“It’s an antimony-gold project now,” says Critical One Energy Inc (CNSX: CRTL) (OTCMKTS: MMTLF) (FRA: 4EF). The critical mineral’s immense spot price gains over the past year or so recently prompted the company to re-examine historical data from its Howells Lake project in Northern Ontario.

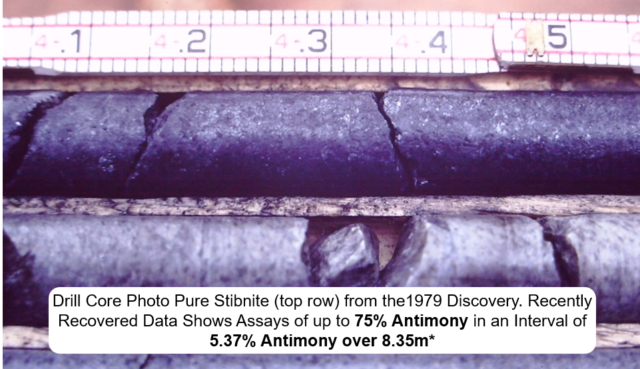

On Wednesday, the mining company revealed that it had dug up a core sample from 1979 with 75 per cent antimony (Sb) in a small interval. The exact length was not specified, but it came from an 8.35-metre core with 5.37 per cent Sb throughout.

Less notable results from old drill holes that Critical One found in the database included 3.33 per cent Sb over 5.6 metres and 1.57 per cent Sb throughout 6.3 metres. Antimony was worth a mere US$1.50 per pound when these assays were first provided decades ago and is now worth over US$25.00 per pound.

“From 1979 to 1984, exploration at our now wholly-owned Howells Lake property led to the accidental discovery of high-grade antimony while the explorers chased gold and base metals,” Critical One said in a social media post this week.

The Namibian uranium miner and antimony-gold prospector, formerly Madison Metals, says it will be continuing to search for additional historic Sb data from the property. An old resource estimate determined that the site holds about 51 million pounds of contained antimony. The Howells Lake property spans nearly 14,000 hectares.

“The market and governments are clear → antimony is critical. North America needs more. And we’re ready to define it with boots on the ground, as soon as conditions allow.”

In Critical One’s latest presentation from February, the company highlighted that the American manufacturing sector consumes about 50 million pounds of antimony per annum. The nation’s stockpile was set to run out within six to eight weeks at the time, Critical One pointed out.

Photo credit: Critical One Energy

Read more: NevGold’s Nevada property may just be the next American antimony resource of scale

Demand soars, but there’s only 1 major deposit in the U.S.

The lack of antimony production in the United States and Canada is particularly concerning when considering that China currently has a stranglehold on approximately 50 per cent of the world’s supply. In December, the Asian nation cut off its antimony exports to the U.S. completely over national security concerns.

The Canadians may have better luck obtaining Chinese shipments of the commodity, but the dire need for North American antimony production remains nonetheless.

Thus, prospecting and analysis of historic data have become popular trends in recent months. Like Critical One, Phenom Resources Corp (CVE: PHNM) (OTCMKTS: PHNMF) has been examining grab samples and drill results from previous years to understand the antimony footprint of one of its projects.

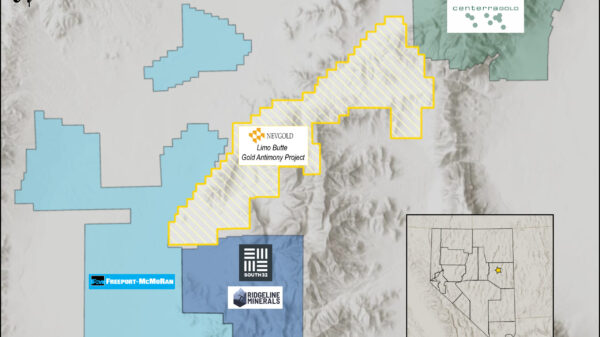

Nevada has become one of the most appealing antimony mining states. Phenom’s King Solomon project, the Limousine Butte operation under development by NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) (FRA: 5E50) and the past-producing Green Mine held by Global Tactical Metals Corp (CNSX: MONI) (FRA: A7F) are promising development prospects.

In Canada, New Age Metals Inc (CVE: NAM) (OTCMKTS: NMTLF) (FRA: P7J) just launched an antimony exploration campaign in Newfoundland.

The only sizeable Canadian antimony mine is currently shut down.

Meanwhile, the Stibnite gold-antimony project under development Perpetua Resources Corp (TSE: PPTA) (NASDAQ: PPTA) in Idaho won’t enter the production phase for years. It holds the only scalable Sb deposit in the country.

Read more: NevGold continues its good fortune with antimony grades in Nevada

NevGold is a sponsor of Mugglehead news coverage

Follow Rowan Dunne on LinkedIn

rowan@mugglehead.com