F3 Uranium Corp. (TSXV: FUU) (OTCQB: FUUFF) announced a non-binding letter of intent with Canadian GoldCamps on an earn-in option in the Athabasca Basin.

The companies announced on Tuesday that Canadian Goldcamps can earn up to 70 per cent in the Murphy Lake Property in the Athabasca Basin for approximately CAD$10 million.

The property is in the north-eastern corner of the Athabasca Basin, approximately 30 kilometers northwest of Orano Canada’s McLean Lake deposits, and 5 kilometers south of ISOEnergy Limited‘s (TSXV: ISO) Hurricane Uranium Deposit and spans 6.1 kilometers of land.

During the earn-in period, F4 will operate using the management and technical team responsible for three major uranium discoveries in the Athabasca Basin.

Through this LOI, F4 will receive cash of up to CAD$1.4 million, with CAD$600,000 in the first year, and shares and will benefit from up to CAD$18 million in work expenditures. This transaction exemplifies F4’s approach of maximizing opportunities through the use of property options, joint ventures, and directly funded exploration.

“With this transaction, we have immediately demonstrated the successful unlocking of value within F4’s portfolio of fourteen Athabasca Basin projects,” Dev Randhawa, CEO of F3 adn incoming executive chairman of F4, said.

“The partnership highlights the prospectivity of the Murphy Lake property with Canadian GoldCamps sole-funding exploration for three years, minimizing share dilution to F4 shareholders.”

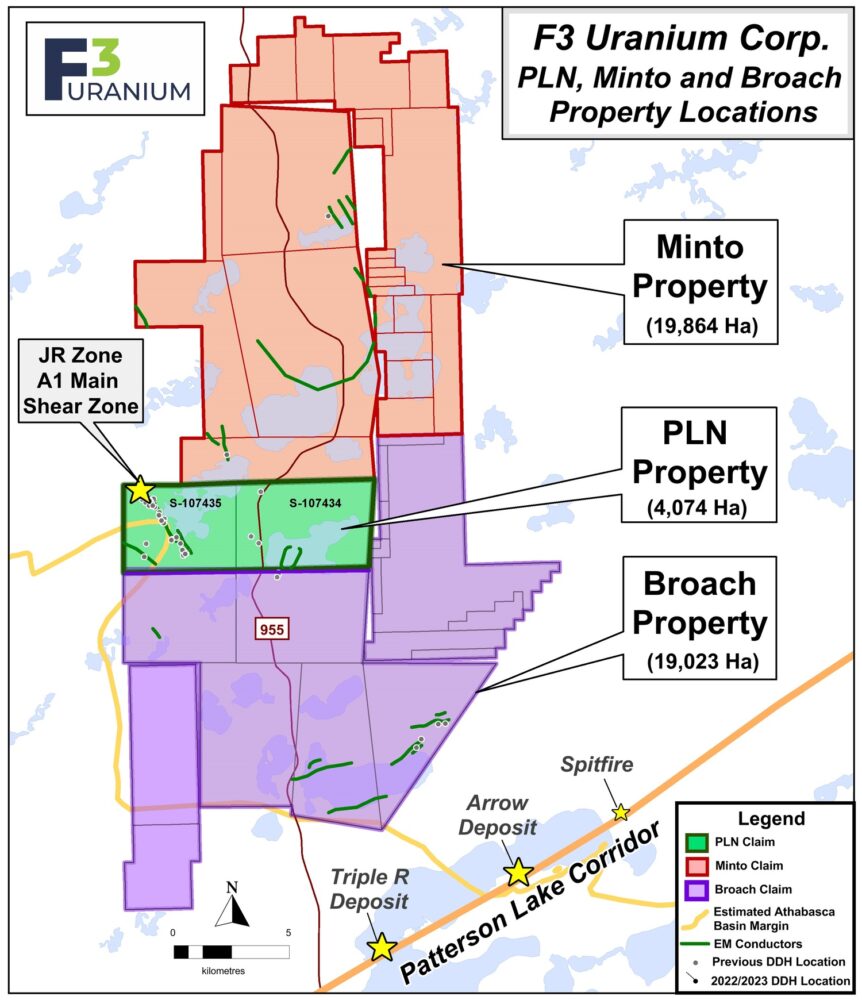

F3 Uranium Property map. Image via F3 uranium.

