’s stock remained steady at £457.75 on the London Stock Exchange. Meanwhile, PolyMet experienced a surge, with its stock price climbing by 155.8 per cent to CAD$2.66 on the Toronto Securities Exchange.

Read more: Teck Resources rejects $22.5B takeover bid from Glencore plc

Read more: Teck Resources gets regulatory approval for copper project in Peru

Teck has 50 per cent interest in PolyMet clean energy minerals project

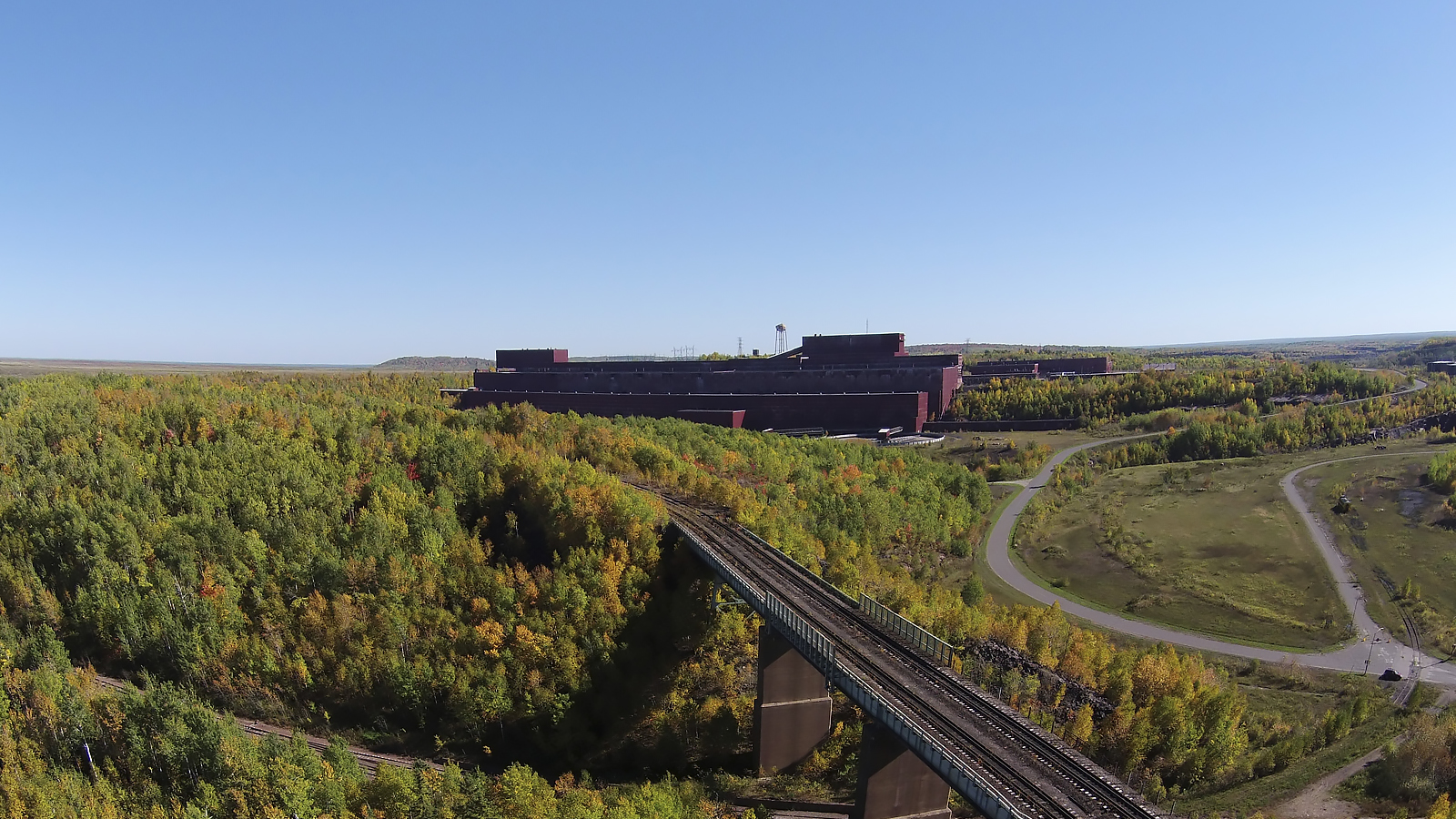

PolyMet is a mine development company that holds a 50 per cent interest in NewRange Copper Nickel LLC, a joint venture with Teck Resources Limited (TSX: TECK.A and TECK.B) (NYSE: TECK).

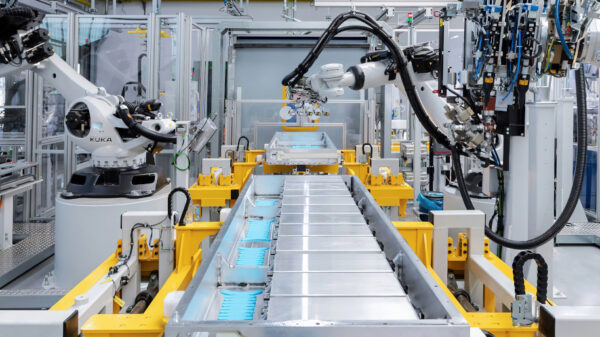

NewRange Copper Nickel holds the NorthMet and Mesaba copper, nickel, cobalt and platinum group metal (PGM) deposits, two globally significant clean energy mineral resources located in the Duluth Complex in northeast Minnesota.

Over the past year, PolyMet has made strategic strides in its operations. In May 2023, the company initiated a readiness program for the NorthMet Project, backed by an estimated US$18M investment. This move was preceded by a successful rights offering in April 2023, which bolstered the company’s finances by approximately US$195 million.

This progression of events provides context to Glencore’s recent proposal to acquire all outstanding shares of PolyMet.

Notably, this comes after Glencore’s unsuccessful $22.5 billion acquisition offer to Teck Resources last April, which was rejected on the grounds of undervaluing Teck’s shareholders’ interests.

Read more: Gobsmacked by Calibre Mining’s high grades from Palomino, Nevada: Haywood Securities

Read more: Calibre Mining assays at Palomino property in Nevada may improve mineral resource

PolyMet has cautioned its shareholders and others considering trading in its securities that no decisions have been made with respect to the company’s response to the proposal. PolyMet shareholders do not need to take any action at this time.

Glencore has been a strategic partner to PolyMet for many years. Glencore increased its stake in PolyMet to 71.6 per cent in June 2019. The move was part of a rights offering that helped PolyMet pay off the debt it owed to Glencore.