Coeur Mining (NYSE: CDE) reached an agreement to pick up precious metals producer Silvercrest (TSE: SIL) (NYSE: SILV) in deal worth USD$1.7 billion.

Announced on Friday, the acquisition positions Coeur Mining as one of the leading global silver producers, significantly enhancing its portfolio with the addition of Silvercrest’s high-grade Las Chispas mine in Mexico.

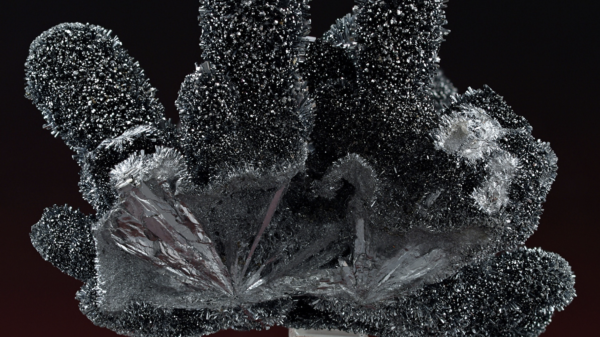

The Las Chispas mine began production in late 2022. Furthermore, it’s recognized as one of the lowest-cost and highest-grade silver operations in the world. Coeur expects the addition to increase its annual production to 21 million ounces of silver and 432,000 ounces of gold. This would position it as a top-tier silver mining company.

After the deal goes through Coeur shareholders will own 63 per cent of the combined company. Silvercrest shareholders will hold the remaining 37 per cent. Silvercrest’s shares have surged following the announcement, signalling the market’s positive view of the merger’s potential.

The Las Chispas mine’s low cash cost per ounce of silver is expected to enhance Coeur’s cost structure.

Coeur plans to complete the transaction in the first quarter of 2025, pending regulatory and shareholder approvals, with a special meeting scheduled by the end of 2024.

The merged company will operate five mines across North America. This includes three of the top silver producers: Rochester in Nevada, Palmarejo in Chihuahua, and the newly acquired Las Chispas in Sonora, Mexico.

Read more: Calibre Mining shuffles strength into its board for future growth

Read more: Calibre Mining strikes gold: new high-grade discovery at Nicaragua’s Limon Mine

Silver market has a 15% supply deficit

Silver prices have surged nearly 35 per cent this year, reaching a 12-year high in late September. The metal is useful for industries like solar panels and electronics. It’s also become one of the top-performing major commodities of the year and ignited a rush among miners to secure reserves.

Additionally, the silver sector has gone through some recent consolidation. Canada’s First Majestic (TSX: AG) recently agreed to acquire Mexico-focused Gatos Silver (NYSE: GATO) for USD$970 million.

Last year, the silver market faced a 15 per cent supply deficit, and between 2020 and 2024. It’s projected to experience a cumulative deficit of 1,093.4 million ounces.

This acquisition represents a pivotal moment for Coeur Mining as it seeks to capitalize on the growing demand for silver and leverage Silvercrest’s valuable asset to gain a competitive edge in the global market. Financial news platforms have widely covered the move, sparking interest among investors eyeing the mining sector’s future, particularly with global economic trends favouring precious metals.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com