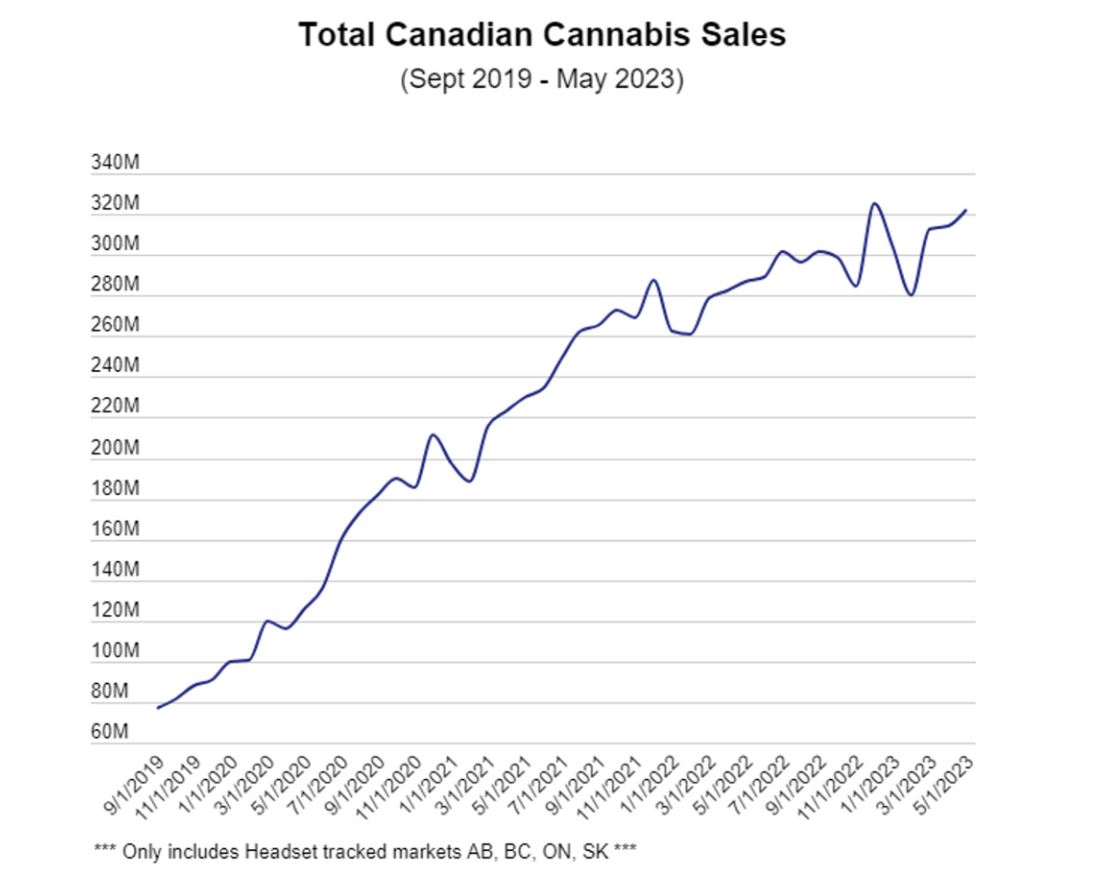

Despite facing market challenges and a slowing growth rate, Canada’s recreational cannabis industry has experienced a remarkable 157 per cent surge in sales over the past three years, reveals a new report by Headset.

The report underscores the industry’s resilience and adaptability, even as it grapples with shifting consumer preferences and an increase in store count rather than demand.

It also found that while sales have increased year-over-year, the growth rate has been slowing for the last three consecutive years. Between 2020 and 2021, sales grew by 88.3 per cent, but between 2022 and 2023, that number dropped to 11.8 per cent.

Interestingly, sales growth appears to be driven more by an increase in store count rather than growing demand. For instance, average monthly sales per store in Ontario have dropped by approximately 20 per cent in the last year, while store count has grown by approximately 40 per cent in the province over the same period.

The report also highlights a shift in product preference. Flower, once the dominant product category, has seen its share of total sales decrease by 15.8 per cent in the last year, falling to nearly a third of all sales. In contrast, pre-roll products have grown their share by 23.5 per cent in the same period, bringing the category to near parity with flower.

The number of brands in the Canadian market grew by 369 per cent between 2020 and 2023. However, this influx of new entrants has contributed to a diminishing median total sales per brand, which has decreased by 70 per cent in the same period.

Photo via Headset.

Read more: Edibles are unpopular in Canada because of low THC regulations: Headset

Read more: Men and younger generations consume the most cannabis: Headset report

In 2020, the top 21 per cent of brands captured 80 per cent of total sales. In 2023, the top 12 per cent captured that same amount.

After several years of pricing compression, inhalable products, such as flower, have seen the price per gram flatten since the start of 2022. Consumer preference towards higher THC limits in Edible packages has heavily influenced an EQ price drop of 25.3 per cent for non-inhalables in the last year.

While the Canadian cannabis industry has seen substantial growth and development since its legalization, it faces several challenges. The current sales growth throughout the country is likely buoyed by store count growth rather than growth in consumer demand.

This, coupled with pricing compression and other regulatory hurdles, poses potential risks to industry players.

Headset suggests the focus of the industry participants in the coming years should be working smarter and building a business that understands current trends, tastes, and the competitive landscape.