Read more: ATHA Energy to acquire Latitude Uranium and 92 Energy, creating industry’s largest uranium portfolio

Read more: ATHA Energy increases private placement offering up to $22.84M

F4 will pick up 9.9% of Canadian Goldcamps after equity financing

F4 will make several payments, including an initial payment of CAD$100,000 within 7 calendar days of signing the LOI, followed by CAD$200,000 upon entering into a definitive agreement.

Subsequent payments of CAD$150,000 each are due on or before the six-month, 12-month, 18-month, and 24-month anniversaries of the definitive agreement.

Additionally, following the next equity financing of Canadian GoldCamps, F4 will receive 9.9 per cent of the issued and outstanding common shares of Canadian GoldCamps.

In terms of property expenditures, CAD$5 million is allocated for expenditure on or before the 1-year anniversary of the definitive agreement, with an additional CAD$5 million to be spent by the 2-year anniversary.

Moreover, an additional 20 per cent interest in the property can be acquired, bringing the total to 70 per cent. Cash payments of CAD$250,000 each are due on or before the 30-month and 36-month anniversaries of the definitive agreement.

Concurrently, the deal makes concessions for property expenditures amounting to CAD$8 million. These will be completed by the 3-year anniversary of the definitive agreement. Additionally, F4 will receive a net smelter returns royalty (NSR) equal to Canadian GoldCamps’ percentage interest in the property, calculated at a rate of 2 per cent.

The reason why uranium has become a hot commodity is because of the re-emergence of nuclear energy as a low-carbon alternative energy source with the potential to reduce greenhouse gas emissions. Furthermore, the growing demand for uranium stems from the increasing interest in nuclear energy as countries seek to diversify their energy mix and reduce reliance on fossil fuels.

The Athabasca Basin has also received increased attention as a result.

Read more: ATHA Energy defines 18 high-priority prospective mining targets after EM survey

Read more: ATHA Energy aerial surveys over Athabasca Basin reveal strong potential for uranium

Athabasca Basin holds 25% of world’s uranium reserves

The basin holds about 25 per cent of the world’s uranium reserves, making it a globally recognized source of nuclear fuel. The uranium deposits in the Athabasca Basin are renowned for their exceptional quality, with ore grades often exceeding 100 times the global average uranium concentration.

That’s important because of the present geopolitical situation, which may end up calling upon the basin and its companies to make up shortfalls in global supply.

Especially since Canada’s largest uranium supplier, Cameco Corporation (TSX: CCO) (NYSE: CCJ), may not be able to handle all the increased demand in the future.

The company is bracing for impact following Kazakhstani partner, Kazatomprom’s (KAP) prediction of a 20 per cent production shortfall in Kazakhstan due to a sulfuric acid shortage. Add to that the growing rift between the United States and Russia following Russia’s invasion of Ukraine, which resulted in the U.S. House of Representatives passing a motion to ban U.S. uranium imports from Russia without knowing how they were going to meet its own demand.

But Cameco’s failure to perform could signal a strong performance for its competitors.

For instance, Skyharbour Resources Ltd. (TSXV: SYH) (OTCQX: SYHBF) (Frankfurt: SC1P) is currently engaged in its 8,000 meter winter drill campaign at its Russell Lake Uranium Project in the central core of the basin in northern Saskatchewan.

There’s also ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF), which recently completed its acquisitions of Latitude Uranium Inc. (CSE: LUR) (OTCQB: LURAF) and 92 Energy Limited (ASX: 92E) (OTCQX: NTELF).

ATHA Energy Corp. is a sponsor of Mugglehead news coverage