The Chinese lithium chemicals producer Ganfeng Lithium (SHE: 002460) will acquire a 15 per cent stake in a promising advanced-stage Argentina lithium brine project for US$70 million.

Lithium Americas (Argentina) Corp. (TSX: LAAC) (NYSE: LAAC) owns the Pastos Grandes operation in the country’s Salta province. The companies inked an investment agreement in early March and the deal is expected to close by the end of June.

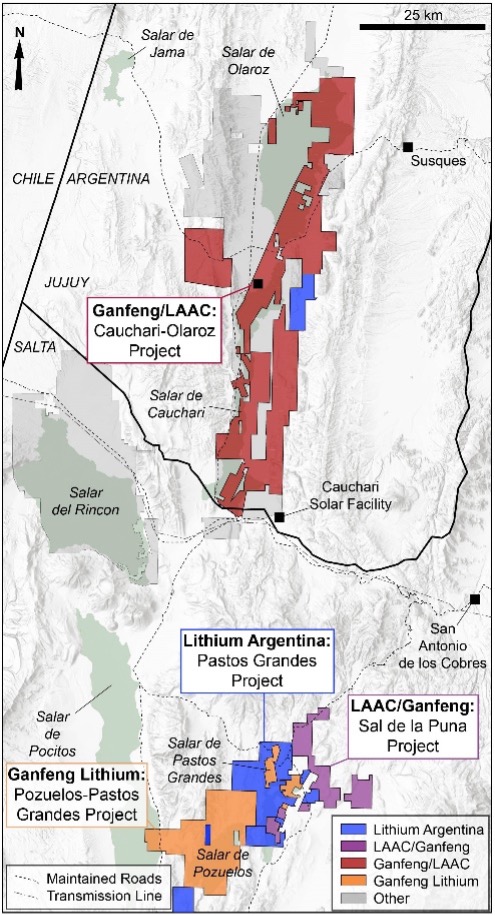

The Chinese chemical manufacturer will assist Lithium Americas’ Argentine division with preparing a regional development plan for Pastos Grandes and the neighbouring Sal de la Puna project. The two sites are situated in what is called the Pastos Grandes Basin. They plan to complete this endeavour by the end of the year.

Pastos Grandes is located right next to Ganfeng’s Pozuelos-Pastos Grandes project. Ganfeng and Lithium Argentina jointly operate the Caucharí-Olaroz operation 100 kilometres from those sites.

“The transaction with Ganfeng demonstrates our long-term commitment to Salta and the sustainable development of Argentina’s lithium industry,” John Kanellitsas, Executive Chairman and CEO of Lithium Argentina, said.

Lithium Argentina plans to investigate the potential benefits of Ganfeng’s direct lithium extraction technology at the project. Should control or ownership of Lithium Argentina change, Ganfeng will have the option to acquire a 50 per cent stake in Pastos Grandes for an additional US$330 million.

“While we continue to prioritize the ramp up at Caucharí-Olaroz, already among the largest lithium brine operations in Argentina, the transaction further strengthens our balance sheet and enhances our growth plans,” Kanellitsas added.

Map: Lithium Argentina

Read more: Lithium South preliminary economic assessment shows optimism for lithium’s future

Read more: Lithium South near completion of production well and economic assessment at flagship operation

Mining activity in Salta accelerates

The province, along with Catamarca and Jujuy, has attracted investors throughout the globe.

Representatives from Saudi Arabia, Israel, Europe, India and elsewhere have visited Argentina in recent days to discuss potentially lucrative mining deals.

Meanwhile, domestic investors are intrigued as well. For example, the Buenos Aires-based conglomerate Techint presented a plan for an US$800 million Salta lithium project to the province’s governor late last month.

In another recent development, Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) just completed its preliminary economic assessment for Salta’s Hombre Muerto North operation. The project is now estimated to have a net present value of US$934 million with a 31.6 per cent internal rate of return.

The assessment included an updated lithium recovery process that will reduce losses and would improve the project’s recovery rate by 20 per cent. The operation will produce about 15,600 tonnes of lithium carbonate per annum.

$LIS $LISMF $OGPQ@LithiumSouth & its ~$30M market cap release the Preliminary Economic Assessment for a potential lithium mine in Argentina's Lithium Triangle. 25 year mine life, 2.5 year payback, net present value $934M, a proven resource.

Learn more:https://t.co/lPfcPUHcDH pic.twitter.com/focwI8VT4j

— CFN Media (@CFNMediaNews) March 4, 2024

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

rowan@mugglehead.com