Eminent Gold Corp. (TSXV: EMNT) (OTCQB: EMGDF) bought the Gilbert South gold property from Orogen Royalties Inc. (TSX.V:OGN) (OTCQX:OGNRF) in an all-share deal for approximately $150,000.

According to a Thursday press release, this sale and purchase arrangement replaces the option agreement in place since June of 2021.

According to the agreement, Eminent will issue 350,000 common shares initially, and an extra 200,000 common shares when drilling starts. Eminent will also grant Orogen a 2.25 per cent net smelter return (NSR) royalty on Gilbert South claims, with the option for Orogen to reduce it to 1 per cent by paying US$1 million.

Additionally, Orogen may acquire a pre-existing 1 per cent NSR on its claims at the Timberline property by paying US$1 million. Orogen has already received US$75,000 in cash and 150,000 common shares through the option agreement.

“We are pleased to support Eminent’s plan for taking a longer-term approach to Gilbert South with an agreement that provides more flexibility for exploration,” said CEO Paddy Nicol.

“Field work and geophysics at Gilbert South have been completed over the past two years and we look forward to the next rounds of exploration and drilling. The Gilbert South transaction represents Orogen’s 25th royalty in its portfolio.”

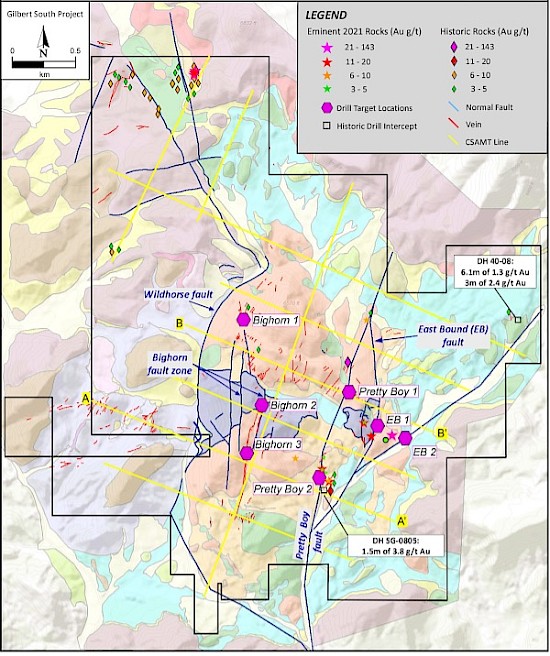

The Gilbert South project is situated 42 kilometers west of Tonopah, Nevada, in the productive Walker Lane trend known for its valuable precious metal deposits.

The project area spans two square kilometers and contains a notable low-sulfidation epithermal vein system within a volcanic region formed during the Cenozoic era. Some surface samples show exceptionally high gold grades, exceeding thirty grams per tonne.

While historical drilling revealed extended sections with lower-grade gold mineralization, it didn’t explore the most promising surface chemistry or the potential deeper feeder structures, which could contain exceptionally rich gold veins.

“The Gilbert South Property is a classic large epithermal system with high grades of gold,” said Dan McCoy, chief geologist and director of Eminent Gold.

“Previous drilling did not test the most prospective targets and little targeting has been done with respect to the potential bonanza grade gold that may exist at depth.”

Since Eminent entered the option agreement in June, it has conducted various assessments, including rock and soil analyses, mapping and Controlled Source Audio-frequency Magnetotellurics (CSAMT) surveys.

These efforts have pinpointed three high-priority drilling targets with potential for rich epithermal gold veins. Eminent released an updated technical report in August 2022, compliant with NI 43-101 standards, outlining these targets and plans for future drilling programs.

Eminent shares dipped 6.9 per cent to $0.27 while Orogen Royalties shares rose by 1.6 per cent to $0.63 on Thursday on the TSX Venture Exchange.

Map of the Gilbert South Property. Image via Orogen Royalties.

Read more: Calibre Mining publishes open pit gold estimate for Cerro Volcan Gold, Nicaragua

Read more: Calibre Mining expands high-grade gold mineralization zones within Limon mine complex

Nevada gold revenues are strong in 2023

Gold mining operations in Nevada have proven to be lucrative in 2023.

The estimated revenue for Nevada Gold Mines joint venture between Barrick Gold (TSX: ABX) (NYSE: GOLD) and Newmont Corporation (TSX: NGT) (NYSE: NEM) is presently $766.3 million. Meanwhile, Gold junior Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF) posted record breaking numbers earlier this year due to its cost-reduction strategies and underground mining operations in Nevada and Nicaragua.

In its second quarter financial report covering the period ending in June 2023, the company revealed that it sold around 69,000 gold ounces, resulting in a net income of $139.3 million. This represents a 6 per cent increase compared to the 65,000 ounces sold in the previous quarter.

Calibre Mining is a sponsor of Mugglehead news coverage

.