The Athabasca Basin explorer Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF) has added a new property to its portfolio in a region known for its high-grade uranium deposits.

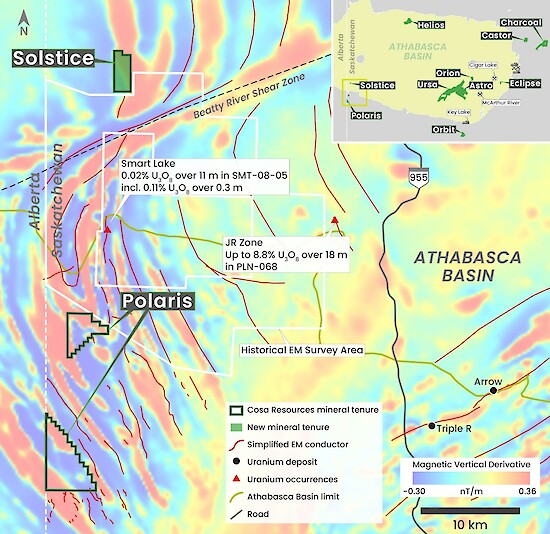

On Thursday, the company announced that it had acquired the Solstice uranium exploration property through low-cost claim staking. The project spans 628 hectares and covers three kilometres of strike length in an area of the Athabasca Basin with several mineralized zones.

It is situated 24 kilometres northwest of the PLN property and JR Zone owned by F3 Uranium Corp (TSX-V: FUU) (OTCQB: FUUF) and 14 kilometres north of the Smart Lake uranium project operated by Purepoint Uranium Group Inc. (TSX-V: PTU) in a joint venture with Cameco Corporation (TSX: CCO) (NYSE: CCJ).

Cosa will now be conducting initial exploration work at Solstice, which will include reconnaissance airborne surveys as well as ground-based geophysics for target refinement and diamond drilling when justified.

“Solstice covers the southwest edge of a prominent, north-northwest trending magnetic high, a setting similar to those hosting the Shea Creek uranium deposits and F3 Uranium’s JR Zone,” said Cosa’s VP of Exploration Andy Carmichael.

The company received approval for listing on the TSX Venture Exchange earlier this month.

Solstice property map via Cosa Resources

Read more: ATHA Energy well-positioned to capitalize on world’s best uranium jurisdiction: TF Metals interview

Read more: ATHA Energy performs largest multi-platform EM survey in the history of the Athabasca Basin

The Athabasca Basin: a rich uranium jurisdiction

Cosa’s new property is located west of a portion of ATHA Energy Corp.’s (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) land package and adjacent to a section of land held by NexGen Energy Ltd. (TSX: NXE) as well.

ATHA recently completed the largest multi-platform electromagnetic survey in the history of the Athabasca Basin. The company has the largest land package in the region, roughly the size of Connecticut spanning 3.4 million acres.

The Athabasca Basin is home to Cameco’s Cigar Lake operation, the highest grade uranium mine in the world.

“You’re talking about 100 times, or greater uranium grade in these deposits, which is unparalleled anywhere else globally,” said ATHA’s CEO Troy Boisjoli in a recent interview.

ATHA aims to have the highest priority targets in its vast land package defined by the end of H1 next year before commencing drill testing on them in the latter half of 2024 to locate new high-grade deposits.

ATHA’s shares are currently trading for $1.02 on the Canadian Securities Exchange. The company is well funded, having a cash position of $25 million.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com