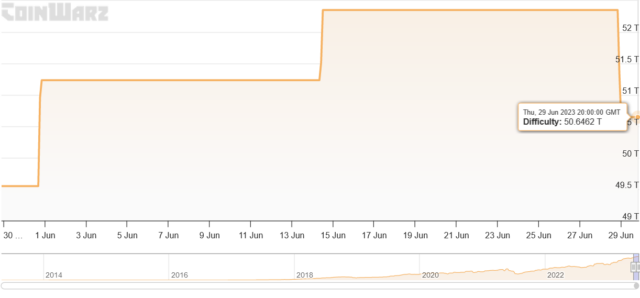

The Bitcoin network difficulty dipped by 2 per cent on Wednesday from its all-time high despite industry projections that it would increase.

The network has experienced a series of consecutive increases in mining difficulty over the past four retargets. Over the course of three successive adjustments prior to the latest in mid-June with the difficulty had increased by 8.8 per cent. This latest decrease has caused the difficulty rate to hover around the 50 trillion mark.

The difficulty of Bitcoin mining primarily affects the profits of miners. However, some investors may associate an increase in mining difficulty with a potential increase in the market price of BTC. Mining difficulty becomes particularly significant during Bitcoin’s halving event. As mining difficulty rises and block rewards decrease, fewer BTC are introduced into circulation. This dynamic can impact the overall efficiency of mining in relation to the price of BTC.

“Mining difficulty typically self-adjusts over time so that miners are profitable over the long run. Key drivers of the economics of mining that in turn drive mining difficulty are the block reward, bitcoin price and the increasing efficiency of mining equipment,” said Sheldon Bennett, the CEO of DMG Blockchain Solutions (TSXV: DMGI) in an interview.

Chart via Coinwarz.com

Read more: CleanSpark buys two bitcoin mining campuses in Georgia for $9.3M

Read more: Hut 8 Mining merges with U.S.-based data and Bitcoin mining group

The network adjusts difficulty every two weeks

Bitcoin mining difficulty is generated to maintain a consistent block creation rate. Every two weeks, the network compares the average block time to the target time of 10 minutes. If blocks are mined too quickly, the difficulty increases, and if they are mined too slowly, it decreases.

This adjustment is calculated based on the ratio between the target and average block times, ensuring a stable difficulty level. By dynamically adjusting the difficulty, the network ensures the security and reliability of the blockchain while facilitating the issuance of new bitcoins.

As the difficulty of mining increases, miners require more hash power to successfully solve blocks and earn Bitcoin. However, this upward trend in difficulty leads to a decline in mining profitability over time. Miners are greatly affected by this situation as they need to invest more energy and money into mining to maintain the same payout rate while finding creative ways to cut costs.

“DMG cannot control the block reward nor bitcoin pricing but does maintain one of the industry’s most modern fleets and plans to continue to upgrade its fleet as we mentioned on our most recent earnings call when we talked about our move to utilize immersion cooling technology in conjunction with deploying the latest generation of bitcoin mining equipment,” said Bennett.

Bennett explained that as that Bitcoin protocol self-adjusts the network difficulty the amount of mining equipment on the network responds accordingly.

When the network difficulty rises and the cash profitability of operating equipment on the network decreases for the least efficient equipment ton the network, those equipment will shut off. Sometimes external factors like power purchase commitments and mining operators hoping bitcoin pricing will bounce back causes a lag in shutting equipment down, but generally the industry responds quickly to bitcoin mining economics.

.

Follow Joseph Morton on Twitter

joseph@mugglehead.com