CanAlaska Uranium Ltd. (TSX-V: CVV) (OTCQX: CVVUF) pulled some exceptional core samples from its West McArthur joint venture project this week, which it described as “extremely rare.”

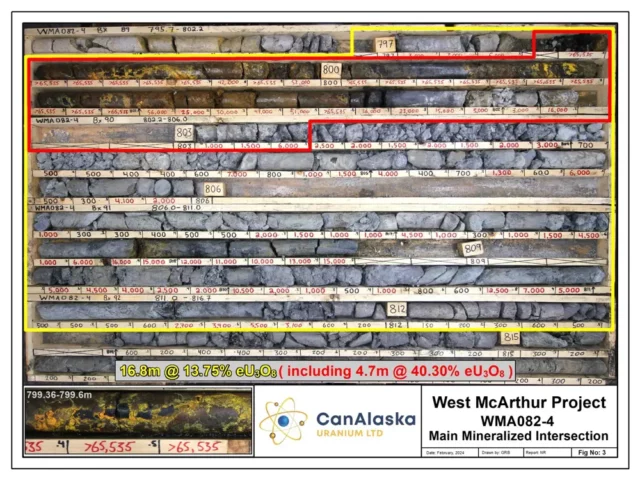

The new results come from the site’s Pike zone discovered in 2022. They most notably consisted of 13.75 per cent yellowcake uranium equivalent (eU3O8) over 16.8 metres, including 40.3 per cent within a 4.7 metre interval. CanAlaska stock shot up by about 34 per cent on Wednesday morning as a result.

“This is a significant outcome for the West McArthur joint venture and CanAlaska shareholders,” CEO Cory Belyk said.

The joint venture project with Cameco Corporation (TSX: CCO) (NYSE: CCJ) is situated to the west of the world’s largest high-grade uranium mine: McArthur River. CanAlaska holds a majority stake in the West McArthur property (83.3 per cent).

“It is extremely rare to intersect uranium mineralization of this grade and width anywhere in the world, including the Athabasca Basin,” Belyk said. The company believes the Pike zone has the potential for high-grade uranium production on par with Cigar Lake and McArthur River.

“Tier 1 uranium deposits always occur as ‘pearls on a string’ and we have now found a pearl.”

The new core samples. Photo credit: CanAlaska Uranium

Read more: ATHA Energy hires knowledgeable senior vice president of business development

Read more: Stallion Uranium completes extensive geophysical survey on ATHA Energy joint venture property

Global uranium production to rise significantly

A recent report from the United Kingdom’s analytics firm GlobalData predicted that annual global uranium production would rise by about 11.7 per cent in 2024. Approximately 60.3 megatonnes will be produced this year, the report says.

The top producer Kazakhstan will be a major contributor. A continuous ramp-up of production activity at McArthur River will be a significant factor as well. Canada’s Nuclear Safety Commission renewed the project’s licenses for another 20 years last fall.

Aside from CanAlaska and Cameco, other companies active in the Athabasca Basin are poised to benefit from this increased rate of production too. These include Stallion Uranium Corp. (TSX-V: STUD), ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF), Baselode Energy Corp. (TSX-V: FIND) and many more.

The commodity is currently worth a high dollar at about US$102 per pound. Its value has increased two-fold in the past year. This has prompted increased attention from investors, hedge funds, explorers and government officials.

ATHA Energy is a sponsor of Mugglehead news coverage

rowan@mugglehead.com