Australian lithium producer Galan Lithium (ASX: GLN) slowed construction at its Hombre Muerto West (HMW) project in Argentina’s Catamarca province in response to the present pricing environment and market oversupply in lithium.

The company said on Friday that the intent behind the slowdown was to preserve cash while waiting on a sales agreement and a funding package.

Galan expects production to start in the second half of 2025, instead of the first half of next year as previously projected. It is actively negotiating with potential partners and aims to reach an agreement soon.

Managing director Juan Pablo Vargas said that the company has received strong international market interest, driven by the low energy cost at HMW, thanks to the use of extractive pumps and an operational system with evaporation wells.

“The current lithium pricing environment and market oversupply is not expected to be a long term trend,” said Vargas.

Galan said that if they had implemented other methods, such as direct extraction technologies, energy consumption would have been substantially higher.

Meanwhile, the company confirms that the average brine flow rate, lithium grade, and evaporation rates are in line with or better than those used in the feasibility study for phase 1. The latest studies and drilling have estimated resources totalling 7.9Mt of lithium carbonate equivalent (LCE) with a content of 883 mg/l.

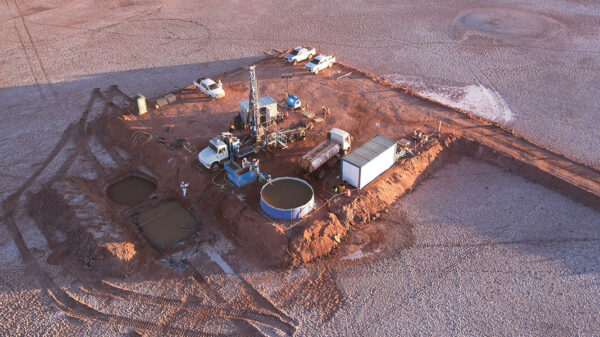

Additionally, the company said the project is now 40 per cent complete, and nearly 750,000 square meters of the evaporation area have been built. This is sufficient to produce a lithium chloride volume of approximately 3.0 ktpa LCE.

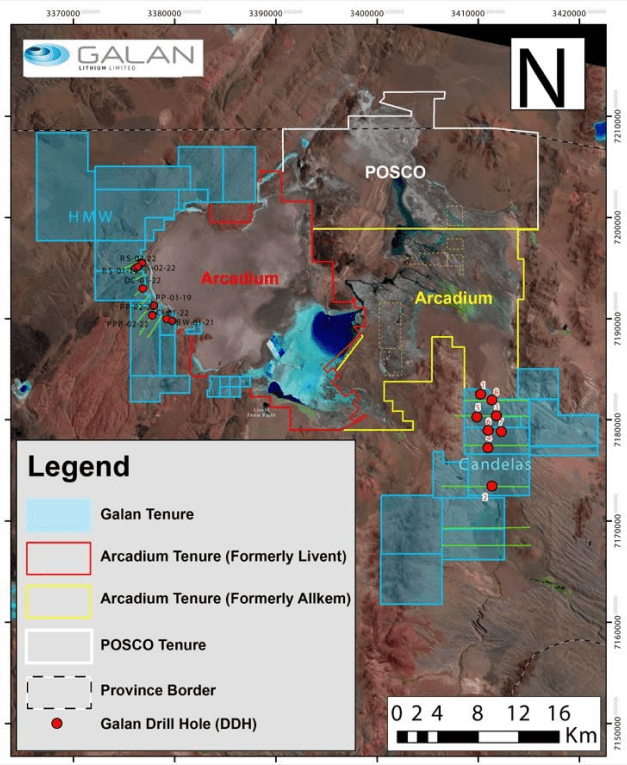

Galan Lithium project map.

Read more: Lithium South installs first production well at largest claim block, prepares for testing

Read more: Lithium South preliminary economic assessment shows optimism for lithium’s future

Final phase includes brine from Candelas project

Galan has accumulated 2,800t in the tanks designed for a capacity of 10,000t/y of LCE. With this, the company estimates that the first phase of HMW will produce 5,400t/y of LCE in a lithium chloride concentrate.

The company also plans to increase the volume through three additional stages, aiming to achieve a production of 21,000t/y of LCE in 2026, 40,000t/y in 2028, and 60,000t/y by 2030.

This final phase will include brine from the Candelas project, which also belongs to Galan. At the end of May, the company raised nearly US$10mn through a share placement, with participation from both Australian and foreign investors and institutions, providing financial flexibility and working capital.

Several companies are actively involved in lithium extraction in the projects surrounding the Hombre Muerto West project.

To the southwest, sits the vast Salar del Hombre Muerto, where Arcadium Lithium plc (NYSE: ALTM) (ASX: LTM) holds a significant presence. Arcadium combines the holdings of Allkem Resources and Livent, making them a major player in lithium production.

Further north in the Salar del Hombre Muerto, Lithium South Development Corporation (TSXV: LIS) (OTCQB: LISMF) (Frankfurt: OGPQ) and Korean steel giant POSCO Holdings (NYSE: PKX) have signed a deal to work together on developing the Hombre North Lithium Project in the Salta Province of Argentina, where both companies have significant operations.

Lithium South Development Corporation is a sponsor of Mugglehead news coverage

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com