Centerra Gold (TSE: CG) (NYSE: CGAU) has acquired a 9.9 per cent stake in Canadian critical minerals explorer Metal Energy (CVE: MERG) (OTCMKTS: MEEED), continuing its string of investments in junior mining companies.

The deal comes as Metal Energy announced a CAD$9.3 million financing round on Thursday, in which Centerra plans to participate.

Metal Energy will issue 8.8 million flow-through shares at CAD$0.73 each and 6.2 million common shares at CAD$0.45 per share. The stock opened at CAD$0.55 before jumping 15 per cent to reach a 52-week high of CAD$0.60, giving the company a market value of roughly CAD$16.1 million.

The funds will finance drilling at Metal Energy’s NIV copper-gold-molybdenum project, which already has all permits in place and several drill-ready targets. The program is scheduled to start next year and will test the centre of the porphyry system for the first time.

NIV spans two main claim blocks covering 215 square kilometres in the Toodoggone district of north-central British Columbia. The property lies about 32 kilometres south of Centerra’s Kemess mine complex. In a statement, Metal Energy chairman Stephen Stewart said the partnership with Centerra strengthens the team’s technical capabilities at NIV. Furthermore, he added that the project represents a rare, undrilled copper-gold opportunity in the province.

Centerra’s stake in Metal Energy is part of a broader expansion in Canadian juniors. Over the past year, the company acquired 9.9 per cent positions in Midland Exploration (CVE: MD) and Azimut Exploration (CVE: AZM) (OTCMKTS: AZMTF) in Quebec, Dryden Gold (CVE: DRY) (OTCMKTS: DRYGF) in Ontario, and Thesis Gold (CVE: TAU) (OTCMKTS: DRYGF) in British Columbia.

Read more: NevGold completes maiden mineral resource estimate for Nutmeg Mountain in Idaho

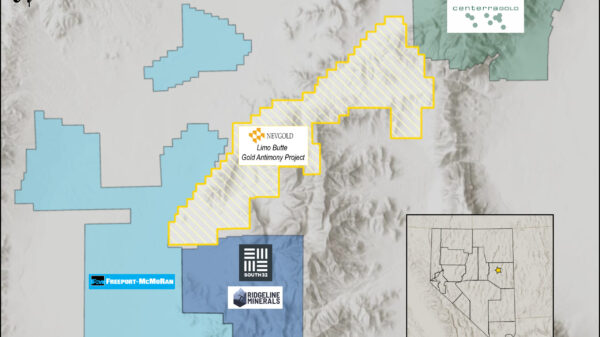

Read more: NevGold discovers new untested areas at Limousine Butte

Mining firms have relative stable extraction and operating costs

The company has continued targeting promising exploration projects while building a portfolio of stakes in early-stage miners. Consequently, its presence in multiple regions across Canada has grown steadily over the last 12 months.

Gold has surged again, with spot prices passing about US$4,250 per ounce as of early December 2025. The rally reflects widespread investor demand, driven by macroeconomic uncertainty, a weak U.S. dollar, and low real interest rates — all of which continue to make gold attractive as a store of value.

Many analysts now view the current climb as more than a bounce — they see gold pushing toward new all-time highs. That view has stirred optimism among investors who believe gold could test much higher levels in the months ahead.

This upward momentum in bullion has direct consequences for companies that mine gold. Mining firms often have relatively stable extraction and operating costs, so when the gold price rises, their profit margins tend to expand more sharply. In practice, a modest rise in the gold price can translate into outsized gains in cash flow and earnings for these companies.

Moreover, elevated gold prices make it profitable to reopen older or marginal mines and to mine lower grade ore that would have been uneconomic at lower prices. That expansion in production and exploration can further boost output and long-term growth prospects for gold producers.

Consequently, the recent rally has strengthened the position of many mining companies, allowing them to fund new projects and improve their financial resilience while benefiting from rising bullion values.

Read more: NevGold closes its Nutmeg Mountain acquisition with Goldmining for $3 million

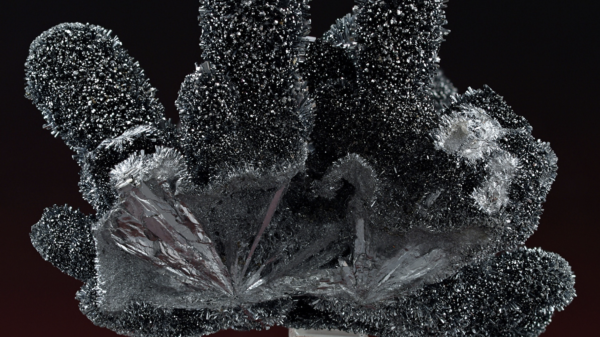

Read more: NevGold’s long intervals of antimony & gold mineralization turn heads

Multiple companies have taken advantage of record prices

Many gold producers have reaped outsized gains from the recent surge in bullion prices. Barrick Mining Corp (TSE: ABX) (NYSE: B) (ETR: ABR0) has also used rising gold prices to lift its profits, recently increasing its dividend and expanding share buybacks after beating quarterly earnings estimates.

Newmont Corporation (TSE: NGT) (NYSE: NEM) (FRA: NMM) has also benefited. The company reported strong free cash flow with higher gold prices and disciplined cost management. It is also now directing that cash toward strategic growth and shareholder returns.

Smaller but growing producers such as Equinox Gold (TSE: EQX) (NYSE: EQX) have seen similar advantages. As gold commands higher prices, Equinox can sell ore from its mines at more attractive margins. Furthermore, this can make its lower cost operations significantly more profitable.

Even exploration-focused firms like NevGold Corp (CVE: NAU) (OTCMKTS: NAUFF) are benefiting from the bullish environment. Higher gold values make development of their gold-bearing assets economically viable, increasing their appeal to investors and potential acquirers.

.