Cameco Corporation (TSX: CCO) (NYSE: CCJ) has committed over CAD$1.8 million in funding for community organizations throughout Saskatchewan.

Tim Gitzel, the president and chief executive of Cameco, made the announcement on Tuesday at a media event at Cameco’s corporate offices. He stated that while most of the funding came directly from Cameco, a large portion of the funding came due to the generosity of Cameco employees and members of the community.

Company employees raised more than $700,000 through the Employee Giving Campaign, with the Saskatoon Community Foundation administering the funds. Three hundred Cameco employees chose a charity for their donations, and the company matched their contributions, resulting in donations to 165 charitable organizations.

“Cameco has proudly operated in Saskatchewan for 35 years and our success wouldn’t be possible without the dedication of our employees and support of our community,” said Cameco President and CEO Tim Gitzel.

“We want to show our gratitude by giving back. We’ve brought our community together through the Step Up for Mental Health run/walk, we’re honouring our workers’ priorities through our employee giving campaign, and Cameco is directly supporting organizations that are working towards the safety and vibrancy of our community.”

As part of the funding announcement, the annual Cameco Step Up for Mental Health run/walk, held in September, another raised $700,000. This event drew nearly 7,000 participants, and Cameco matched 100 percent of the registration fees. The funds from the event were then used to support 24 mental health projects in Saskatchewan.

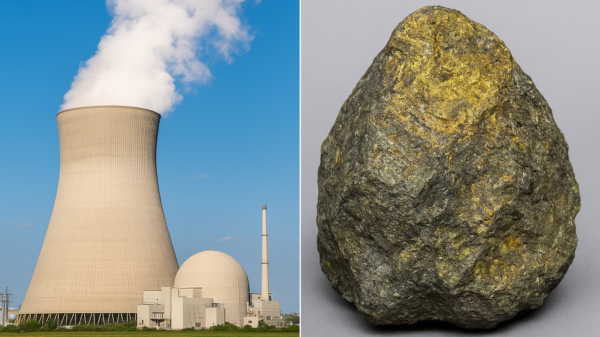

Rise of nuclear technology drives uranium demand

The influx of attention being paid to the uranium sector is due to the emergence of new nuclear technologies such as small modular reactors. Maintaining positive relations with the communities a company operates in is an important part of doing business, especially with nuclear power.

The world saw the inception of the first commercial nuclear power stations in the 1950s. In 2023, approximately 440 power reactors globally contribute to nuclear energy, supplying roughly 10 per cent of the world’s electricity.

Nuclear power is responsible for one-quarter of the world’s low-carbon electricity, positioning it as the second-largest source of low-carbon power, comprising 26 per cent of the total in 2020.

Beyond electricity generation, over 50 countries actively employ nuclear energy, utilizing around 220 research reactors for purposes such as medical and industrial isotope production and training, in addition to research activities.

That number is growing and with it the demand for uranium.

NexGen Energy (TSX: NXE) (NYSE: NXE) (ASX: NXG), for example, is the second largest company by market cap operating in the Athabasca Basin behind Cameco. It’s presently looking to sell off up to CAD$500 million in shares to continue developing its Rook I uranium mine in northwest Saskatchewan.

In November, the province granted the new mine and mill at the Rook I project environmental approval, marking Rook I as the first greenfield uranium development to receive approval in 20 years.

The deposit contains measured and indicated resources of 3.8 million tonnes, grading at 3.10 per cent uranium oxide (U3O8) and holding 256.7 million pounds of U3O8, sufficient for sustaining a mine life of 11 years.

Read more: ATHA Energy well-positioned to capitalize on world’s best uranium jurisdiction: TF Metals interview

Read more: ATHA Energy performs largest multi-platform EM survey in the history of the Athabasca Basin

High demand spurs growth in supply

However, large companies aren’t the only beneficiaries of this new opportunity.

According to the World Nuclear Association, the uranium market presently experiences a production deficit of 26 per cent and is anticipated to see a substantial increase by 2040, with more than 50 per cent of global production carrying significant geopolitical risk.

This increase in demand means that companies seeking opportunities to meet that demand must necessarily rise to the occasion to take advantage, and that’s what uranium junior ATHA Energy Corp. (CSE: SASK) (FRA: X5U) (OTCQB: SASKF) is aiming to do.

ATHA signed an agreement earlier this month to acquire Latitude Uranium Inc. (CSE: LUR) (OTCQB: LURAF) and Australia-based 92 Energy Limited (ASX: 92E) (OTCQX: NTELF). Upon completion, the combined company will possess 7.1 million acres of uranium exploration territory spread out over the basin, as well as Nunavut, and Labrador.

In connection with the acquisitions, ATHA will finalize a USD$14 million financing, with partial funding provided by two investors: IsoEnergy Ltd. (TSXV: ISO) and Mega Uranium (TSX: MGA). This merger inherently forms a company with a significantly larger market capitalization, leading to improved liquidity and increased interest from institutional investors.

ATHA Energy Corp. is a sponsor of Mugglehead news coverage